Chapter 12

Example #2: GBP/USD CFD Trade

We’ve shown you a spot Forex trade, so in this chapter, we’ll take you through a CFD trade on a currency pair.

This is the second worked example of three, where we are taking you through the currency trades using spot Forex, a CFD, and a spread bet.

For the sake of our CFD example, we’ll assume our trader wants to go short GBP/USD. This means they think the US Dollar will appreciate against Pound Sterling. How they came to that view isn’t relevant for this chapter – but we hope it came from good analysis and was part of a thought out trading plan.

- Learn more, take our premium course: Trading for Beginners

A reminder

- A CFD is a contract for difference. When trading a CFD a trader is agreeing to exchange the difference in price between the point the trade is opened to the point it is closed. No underlying currencies are exchanged.

- In a currency pair, the first currency in the pair – the one on the left – is the base currency. The second currency – the one on the right – represents the quote currency.

- In Forex trading, the price you’re trading is always to buy one currency and sell the other. If you think the base currency will strengthen against the quote currency, you would buy the currency pair. Conversely, if you believe the base currency will weaken against the quote currency, you would sell the currency pair.

- In a quote from your broker, the bid price – also known as the sell price – is where you can short the pair, while the ask price – the buy price – is where you can go long the pair.

- CFDs are traded in contracts.

For the sake of this example we’ve assumed the trader is based in the UK, they have chosen to trade with an FCA regulated broker and the currency they fund their account with is Pounds Sterling.

Going short GBP/USD with a CFD

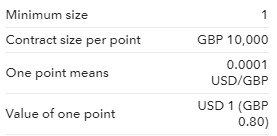

Our trader opens up their trading platform and locates the GBP/USD CFD market. They open up the market information tab just to check over what they are about to trade.

This confirms the contract is 1 CFD, with a notional value of £10,000 (the base currency), a 1 point move in price is 0.0001 – the same as a pip – and given the price is in the quote currency of the pair – USD – the value of one point is $1.

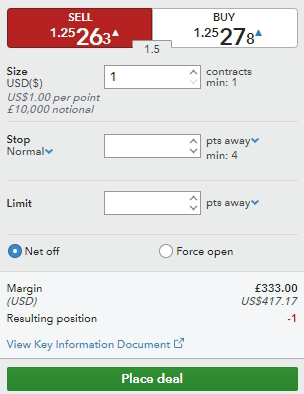

Next, our trader opens up a deal ticket. The sell price is 1.25263, this is the price they can go short at. The buy price is 1.25278, this is the price they can go long at. This is a spread of 1.5 points.

The size is the number of contracts our trader wants to trade – they trade the minimum, which is 1 contract.

1 CFD contract = £10,000 / 30 = £333

This is confirmed by the information on the deal ticket.

Our trader has £50,000 of trading capital in their account and no other open trading positions so they can fund this position comfortably.

The trader is happy with everything so places the Sell 1 GBP/USD CFD at 1.25263 .

The trader is happy with everything so places the Sell 1 GBP/USD CFD at 1.25263 .

For this example our trader hasn’t set a stop or limit order – it is good risk management practice to always trade with at least a stop-loss order in place, protecting the downside. We’ll show you these orders when we take you through the spread bet example in the next chapter.

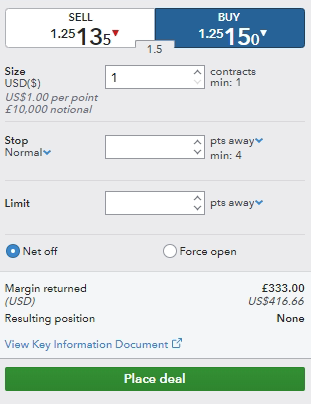

The trader now does not have any open positions – they are flat – so the broker releases the margin, plus the profit, back as funds available to trade.

The P&L on the trade was as follows:

We work out the difference in price (its a contract for difference):

1.25263 – 1.25150 = 0.00113 dollars

Next, how many points this was

0.00113 / 0.0001 = 11.3 points

We know from the market information and the deal ticket the GBP/USD CFD has a value of $1 per point:

11.3 x 1 = $11.30

This dollar profit is automatically converted back to the trader’s account currency – £ – by the broker, so our trader has ultimately made a profit of £9.02.

The trader called it right and made a profit, had the price risen they would have lost money.

We’ve shown you quite a detailed CFD trade here, the points to note are:

- The trader made money because they went long US dollars because they thought it would appreciate again Sterling, which it did.

- The P&L is in the quote currency – in this case, USD. The trader’s account currency is GBP so their broker converted the USD profit back into GBP.

- The profit would likely attract capital gains tax. Had there been a loss it would likely be tax-deductible.

- The trade was not held overnight, but if it was the trader would pay the interest rate of the currency they are long and receive the interest rate of the currency they are short. These would get netted to the tom-next rate and there would have been a small fee on top to roll it.

- There was no stop-loss order set, this was bad risk management, had the price tracked further up it could have created a significant loss.

Start learning now

Learn the skills needed to trade the markets on our Trading for Beginners course.