CFD Trading: A Beginners Guide

CFDs are a popular type of derivatives product that allows traders to efficiently speculate on the prices of stocks, currencies, commodities, or indices, without having to take ownership of the underlying assets.

Here, we’ll shed some light on CFD trading, its main characteristics, and how to trade CFDs online.

What are Contracts for Difference and How Do They Work?

CFDs, short for Contracts for Difference, are popular financial derivatives that track price movements in an underlying financial instrument.

It ‘says what it does on the tin’, it is a contract for the difference in two prices.

Traders decide when to enter a contract and, most of the time, when they exit it. They also decide how many contracts or the volume they want to trade. What they can’t control is the price, this is determined by the price of the underlying financial market the CFD is for.

Long and Short

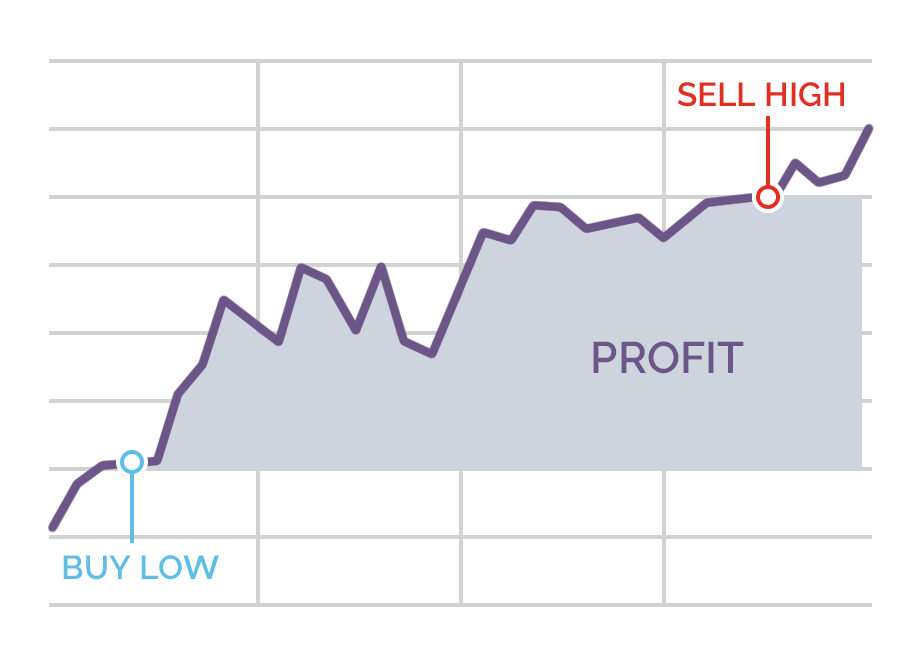

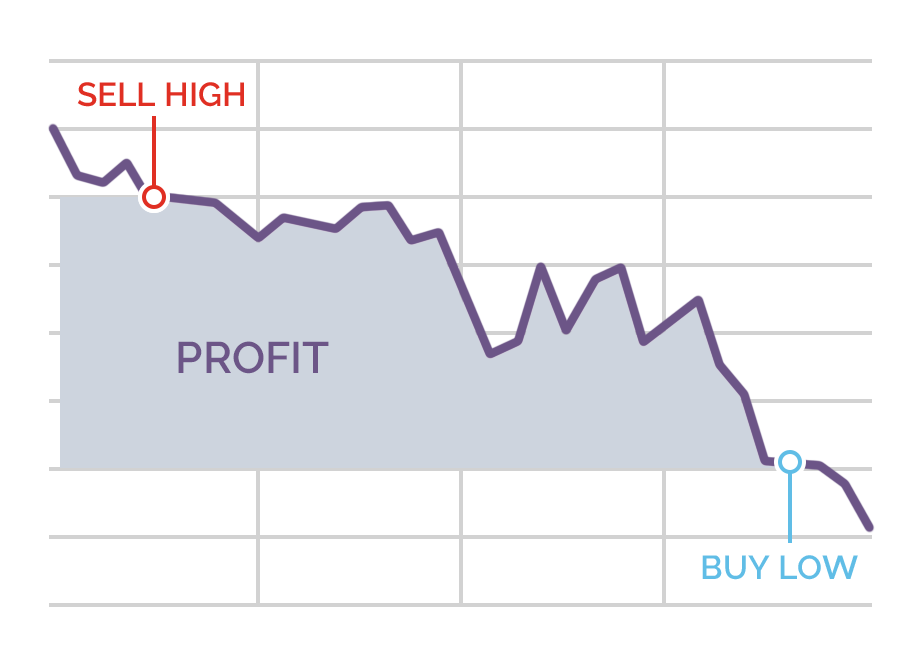

They allow traders to speculate and trade on various instruments across different asset classes. A trader can buy a CFD if he or she thinks that the price of a financial instrument will rise, allowing him or her to profit on the difference between the buying and selling price. Similarly, traders can also profit from falling prices in the markets by short-selling a CFD.

