Day Trading in the UK: How to Get Started

So, you want to become a day trader and join the hundreds of thousands of day traders who are living in the UK? Then this guide is for you.

According to BrokerNotes, there are 9.8 million online traders worldwide, with the UK taking the top spot in Europe with almost 300,000 active day traders!

In this guide, you’ll find everything you need to know if you want to become a day trader in the UK.

What Does a Day Trader Do?

Day trading is a very popular trading style that involves the opening and closing of trades within one trading day.

Swinging around

So, depending on the day trading strategy that a trader uses, a day trader could scan the market for possible trading opportunities early in the morning. Then leave the trades open during the day, and close them a few minutes before the end of the trading day. This is what I call an intraday swing trader. Want to know how much they earn? Check that out here.

Breaking out

Other day traders who follow a breakout trading style may hold their trades even shorter, from a few minutes to a few hours.

A breakout day trader would, for example, look for trading opportunities that arise when the price is breaking out of well-defined technical levels. Those breakouts are usually followed by significant trading volume and volatility, which sends the price up or down fairly quickly. We’ll cover those and other popular day trading strategies later in this guide.

Day trading

Unlike swing and position traders, who are considered longer-term trading styles, day trading is fast-paced. If you want to become a day trader, you’ll need to have fast trading reflexes and the ability to make decisions fast.

However, day trading is still less intensive than scalping, where traders need to make decisions in split seconds and hold their trades from a few seconds to a few minutes.

Given the speed of day trading, you’ll likely face higher trading costs compared to longer-term traders who hold their trades for days or weeks. Nevertheless, the profit opportunity in day trading is immense, especially if you develop and follow a well-defined trading plan and risk management rules.

Day traders know whether they’re right or wrong by the end of the trading day, which is another major point why many traders feel attracted to this trading style. There are plenty of day trading opportunities in a variety of markets, and quite a few high-probability setups during a week that can make your month.

Even though many day traders focus on technical trading, fundamentals play an important role in the short-term. That’s why you need to stay up-to-date on major market news and reports during the day if you want to become a successful day trader. It’s not unusual for financial instruments to move hundreds of points in a matter of seconds just because unexpected news hit the newswires.

Read:

15 Eye Opening Day Trading Stats

Tips to Make Money Day Trading

Is Day Trading Illegal?

Day trading is not illegal in the United Kingdom. You can open as many day trades as you like, around the clock, whenever there is an open market somewhere in the world. Although it’s still important to make sure that you’re trading with a regulated broker. Take our free fast track course and get to grips with choosing the right broker.

If you don’t know where your broker is regulated, take a look at the broker’s website. There you’ll find the broker’s license number and its regulatory authority.

Bear in mind that some countries have prohibited trading on highly-speculative products for retail traders, such as CFDs. At the time of writing, there are only a few countries that have such laws, and the United Kingdom isn’t one of them.

In addition, the Pattern Day Trader rule (PDT) doesn’t apply to UK traders who trade with an FCA regulated broker. The PDT rule, which says that you can’t open more than four day trades within five trading days, applies to traders who trade with US-based, FINRA regulated brokers. In that case, you’ll need a margin account with at least $25,000 to avoid being flagged as a “Pattern Day Trader”.

- Learn more, take our free fast track course: Understanding Brokers

Top Markets You Can Trade as a Day Trader

As a trader who is day trading in the UK, you can have access to hundreds of markets worldwide. The actual number of available markets to trade on depends on your broker, but in most cases, you’ll be able to trade on the following ones:

- Stocks

- Commodities

- Cryptocurrencies

- Forex

- Derivative contracts

So, let’s break down each of them:

1. Stocks: Stocks represent ownership in a public company, like Tesla, Facebook, Amazon, or General Motors, to name a few. Just like in other markets, the price of stocks fluctuates on the dynamics of supply and demand.

When markets feel optimistic about the prospects of a company and its products, when a company reports higher-than-expected earnings or increases its market share, the price of the company’s stock will most likely go higher.

