List of Trading Types and Strategies: Which Suits You Best?

What’s the best trading style to get your feet wet in the markets? There are many styles to choose from and each comes with its own advantages and disadvantages.

Are you an impatient trader who loves fast action on your charts?

Or do you lean more towards long-term trading and holding your trades open for months or even years?

In this article, we explain the main trading styles, the most popular trading strategies, and how to choose the best style based on your trading goals.

Main Types of Trading Styles

The majority of traders can be grouped into one of the following trading styles, depending on the time horizon of their trading:

- Scalping

- Day trading

- Swing trading

- Position trading or investing

Scalping is the most short-term trading style where trades are held for seconds or minutes, followed by day trading that involves keeping trades open for a few hours, and swing trading where trades are held for days or a few weeks. The most long-term trading style is position trading, or investing, where trades are kept open for months or even several years.

Here are the main trading styles explained:

Scalping

Scalping is a very short-term and fast-paced trading style. It involves opening and closing trades in a matter of seconds or minutes, depending on the trading strategy used by the scalper.

Scalpers try to take advantage of very short-term price movements that often come in the form of breakouts. When the price breaks a major technical level, a cluster of stop-loss and pending orders tend to accelerate the market in the direction of the breakout. That’s why you’ll often see strong momentum candlesticks right after the price breaks a major support or resistance level.

Since scalping is a very active trading style, scalpers open a large number of trades each day. It’s not unusual for a scalper to open dozens of trades per day, which inevitably requires active managing of the trades and spending time in front of the trading platform.

With a higher trading frequency come higher trading costs, so scalpers need to take them into account when measuring their trading performance.

The importance of trading costs when scalping the markets becomes even more emphasized when considering that scalpers usually use very tight stop-losses, which in turn allows them to increase their position sizes. Higher position sizes lead again to higher trading costs.

Scalpers often follow important market news and try to scalp or fade quick moves in the markets. Important market reports, especially when they hit the market by surprise, tend to create strong movements in the very short-term. A scalper can enter a trade as soon as those movements break above or below important technical levels, or they can wait to fade the move if the price rises or falls too much, too fast.

To Summarise: Scalping is the most fast-paced trading style of all. It requires quick decision making and nerves of steel to follow your trading plan. A scalper needs to know exactly when to enter into a trade, where to place his stop-loss and take-profit levels, and how to identify a slowing momentum in the market. Without proper risk management, scalping can quickly result in high losses. Check out our premium course Trading for Beginners. Cut your learning curve significantly on a whole range of trading strategies.

Day Trading

Day trading involves opening and closing trades within the same trading day. Day traders usually look for trading opportunities early in the morning or during the day, and close all their active trades before the end of the trading day. There are many similarities between scalping and day trading. Both are very active, short-term trading styles, with the main difference that day traders aim to catch intraday trends and keep their trades open for several hours to achieve this goal.

Many day traders will also adopt some scalping strategies and trade short-term breakouts and momentum trades as they’re waiting for a real day trade to confirm. Again, just like scalping, day trading requires active managing of your trades and following the market during the day.

Forget about the trading gurus who promise amazing returns by trading only for 5 minutes during the day. Day trading requires serious commitment if you want to see success and stay in the game in the long run.

Although day traders usually don’t open as many trades as scalpers, they’re still fairly active. Depending on the trading day and the number of tradeable opportunities, day traders can open a dozen trades per day. However, if there are no opportunities, a day trader will sit on their hands and simply wait for the next trading day.

To summarise: Day trading requires patience to wait for the ideal trade setup but also fast fingers to enter into a trade as soon as it emerges. Trading decisions are made pretty fast, which makes day trading a suitable trading style for the more experienced trader.

Many traders begin as swing traders to get a feeling for the market and switch to day trading or scalping once they feel comfortable with making quick trading decisions.

Swing Trading

Swing trading is a longer-term trading style that involves keeping trades open for several days or even weeks. Swing traders aim to take advantage of the “swings” in the markets; the strong directional moves on the longer-term charts. To do so, they need to use a wider stop-loss to account for the price volatility, with returns usually measured in hundreds of points or pips.