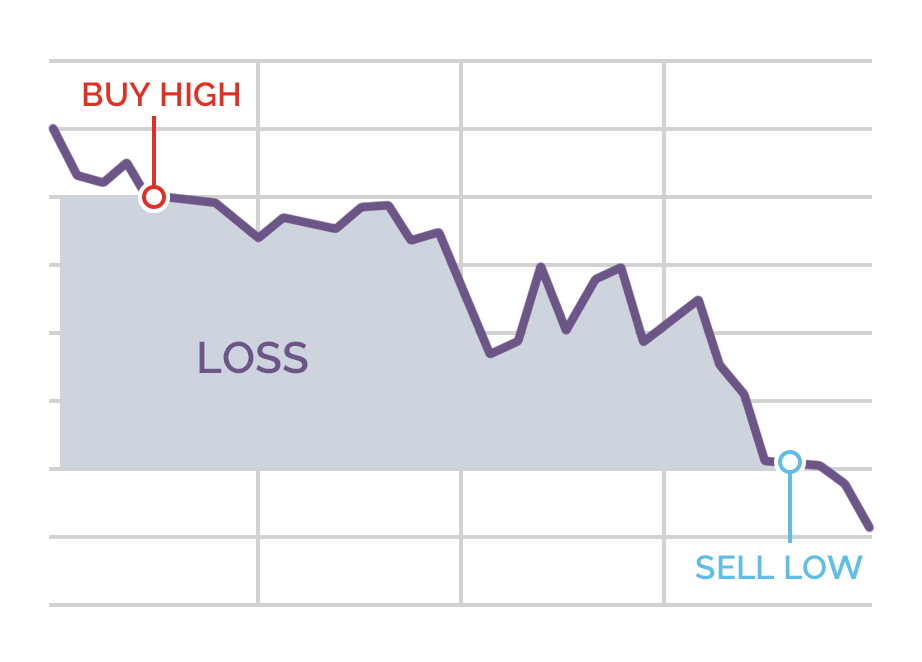

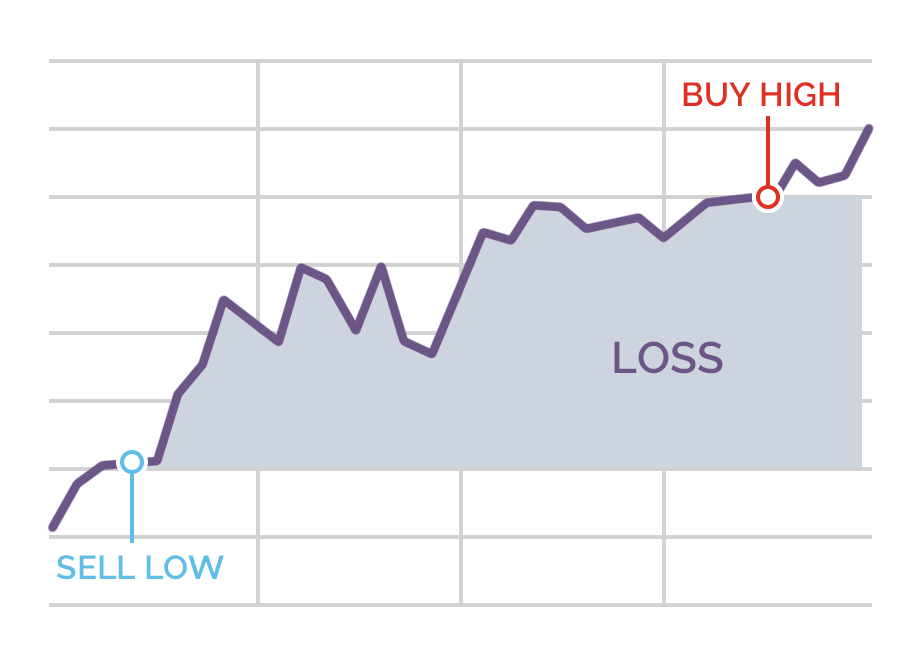

Traders can also get it wrong and call the market incorrectly, this is when they make a loss:

No Ownership of the Underlying Asset

Another major characteristic of CFDs is that the trader doesn’t own the underlying instrument. If you buy a CFD on Brent crude, you don’t actually own physical oil. Instead, you’re only speculating on the future price of Brent crude.

- Learn more about CFDs, take our free course: Margin Trading Products

If the price rises, you’ll make a profit on the difference between the buying and selling price. However, if the price falls, you’ll incur a loss. CFDs never involve and of the hassle of owning the underlying asset. As a private trader, would you want to hassle of funding, storing or transporting oil? No, and therefore the CFD is a great instrument to speculate on price changes without these headaches.

Leverage

Here is another reason why CFDs are so popular among traders – Leverage.

Leverage allows you to open and control a much larger position than your trading account size, and CFDs offer plenty of leverage. So much, that certain financial regulators capped the maximum leverage for retail traders to 30:1. This means that you can control $30,000 with a $1,000 account.