A stock trader who is day trading will follow those reports and important technical levels, aiming to buy stocks at a lower price and sell them later at a higher price. Similarly, a stock trader can also profit from falling prices by shorting a stock.

2. Commodities: The commodities market consists of commodities that are globally traded on financial markets, mostly on the futures market.

However, traders can also trade on CFDs that are tracking the price of commodities. Popular commodities to trade include oil, wheat, gold, silver, natural gas, cocoa, and copper, to name a few.

3. Cryptocurrencies: With the rising popularity of bitcoin, ripple, ethereum, and other cryptocurrencies, an increasing number of brokers are now adding those exciting new digital currencies to their list of tradeable assets.

However, bear in mind that cryptocurrencies can be highly volatile at times, which makes them riskier to trade than regular currencies on the Forex market.

4. Forex: The foreign exchange market is the largest financial market in the world in terms of the daily trading volume.

Hundreds of billions worth of currencies are exchanged daily on the forex market, with the most liquid ones being the US dollar, euro, British pound, Canadian dollar, Swiss franc, Japanese yen, Australian dollar, and New Zealand dollar.

Currencies trade in pairs, which means that you’re always simultaneously buying one currency and selling another currency. For example, if you buy the EUR/USD pair, you’re actually buying the euro for US dollars, which means that you’ll make a profit if the price of the euro rises against the US dollar. Conversely, if you’re shorting the EUR/USD pair, you’re selling euros for US dollars and will make a profit if the price of the euro falls against the US dollar.

There are many factors that influence the exchange rate of currencies, including interest rates, inflation rates, economic growth, productivity growth, market positioning, risk sentiment, and more.

Given the liquidity of the forex market, and the fact that currencies can be traded 24 hours a day, many traders choose the currency market to get their feet wet with day trading. I recommend you read our beginners guide to Forex and get accustomed to the ins and outs of this exciting market.

5. Derivative contracts: Derivative contracts are financial contracts that derive their value from an underlying asset. Popular derivative contracts include options and futures. However, trading derivatives is usually more complex and should be done only by more experienced traders.

If you’re just getting started with day trading, make sure to pick a broker that offers all the markets you’re looking to trade on. Some Forex brokers don’t allow trading on stocks, while others don’t offer cryptocurrencies for example. It’s easier to choose the right broker now than to switch between brokers at a later stage.

Recommended reading:

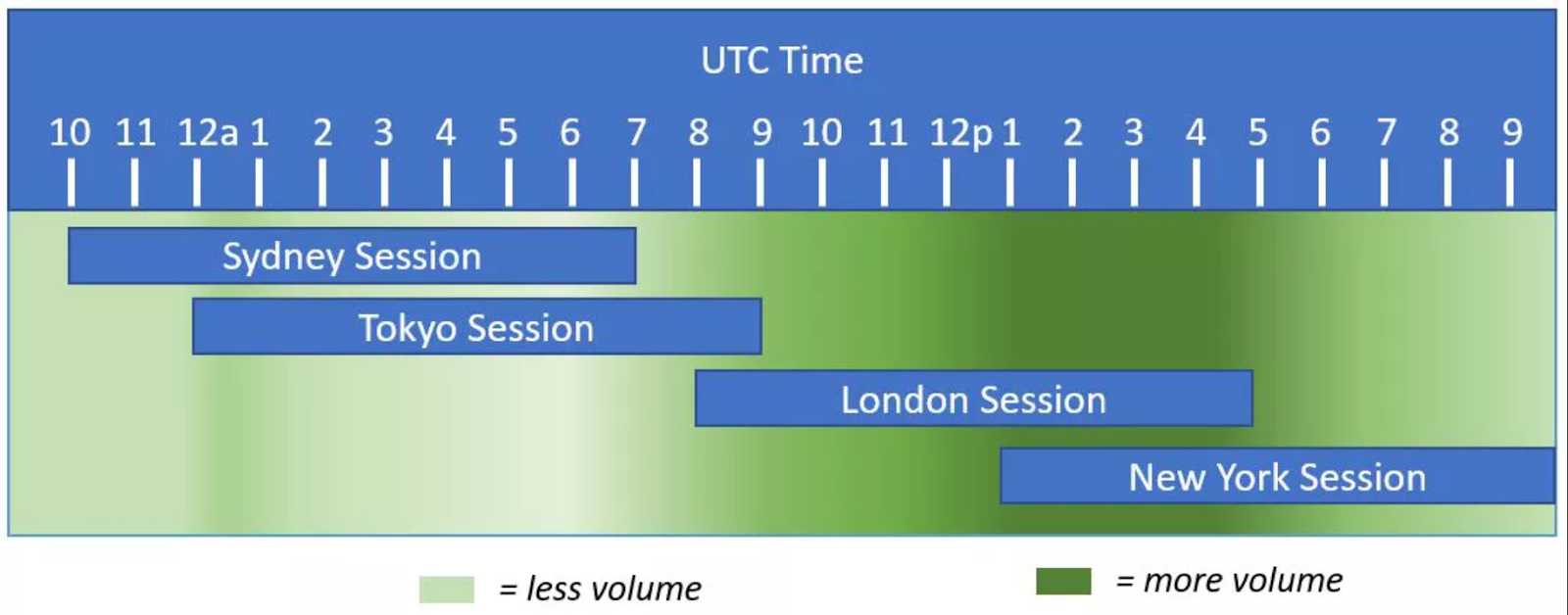

Best Times & Days in the UK to Trade

If you’re located in the UK, you have a great advantage as you’ll be able to day trade during all major trading sessions, including the US markets, European markets, and Asian markets.

The markets open in London at 8:00 AM local time, and the New York session starts at noon UK time, which means that you’ll be able to trade the most active hours of the day if you’re day trading from the UK.

It’s all about the strategy

The best time to day trade depends mostly on your trading strategy. If you want strong trends that have the potential to last the entire trading day (intraday trends), you could trade the London breakout. The London breakout is a simple strategy that aims to take trades in the direction of the breakout after the London session opens.

Since trading activity increases when UK banks and hedge funds join the market early in the morning, there can be large volatility in the market immediately after 8:00 AM London time.

The London breakout is a popular entry strategy among Forex day traders, because the currency market trades around the clock. However, it can also be used for stocks and other markets.

Another great period to day trade in the UK is the London-New York overlap. When US markets open at 8:00 Eastern Time (noon UK time), trading activity tends to peak for the day. The London-New York overlap ends at 4:00 PM London time when the UK markets close.

Many economic indicators and news are also released during this time period, especially important reports from the United States. Depending on the markets you’re trading (US stocks, US dollar, etc.), those reports can have a huge impact on your open trades.

Besides the period of the day you choose to trade, some weekdays also offer better trading opportunities than others. Monday and Fridays tend to be the quietest days, with trading activity gradually picking up from Tuesday to Thursday.

However, there is no rule of thumb what days are best to trade. For example, if there are unexpected news released during the weekend, Mondays can see huge volatility as market participants start to balance their portfolios.

Similarly, Fridays can be very exciting to trade as well, especially when the US release their labour market statistics and non-farm payrolls (each first Friday of the month.)

UK Day Trading Rules & Tax Considerations

As noted earlier, there are no limitations on day trading if you live in the UK, given you’re trading with an FCA regulated broker. You can day trade as much as want, six days a week, on any market that is currently open.

Trading tax considerations are somewhat more complex and can be subject to change in the future. At the time of writing, the tax year in the UK begins on April 6 the current year and ends on April 5 the next year. The personal allowance on income that is not taxable currently stands at £12,500 (2020-2021).

According to the HMRC, if you’re day trading as an independent trader, your income should be declared as self-employment. However, if you’re a longer-term investor, then your income and gains should be declared for capital gains purposes.

Forex traders and day traders who are trading on CFDs (Contracts for Difference) aren’t subject to income tax, business tax, or capital gains tax. This is because CFDs don’t involve the ownership of the underlying asset and any stamp duties are paid by the CFD providers instead (your broker).