Since swing traders hold their trades over relatively long periods of time, they don’t need to actively manage their trades. This makes swing trading a more appropriate trading style for traders who have regular jobs and don’t wait to follow the market hour by hour.

Fundamentals also play an important role over longer timeframes. Strong directional moves are often caused by important or unexpected market news, such as company earnings reports or central bank meetings, which means that swing traders need to stay up-to-date on market fundamentals.

Although swing trading tend to be less stressful than scalping or day trading, it still requires an important trait: patience. Traders need to be able to wait for a trade setup to develop and confirm over the course of several days. Once they are in a trade, they need the discipline to ride the trend as long as it lasts and avoid closing their profitable trades too soon.

- Learn more, take our premium course: Trading for Beginners

Position Trading / Investing

Finally, position trading is the most long-term trading style where trades are kept open for months or years. While position trading has many similarities with investing, keep in mind that this is still a trading style.

Position traders can be long or short the market, and have stop-loss and take-profit levels for their trades, whereas investors usually invest in the long-term and adopt a buy-and-hold strategy.

Position trading is heavily impacted by market fundamentals, especially by long-term fundamentals such as economic cycles, credit cycles, balance of payments, terms of trade, and interest rate differentials. Position traders also need to have wide stop-losses to withstand negative price fluctuations over the short and medium-term.

To be a successful position trader, besides patience, you need to understand what impacts the markets in the long run.

Read: How Do You Choose the Right Share Trading School

What is a Trading Strategy?

A trading strategy is a set of rules that guide you through the markets. Your strategy defines how you identify tradeable setups, when to enter, where to exit, and how to manage your trades. It’s important that your strategy has clear and unbiased buy and sell rules that help you pull the trigger as soon as a trade setup emerges.

The less discretion you have when making trading decisions, the better you’ll perform in the long run. Discretion and intuition become more important as your experience grows, so don’t rely on your intuition and gut feeling unless you have spent years in front of your charting platform.

Your trading strategy should be an integral part of a well-defined trading plan. Your trading plan acts like a compass for the markets. It defines what markets you’re trading, what trading style (or styles) you’re using, what market hours you’re trading, and how you manage your risks.

Risk management is perhaps one of the most important sets of rules you need to define, including the risk you’re taking per trade, the reward-to-risk ratio you’re aiming for, whether you are scaling in and out of positions, and so on.

Main Types of Trading Strategies

Whether you’re scalping, day trading, swing trading, or position trading the markets, you need to have a robust trading strategy that returns profits over a decent sample of trades. There are many trading strategies, but most can be grouped into trend-following, breakout/momentum strategies, and mean-reverting strategies.

Here’s a brief breakdown of each strategy group:

Trend-following

As their name suggests, trend-following strategies are based on following the current market trend. In an uptrend, a trend-following strategy will buy the market, and in a downtrend, it will sell the market.

Trend-following strategies can be very profitable in markets that show strong and long-lasting trends, such as the stock or currency markets.

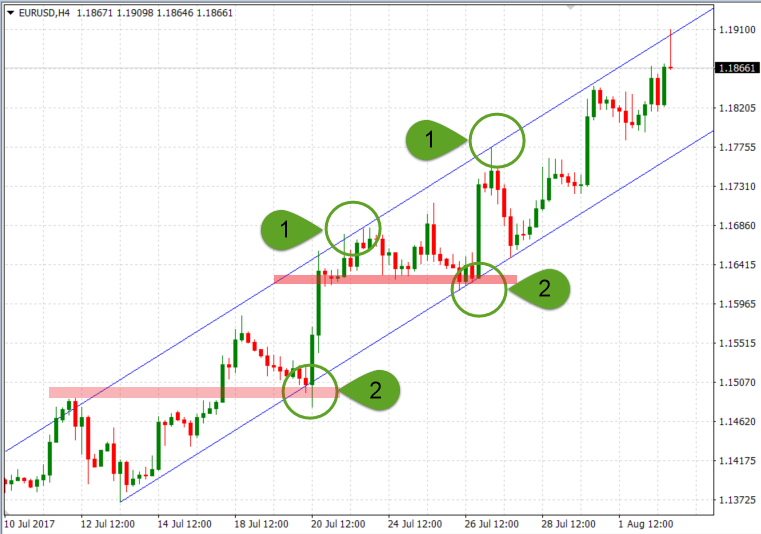

The following chart shows a trend-following trade in the EUR/USD pair. Pay attention to points (1) and (2). Points (2) represent good entry points in the direction of the underlying trend after the price reached the lower channel support, while points (1) show possible profit targets as the price approaches the upper channel resistance.

