Chapter 4

How Forex Works

The Forex markets are some of the most exciting to trade.

They’re the largest and most liquid, open 24 hours a day from 10 p.m. GMT on Sunday until 10 p.m. GMT on Friday, and you can take advantage of them from almost any country.

So, ready to jump into the world of Forex? Great!

We’re at the start of Part II of our guide, in it, we’ll explain exactly what Forex trading is, how it works, its history and how traders access it. First of all, in this chapter on How Forex Works, we’re going to introduce some key concepts and go through the basics.

- Learn more, take our premium course: Trading for Beginners

What is a currency pair?

Governments, banks, companies and individuals need foreign currency every day. This might be businesses buying stock from an overseas supplier, a bank hedging its exchange rate risk or an individual going on holiday and needing some spending money. Whether directly or through intermediaries like brokers these parties all come together to buy and sell currencies – this creates the market and the price you see on your trading screen.

When trading Forex, you’re trading currency pairs – what this means is you are buying one currency and selling the other so the price you see is the price of one currency relative to the other.

Every currency union, normally a country, has a currency – US Dollars for the United States, the Euro for the Eurozone, Pound Sterling for the United Kingdom, Yen for Japan, Renminbi for China and so on.

Exchange rates can either be floating – meaning free to change from one moment to the next or pegged to another currency, or a basket of currencies – meaning that the value of the exchange rate is at a fixed rate, such as the Saudi Riyal which is pegged to the U.S. Dollar at 3.75. The largest quoted currencies – like EUR/USD and USD/JPY – are floating.

It’s always quoted in pairs

Because one currency is being bought and one sold exchange rates are always quoted in pairs. When trading Forex markets, we’re always concerned with currency pairs, not just a single currency. Let’s look at a live price for the EUR/USD pair – the Euro and the US Dollar.

What this is telling us is in the market right now you can sell 1 euro and buy about this number of dollars. You can also sell about this number of dollars to buy 1 euro.

Note: we’ll go into why it is only ‘about’ in a moment when we talk you through Bid and Ask prices.

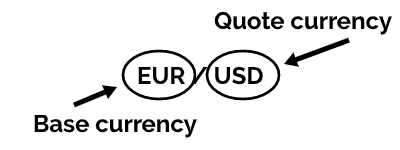

Base currency and quote currency

The price of a currency pair is always quoted using the same convention: the first currency in the pair is called the base currency and it is always worth 1, while the second currency is called the quote currency and shows how much of the quote currency you’ll exchange for 1 unit of the base currency.

Majors, minors, and exotic currency pairs

Theoretically, you should be able to trade any currency in the world with any other. However, you’ll only have access to those offered by your Forex broker.

There are three broad classifications for currency pairs.

- EUR/USD – Euros/US dollar

- USD/JPY – US dollar/Japanese yen

- GBP/USD – British pound/US dollar

- USD/CHF – US dollar/Swiss franc

- AUD/USD – Australian dollar/US dollar

- USD/CAD – US dollar/Canadian dollar

- GBP/MXN – British pound/Mexican peso

- SGD/JPY – Singapore dollar/Japanese yen

- EUR/GBP – Euro/British pound

- EUR/AUD – Euro/Australian dollar

- GBP/JPY – British pound/Japanese yen

- CHF/JPY – Swiss franc/Japanese yen

- NZD/JPY – New Zealand dollar/Japanese yen

- GBP/CAD – British pound/Canadian dollar

This isn’t an exhaustive list.

- CHF/HUF – Swiss franc/Hungarian forint

- GBP/CZK – British pound/Czech koruna

- EUR/TRY – Euro/Turkish Lira

- JPY/NOK – Japanese yen/Norwegian krone

- NZD/SGD – New Zealand dollar/Singapore dollar

Again, this isn’t an exhaustive list.

Read: These Are the 16 Most Popular Currency Pairs You Can Trade

Are you bullish or bearish?