However, bear in mind that you’re also not able to claim any losses against your other personal income if you’re day trading with CFD contracts.

You should always seek advice from a professional tax accountant or the HMRC since tax laws can be subject to change.

How Much Money Do You Need in Day Trading?

You don’t need a lot of money to start day trading. Most brokers don’t have any minimum deposit requirements, which means you can start trading with as little as £10. However, the size of your trading account ultimately affects the profit you’ll be able to make as a day trader.

Many beginner day traders I met in my trading career were making the same mistake over and over again. They fell for overtrading, which means they took very high trading risks, hoping to make the big buck.

Bear in mind that trading isn’t sprinting, but a marathon where the most successful traders make consistent small profits, month by month. A sprinter in day trading will much more likely blow his or her account than make a profit by the end of the day. Consistency and controlling your risk levels is key if you want to become a profitable trader.

Imagine a trader who trades with a £1,000 account and risks 20% of his trading account on any single trade, which would equal a risk-per-trade of $200. He could be lucky in his first few trades, but over a period of weeks or months, he will inevitably face a losing streak of 5 trades or more. Risking 20% per trade, that losing streak would blow up his entire account.

On the other hand, imagine a trader with the same account size (£1,000), but risking only 2% per trade. With an effective trading plan, discipline, and patience, the trader will be able to slowly grow his account.

Check it out: What is the 1% Rule? (And Why It’s Useful for You)

So why do traders overtrade in the first place?

The most common reason I’ve found so far is a small trading account size. Making a £1,000 profit with a £1,000 account requires a 100% return, which in turn requires increasing one’s risk levels significantly. That trader will likely overtrade and overleverage his trades, which increases his risks of a trading disaster.

With a £100,000 account, the same £1,000 profit would only require a 1% return. This is much more manageable and allows a trader to stay in the day trading game in the long run.

Naturally, many beginner day traders don’t have enough capital at hand to fund very large trading accounts, so how much money do you need to start day trading but avoid overtrading? I would personally start with any amount of money you can afford to lose, be it £1,000, £5,000, or £10,000.

Since you’re just getting started with trading, the key isn’t to hit the jackpot, but to sharpen your trading skills and practice patience and discipline. Many successful traders started with a small account and grew it steadily and consistently over months and years.

Read: How to Get Started Trading with Only £100

Should You Take a Trading Course First?

Trading can be simple, but it isn’t easy. By simple, I mean that you can have a profitable yet straight-forward and logical trading approach.

When I say it’s not easy, I mean that trading isn’t “Buy when this line crosses above, and sell when it crosses below.” Trading is like any other skill you learn in life. It’s like learning to walk, driving a car, or playing chess. There are rules that you need to respect and experience you need to gain. The same things you need in order to avoid hitting a tree while driving or losing in a chess game.

Trading isn’t a hobby, it requires total focus and dedication to learn the fundamentals and stay in the game in the long run. This is where comprehensive and quality trading courses can help you achieve your goals as a trader.

At My Trading Skills, we offer these trading courses led by expert traders. We know what it takes to become a successful trader and what trading mistakes beginner traders make. Trading is a journey, and every journey begins with the first step. Start now.

- Learn more, take our premium course: Trading for Beginners

How Should a Home Trading Setup Look Like?

To day trade from your home, you’ll need a home trading setup. Although you may find some trading gurus posting pictures on social media of them trading from on the beach, the truth is that you’ll need a dedicated space for your trading. Without any distractions.

A home trading setup doesn’t have to be expensive. A nice and clean table and a modern laptop with broadband internet will do most of the job.

Although you don’t necessarily need an external monitor, I recommend that you get one. It’s much easier to have your charts and watchlists on one screen, and market news, articles, fundamentals, your trading platform, or any other tool that you’re using to trade on another screen.

Also, make sure your monitor is large enough and has a good enough resolution to get a crisp and clear view of your charts. A 24 inch, 1080p will do the trick, although you could also go for larger screens with a 1440p resolution, depending on your trading budget.