Depending on where your broker is regulated, you can still find broker accounts that come with leverage ratios of 100:1, 200:1, or even more! However, bear one thing in mind: The higher your leverage, the greater your risk. Leverage increases both your profit potential but also magnifies your losses in equal measure.

Range of Markets

Today, you can trade CFDs on almost any financial instrument, including stocks, stock indices, bonds, currencies, cryptocurrencies, commodities, and metals. CFDs on currencies usually come with the highest available leverage ratio, while stocks are usually capped to 5:1 or 10:1.

How to Trade CFDs Online?

The actual trading of CFDs online is now pretty easy. All you have to do is to open a brokerage account with a CFD broker, and you’re good to go. Your account will usually be verified within two business days, after which you’ll be asked to fund your account. Once your account is funded (via bank wire, credit/debit card, or online payment providers), you’re ready to open your first CFD trade. The difficult bit is deciding when to buy and sell to deliver consistent profits.

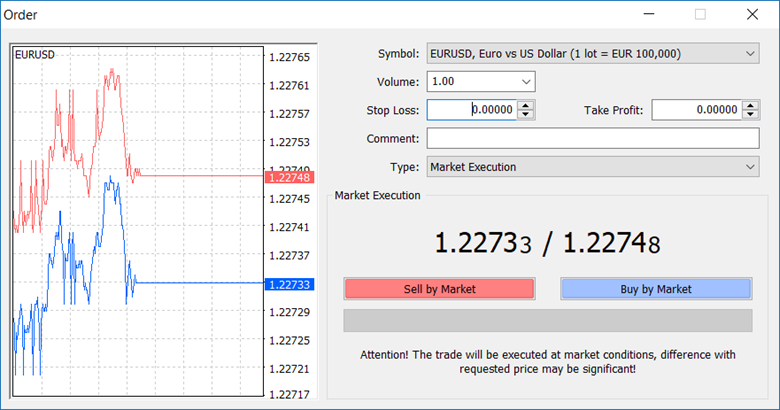

Most brokers offer CFD trading on MetaTrader, which is arguably the most popular retail trading platform. MetaTrader comes with advanced charting tools, the most important broker order types, and different chart types, and is pretty much robust in its current version.