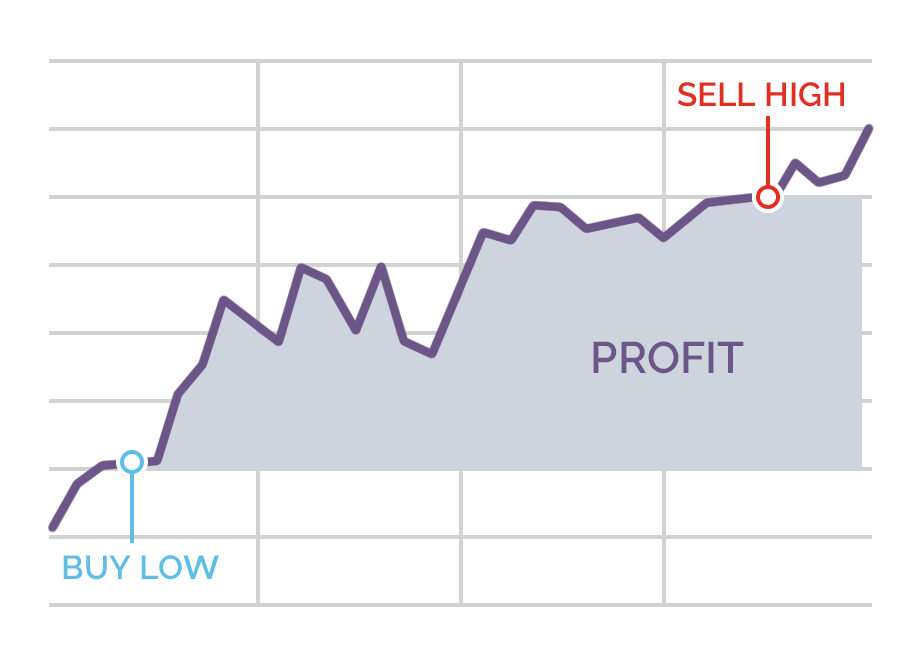

So you now know how a currency pair’s price is displayed. From there, you have two trading opportunities: either you open a buy position, or a sell position on the currency pair.

If you think EUR is likely to increase in value against USD – that would mean the price you are seeing quoted will go up – then you would buy the EUR/USD currency pair, or “go long”. What you’re doing here is buying euros and selling dollars. At this point in time you are bullish EUR and bearish USD.

You’re expecting the euros you are now the proud owner of to appreciate in value – the EUR/USD price will go up – and you sell them back, buying dollars at a later point in time for a better rate and booking a profit.

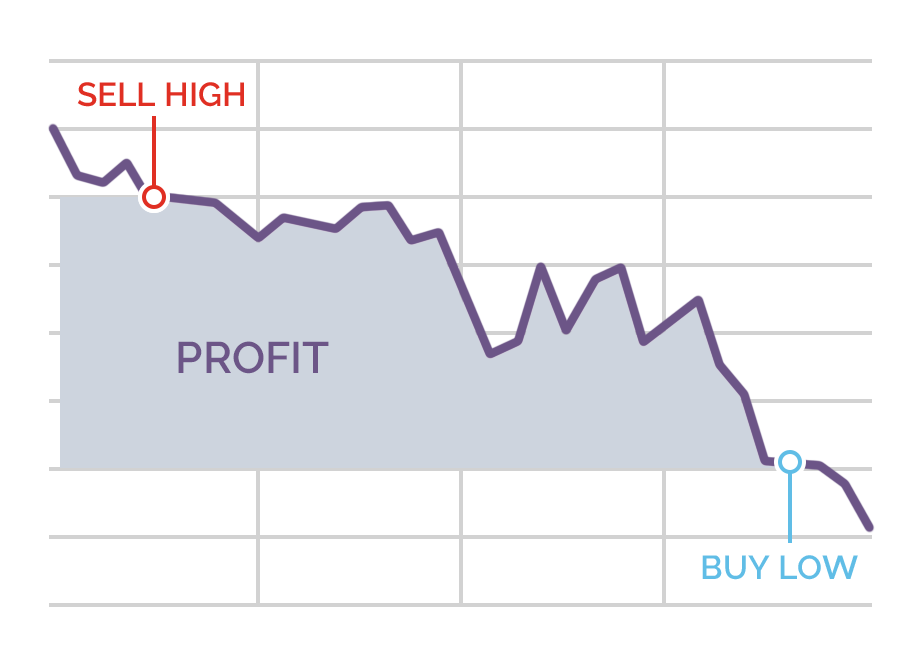

Conversely, if you believe that the EUR is likely to weaken against the USD, then you would sell the EUR/USD, or “go short”. You would be long dollars and be anticipating the EUR/USD price to fall.