Regarding your laptop, make sure it’s fast enough to handle your charting and trading software without any lags. Most modern laptops with at least 4 GB of RAM are good to go. Just like with the second screen, high-end laptops with fast processors and more RAM will provide a better trading experience, but this depends again on how much you’re willing to invest in your setup. I recommend you read our guide on the best laptops for day trading.

Now that you’ve found a nice place in your home to trade from and connected your monitors and laptops, it’s time to focus on the trading software.

While most brokers support the MetaTrader 5 trading platform. And this is arguably the most popular platform among retail traders, I personally use different programs for charting purposes and for placing trades. TradingView offers great charting tools, watchlists, price-alerts, multiple chart layouts, charts overlays, etc.,

I am using my broker’s platform only to place trades identified on my charting software.

Read: MT4 vs MT5: Which Should You Use?

For economic reports and news, there’re hundreds of free websites that provide economic calendars and timely market news. I personally like to use Bloomberg.com, TradingEconomics.com, and ForexFactory.com.

Top Trading Strategies

Day traders have a variety of trading strategies at their disposal. Here’s a list of the most popular ones, but bear in mind that you need to create your own trading rules that suit your risk profile and trading plan to become a successful trader. You can’t just copy and paste a trading strategy and expect to become profitable. What works for one trader, doesn’t have to work for another one.

The most popular day trading strategies can be grouped into three groups:

1. Trend-following

2. Breakout trading

3. Mean-reverting strategies.

Let’s take a look at each of them.

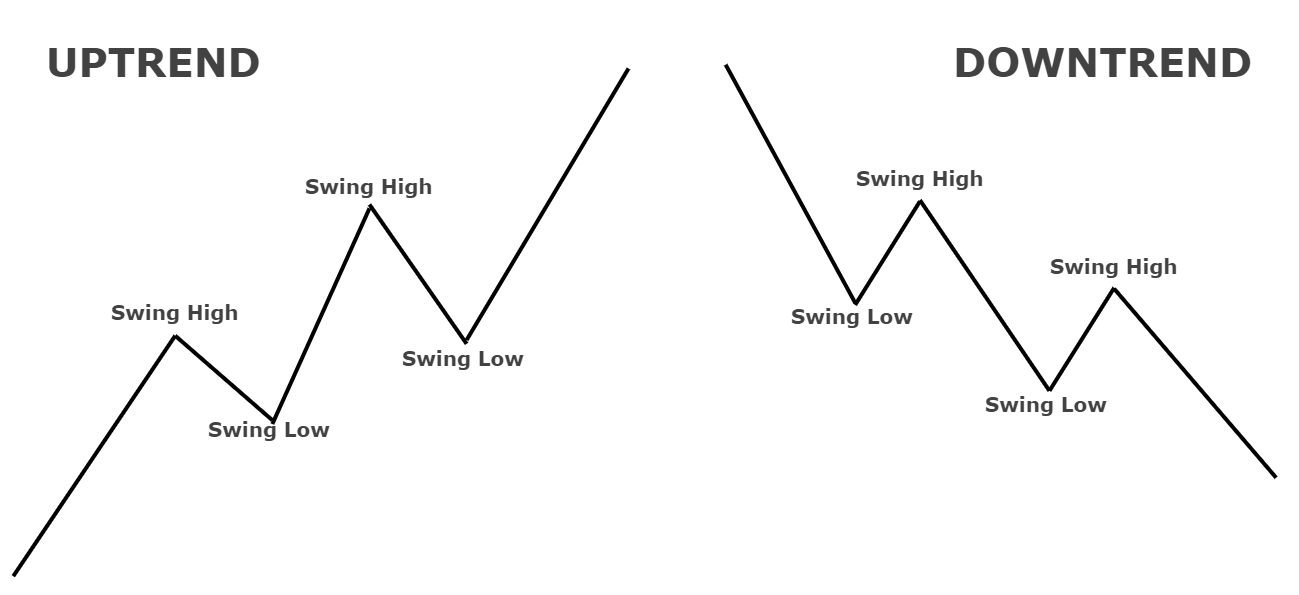

1. Trend-following: Trend-following strategies are arguably the most popular day trading strategy out there. They aim to take advantage of intraday trends, which are strong price-moves that go either up or down. In this regard, there are two types of trends: uptrends and downtrends.