Breakout / Momentum Trading

Breakout strategies are designed to take advantage of price breakouts above or below important technical levels. As explained earlier, traders often place their stop-loss and pending orders around important technical levels, which tend to accelerate the breakout move once triggered.

Breakout strategies are based on the momentum that follows a breakout, which is why those strategies are also called momentum strategies. They are popular among scalpers and day traders and return the best results when traded in the direction of the underlying trend.

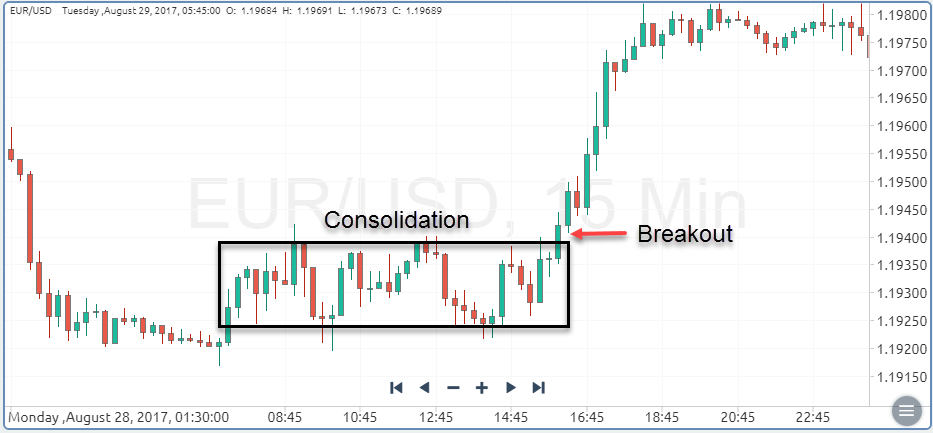

Here is an example of a breakout trade after a consolidation period. The move came with strong momentum as stop-loss and other pending orders (such as buy stops, for example) got triggered and moved the price higher.

Mean-reverting

Last but not least, mean-reverting strategies are based on the phenomenon of markets to revert to their mean value.

Markets don’t go up or down in straight lines. Instead, they form corrections, consolidations, and return to their average value as market participants take profits and new traders place their trades. Mean-reverting strategies play an important role when fading strong moves for a quick scalp, or when day trading overbought or oversold markets.

Mean-reverting strategies often rely on oscillators to find overbought and oversold market conditions. The Relative Strength Index, a popular oscillator, returns an overbought signal when its value rises above 70, and an oversold signal when the value falls below 30.

The GBP/USD pair has been trading in a sideways market in the chart below and returned to its mean-value each time the RSI reached oversold or overbought levels.

- Take our free course: Technical Analysis Explained

- Take our free course: Trends, Support & Resistance

- Take our free course: Japanese Candlesticks Decoded

- Take our free course: Reversal Price Patterns

- Take our free course: Continuation Price Patterns

- Take our premium course: Trading for Beginners

What Trading Type Would Suit You Best?

So here we have the four most popular trading styles: scalping, day trading, swing trading, and position trading. Each trading style can be combined with one of the three main trading strategies: trend-following, breakout/momentum trading, or mean-reverting strategies.

But, how to choose the best trading style and strategy that suits your personality?

If you’re a new trader, the best way is to spend some time with each of the styles and strategies and figure out what works best for you. If you’re into fast-paced trading on very short-term timeframes, then scalping combined with a breakout strategy may be the best fit for you.

On the other hand, if you want to hold your trades open for a few days or weeks and don’t have the time to actively manage your open trades, then take a look at swing trading with a trend-following strategy.

Day trading may also be a good option for you if you have the experience to make quick trading decisions and want to follow the markets every day for tradeable opportunities.

Finally, position trading is more for the long-term trader who has a good understanding of market fundamentals and who wants to ride long-term trades in the markets.

- Are you ready? Take our premium course: Trading for Beginners