To open a trade, simply select the financial instrument you want to trade and press the “New Order” button, or F9 keyboard shortcut. A window similar to the following one will appear on your screen. This is the New Order window in MetaTrader.

Select the volume you want to trade (in this case, 1.00 lots of EUR/USD), define your stop-loss and take-profit levels, and hit the Sell by Market or Buy by Market button to execute your trade.

Trading CFDs online has skyrocketed in popularity since the early 2000s. The advance in information technology and widespread internet access allowed retail traders and brokers to compete with the big boys on the Street.

According to BrokerNotes.co, there are almost 300,000 active day traders in the UK alone, and the number keeps growing!

- Learn more, take our premium course: Trading for Beginners

Pros and Cons of CFDs

Now, let’s take a deeper look at the main pros and cons of CFDs.

Pros:

Cons:

Here are the main disadvantages of trading CFDs:

Fortunately, the strong competition between CFD brokers has significantly lowered spreads and trading costs. For example, if you want to trade major Forex pairs like EUR/USD and GBP/USD, your spread could be as low as 1 pip (the fourth decimal place).

Your margin depends on the leverage ratio you’re using: For example, if you trade with a 50:1 leverage, your margin will be equal to 2% of your total trade size. The higher your used margin, the lower will be your free margin and the higher your risk of facing a margin call. As a rule of thumb, don’t risk more than 2-3% of your trading account on any single trade, and you shouldn’t have any problems with your margin.

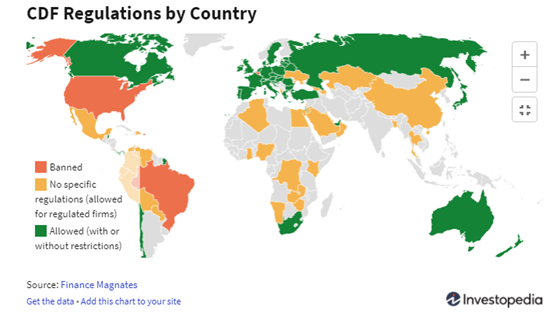

Rules Around CFDs in Different Countries

Given their speculative nature and the potential for large losses, some countries have banned retail trading on CFDs. These derivative contracts are banned in the United States and Belgium but are allowed in many other major trading countries, including the United Kingdom, Germany, Sweden, Switzerland, Japan, South Africa, Canada, Australia, and New Zealand, to name a few.

Some countries – like Australia – are planning to increase the regulation of CFDs following the constant losses of the majority of retail traders. According to data that brokers have to make public, around 65% to 85% of their clients lose money when trading CFDs.

However, one could argue that the main reason for such a weak retail performance is poor risk management and a general lack of trading knowledge and experience.

- Develop into a well informed, confident private trader, take our premium course: Trading Foundations Programme (Live)

Final Words

CFDs, or Contracts for Difference, are a very popular financial derivative that allows traders to trade on a variety of financial instruments and speculate on their future prices, without the need to actually own the underlying asset. In this regard, a CFD is a contract between a buyer and a seller where the buyer makes a profit on the difference between the buying and selling price of the underlying asset tracked by the CFD.

The main advantages of CFDs include access to high leverage, low entry barriers, short-selling, and around-the-clock access to the financial markets. Major drawbacks include trading costs (spreads), margin requirements, and financing costs in case a trader uses leverage in his or her trading.

Trading on CFDs is allowed in most parts of the developed world, except the United States and Belgium. However, some countries have already announced that they will make some changes to their CFD regulations in order to protect retail traders from large losses when trading CFDs.

- Learn more about CFDs, take our free course: Margin Trading Products