Uptrends form when the price makes consecutive higher highs and higher lows. Uptrends (and trends in general) don’t go in a straight line, but occasionally form corrections that go in the opposite direction of the underlying trend. Those price-corrections, which can be the result of profit-taking activities or market noise, is what forms the higher lows in uptrends.

The same is true for downtrends. Markets don’t go down in a straight line, but form occasional corrections to the upside. Those corrections create the so-called lower highs in downtrends.

This is best explained by the following graphic. Swing highs and swing lows refer to higher highs and higher lows in uptrends, and lower highs and lower lows in downtrends, respectively.

Trend-following strategies aim to take advantage of those prolonged price-moves when markets are trending. There are dozens of trend-following strategies out there: Some are trading breakouts and breakdowns of previous swing highs and swing lows, while other strategies aim to pick the tops and bottoms of corrections.

Some trend-following strategies are also based on moving averages, with a rising MA representing an uptrend, and a falling MA a downtrend.

Here’s an example of an uptrend in the USD/CAD pair. Notice the higher highs and the price holding above the 50% Fib level. All this signals that the uptrend has further upside potential.

2. Breakout Strategies: As their name suggests, breakout strategies aim to catch price-breakouts of important technical levels.

Breakout traders aim to take advantage of the increased volatility following a breakout, with prices sometimes moving hundreds of points. This also means that breakout traders need to be fast to pull the trigger, or risk missing the majority of the move.

To catch breakouts, traders often use pending orders, like stop and limit orders. Those orders will execute a market order once the price reaches a pre-specified level, without the need for the trader to look at the charts in real-time. That’s why pending orders are also a popular tool of day traders who also have regular day jobs.

Here’s a simple breakout trade in the USD/JPY pair. The price triggered a symmetrical triangle pattern and moved lower on significant momentum. A breakout trader aims to catch the moment the price breaks below the lower triangle trendline.

3. Mean-Reverting: Trends don’t move in a straight line forever, because markets tend to return to their mean-value over time. That’s where mean-reverting strategies come into play.

Those strategies aim to identify markets that have significantly overshoot their mean-value and that have a high possibility to reverse. An example of a mean-reverting trade would be a sideways-moving market that reached its long-term upper resistance or lower support zones, therefore trading well above/below its mean value.

Take a look at the chart above. The 50-period EMA represents the average price of the pair for the last 50 periods. Since markets tend to return to their mean-value, the price is oscillating above and below the 50-period EMA but will eventually return to those levels.

A buying opportunity forms when the price overshoots its mean-value significantly to the downside, while a selling opportunity forms when the price overshoots its mean-value significantly to the upside.

- Take our free course: Technical Analysis Explained

- Take our free course: Trends, Support & Resistance

- Take our free course: Japanese Candlesticks Decoded

- Take our free course: Reversal Price Patterns

- Take our free course: Continuation Price Patterns

- Take our premium course: Trading for Beginners

Beginner Day Trading Tips

Here are some day trading tips that helped many new traders become consistently profitable. While this list is not all-inclusive (we’ve listed 26 awesome beginner tips here), it covers the most common mistakes made by beginner traders.

a. Keep a trading journal: A trading journal is just like a trading diary. It includes all your trades and their results, entry and exit prices, reasons for taking the trade, position size, date and time of the trade, chart, and any other field that you consider helpful to archive. Trading journals help you spot trading mistakes and fine-tune your trading strategy.

Try to identify setups that didn’t play out as expected, setups where your stop-loss was too tight, or chart patterns that often return losing trades. You can analyse your trading journal in any way you like to make helpful conclusions for your future trading.

b. Create a trading plan: A trading plan describes how you approach the markets. A well-defined plan should include your trading strategy (where and why you’re taking trades), your risk management rules (how much you’re risking and where you’re exiting losing positions), the markets you’re trading, and any other trading rule you use.

