7 Day Trading Styles and Techniques of the FX Market

Financial markets can be traded using various trading styles, and the Forex market is no different.

In this article, we’ll explain what day trading is and show you some popular techniques to day-trade the market. However, before we dig deeper into day trading, let’s quickly cover the main trading styles that traders use to trade financial markets.

Read:

The Four Main Trading Styles

Depending on your personal preferences, there are four main trading styles which can be used to trade the Forex market.

Each style has its advantages and drawbacks, so make sure that you choose the one that best fits your psychological traits or you won’t be able to take the most out of your trading.

The main trading styles are scalping, day trading, swing trading and position trading.

Scalping

Scalping is the most dynamic trading style in the list, as it involves opening multiple trades during the day and closing them shortly after. Scalpers like fast-paced trading and they don’t want to wait for hours or days for trade setup to form. That’s why scalpers trade on very short-term time-frames, such as the 1-minute or 5-minute ones.

Day Trading

Day trading is based on higher time-frames, such as the 1-hour or 4-hour timeframes. Day traders aim to hold their trades for the whole trading day and usually close their trades by the end of the day. US-based brokers will usually flag you as a day-trader if you place at least three trades per day for five consecutive days. We’ll soon cover the main techniques that day traders use to trade the market.

Swing Trading

Swing trading is based on longer-term timeframes and trades are usually held open for a few days. Unlike day traders, swing traders are exposed to overnight market risks which may turn their positions against them. It’s not unusual that swing traders hold their trades over the weekend.

Position Trading

Finally, position trading is the longest-term trading style in our list. Position traders hold their trades for months or even years. Since fundamentals play an important role over such long time-frames, position traders need to have a good understanding of economics and market dynamics that impact exchange rates.

- Learn more, take our premium course: Trading for Beginners

Must Reads:

- 9 of the Best Forex Books That’ll Turn You Into an Expert Currency Trader

- Can You Trade Forex While Working Full Time?

- Who are the Best Forex Traders in the World?

Day Trading Techniques

Now that you’re familiar with the main trading styles and know the main characteristics of day trading, it’s time to see how day traders trade the market. There are three main day-trading techniques, all of which have a proven track-record: (1) breakout trading, (2) trend-following and (3) counter-trend trading.

Let’s explain each of them with examples.

#1 Breakout Trading

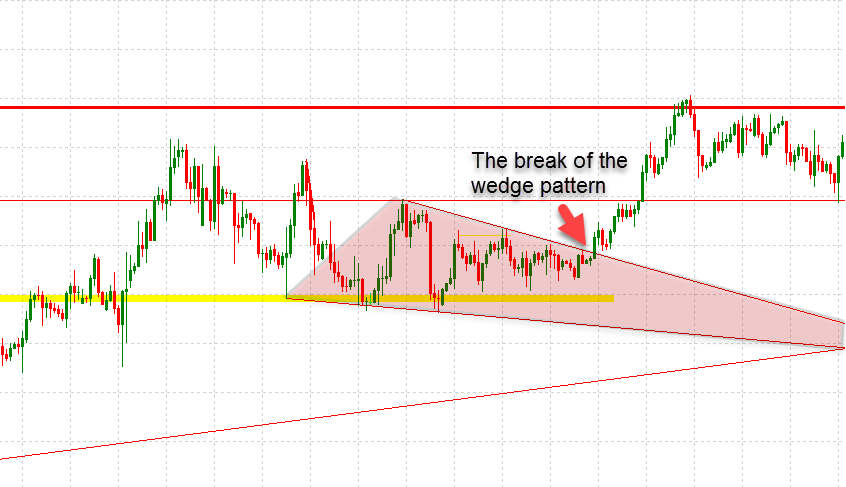

As its name suggests, breakout trading is based on catching the buying or selling momentum immediately after a breakout occurs. Breakout traders usually rely on chart patterns and trendlines to analyse the market and wait for the price to break above or below important technical levels.

Since breakout traders want to catch the breakout as soon as it happens, they often use pending orders placed just above or below the potential breakout point. Using pending orders is also time-efficient, as you don’t have to wait in front of your screen to open the trade – the pending orders will be automatically executed when the price reaches the pre-specified level.

The chart above shows a typical breakout trade setup based on a bullish wedge chart pattern. Breakout traders should also be up-to-date on important market developments, as news can often trigger a break of important technical levels.

#2 Trend-Following Trading

The next popular day-trading technique is based on trend-following. Trading doesn’t have to be complicated, and trend-following trades are arguably the simplest and most rewarding of all. Bill Dunn is a famous trend-following trader who made significant returns on the US dollar vs. Japanese yen pair over 1995, simply by using a trend-following strategy.

By using trendlines, Dunn captured both the downtrend in early 1995 and the following uptrend during the Summer of the same year in the USD/JPY pair.

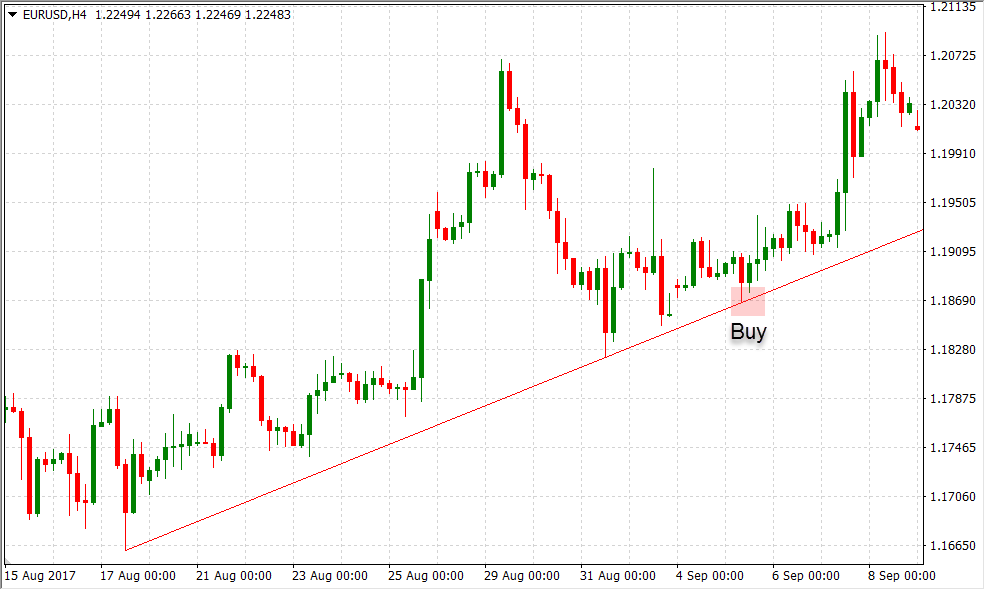

Trend-following traders use simple technical tools such as trendlines and channels to identify the current trend and spot trend-reversals. When the price reaches close to a trendline, and the following price-action shows that the trendline is respected, trend-following traders would enter in the direction of the trend.

The chart above shows a simple trend-following setup. Since the price is forming consecutive higher highs and higher lows, which are characteristics of an uptrend, a trend-following trader would wait for the price to reach towards the rising trendline and open a long position if the trendline shows to hold.

Read:

Awesome Guide to Candlestick Patterns (You’ll be Amazed!)

Make Sure You Can Identify Candlestick Charts

Advantages and Disadvantages of Automated Trading Systems

Counter-Trend Trading

Last but not least, counter-trend trading is also a popular day trading technique. However, since this day trading style involves opening trades in the opposite direction of the underlying trend, counter-trend trades are usually riskier than their breakout of trend-following counterparts.

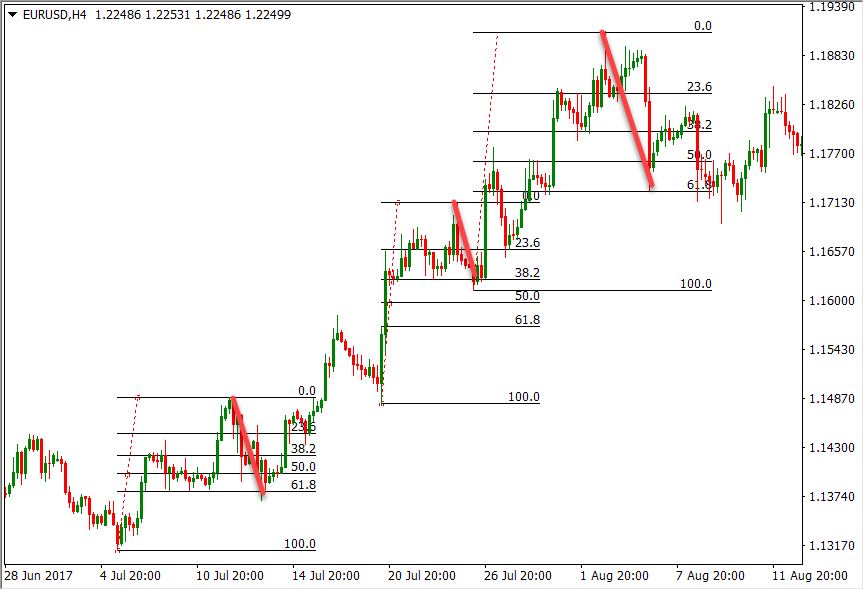

Counter-trend traders often use mean-reverting strategies to open a trade. In essence, the price makes ups and downs even when the market is trending, and this type of trader wants to take advantage of these moves.

If the price moves too much up during an uptrend, counter-trend traders will look to short the currency pair. Similarly, if the price moves too much down during a downtrend, these traders will look to buy the currency pair.

Read:

Alternatively, counter-trend traders can use Fibonacci tools to measure the extent of a correction and the potential profit target. The following chart shows how to use Fibonacci retracements to enter a counter-trend trade based on price corrections.

Strong uptrends and downtrends usually find support at the lower Fib percentages, such as the 23.6% and 38.2% levels. Weaker trends may correct all the way to the 61.8% Fibonacci level.

- Learn more, take our free course: Fibonacci: Fast-Track

Final Words

Day trading is a popular trading style in the Forex market. It allows traders to place trades in the morning, hold them during the day and close them by the end of the trading day, knowing whether they made a profit or a loss for the day. While day trading is not as fast-paced as scalping, it allows placing more trades during a week than swing traders would do, not to mention position traders.

There are three main day trading techniques: breakout trading, trend-following trading and counter-trend trading. While trend-following trades are usually the simplest and most rewarding of the three, your trading performance ultimately depends on your experience and market understanding.