You should have your trading plan written down on a sheet of paper and keep it near your trading desk. Those are the rules you use in your trading, so make sure you re-check them in times when you experience a losing streak. Learn more with our article on the 16 steps to creating a successful trading plan.

c. Pay attention to risk: The most common mistake I see among beginner day traders is not paying attention to risk. Trading is all about controlling your risk; the better you control it, the higher the chance that you’ll become a successful trader.

The first value you need to define is how much you want to risk per any single trade. New traders who don’t have an understanding of trading risks often open too large position sizes, which inevitably causes huge losses and fear. Ask yourself how risk averse you are.

Consider risking only up to 2% of your trading account per any single trade. As you gain experience and become a better trader, you can start to increase your risk on certain high-probability setups (those setups that usually close in profit can be identified in your trading journal).

When you start to control your risk, there is no room for fear in your trading. You know that if your stop-loss gets hit, you’ll only lose a certain (hopefully small) portion of your trading account, which helps you stay in the game for longer.

d. Don’t overtrade: Overtrading is another common mistake among beginner traders. When looking at a chart, there is an almost infinite number of profitable opportunities.

Prices go up and down every minute, hour, and day, and beginner traders often try to catch all movements they see on a chart. Unfortunately, the truth is that not all movements are tradeable. We need a strict plan to trade the market, and we only enter into a trade when all rules of our plan align.

e. Look at the bigger picture: What looks like a downtrend on the 5-minute chart, could actually be an uptrend on the 1-hour chart. Even then, the market may be ranging on the daily chart. Looking at only one timeframe when trading is a common mistake among inexperienced traders.

Multiple timeframe analysis (MTFA) helps you avoid fighting the underlying trend and provides better trading opportunities.

f. Adjust your reward-to-risk: The reward-to-risk ratio of a trade is simply the ratio between the trade’s potential profits and losses. For example, if you buy a stock at $50, have a profit target at $60 and a stop-loss at $45, the reward-to-risk of that trade would be 2:1, i.e. you’re risking $1 to make $2.

Traders who aim for an R/R ratio of 1:1 and higher have shown to have a better trading performance than traders with an R/R ratio of below 1.

However, don’t go crazy with your reward-to-risk. It’s easy to justify a mediocre trade by increasing its R/R. If your profit targets are 10 times larger than your stop-loss sizes, it’s no wonder that your stop-losses keep getting hit over and over again.

g. Keep your winners running: Finally, beginner traders tend to close their winning trades too early and let their losing trades run. There’s a simple explanation behind this kind of behaviour: Traders are afraid the markets will reverse and wipe out their profits. Conversely, since inexperienced traders try to avoid losses at any cost, they will stick to their losing positions, hoping the market will reverse.

Keep two things in mind:

- You need a very good reason to close a winning position. Did it hit an important support/resistance level? Are there signs of a possible trend-reversal? Is there important market news about to hit the newswires? If not, stick to your trade.

- Be very impatient with losing trades. If a trade doesn’t perform as expected in the first few minutes or hours, just close it. There’s a new opportunity just around the corner.

Final Words

In this guide, we’ve tried to cover what does it take to become a day trader in the UK. The UK is home to the largest number of day traders in Europe, with almost twice the number of day traders compared to second-placed Germany.

Day trading is an exciting and rewarding endeavour, but only if you get the basics right. Day trading is a trading style that involves taking trades within one trading day. A day trader opens and closes his trades during the same day, avoiding overnight risks.

You don’t need a lot of money to become a day trader. Most brokers don’t have a minimum deposit requirement nowadays and you can start trading with any amount you can afford to lose. Try to grow your account gradually, and consider making regular deposits to your account when you become consistently profitable.

Becoming a successful trader requires experience, knowledge, skills, patience, and discipline. Trading is like any other skill, and an experienced trading mentor can help you grasp the foundations of successful trading faster. At My Trading Skills, you’ll find a detailed Trading for Beginners course that can help you fast-track your trading career. Get started today.