Whether you’ll make profit or loss depends, naturally, on whether you were correct in your prediction.

Don’t worry if this hasn’t sunken in yet, we’ll run through several worked examples later in the guide.

Bid and ask prices

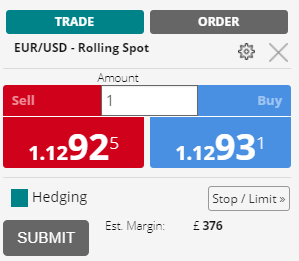

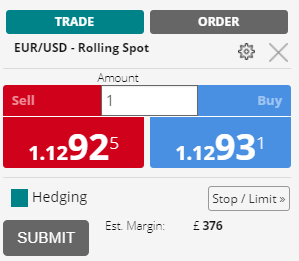

However, it is not as simple as going long or short at a single price. Here is a real deal ticket. As you can see, there are 2 prices displayed: a sell price at $1.12925, also called the bid price, and a buy price at $1.12931, also called the offer or ask price.

However, it is not as simple as going long or short at a single price. Here is a real deal ticket. As you can see, there are 2 prices displayed: a sell price at $1.12925, also called the bid price, and a buy price at $1.12931, also called the offer or ask price.

The bid price is the price to open a short position. The ask price is the price to open a long position.

Spread

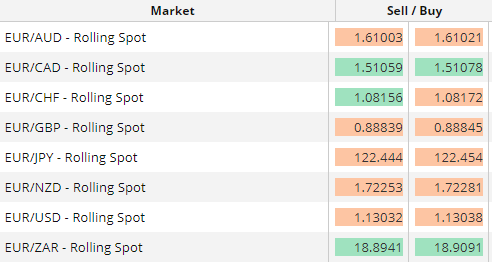

Here is a list of all the Euro linked currencies we’ve clipped from a trading platform.

You’ll notice that the buy price is always higher than the sell price (ask price > bid price). The difference between these 2 prices is called the spread, on our EUR/USD deal ticket it is 0.00006 (1.12931 minus 1.12925).

It is a bit of a stretch to get your head around if you’re coming across spread for the first time but this is one of the ways traders pay the market to trade – its a cost of trading. The wider the spread the more it costs, the narrower the cheaper it costs – all other things being equal.

- Learn more, take our free course: Breaking Down Trading Costs

Pips

Pips are used to measure the movement in Forex prices.

For the large majority of currency pairs, a Pip is the 4th decimal place. The one exception being the Japanese Yen, with a Pip at 2 decimals.

So, if EUR/USD moves from $1.12925 to $1.12935, then it has moved one Pip.

Don’t get confused when you see a currency quoted, it is not always the last number that is the Pip – our example deal ticket had five decimals. It doesn’t matter how many decimals are displayed – a Pip is still the fourth decimal.

Read More: What is Tick Size and How much is it Worth?

Lots

Contracts for currency pairs come in a standard size, called lots.

A standard lot is for 100,000 units of the base currency.

Going back to our EUR/USD example, if you went long 1 lot of EUR/USD, using the ask price of $1.12931, you are buying €100,000 and selling $112,931.

Not everyone wants exposure to 100,000 units of a currency, so retail brokers offer smaller contract sizes:

- Standard lot: 100,000 units of the base currency

- Mini lot: 10,000 units of the base currency

- Micro lot: 1,000 units of the base currency

- Nano lot: 100 units of the base currency

Value per Pip

When we know the size of the contract we can work out the value per pip in the quote currency. To do this we take the contract size and multiple it by one pip.

For our EUR/USD example, 100,000 x 0.0001 = $10.

So, if EUR/USD moves from $1.12925 to $1.12935, and you are trading 1 lot then that move is worth $10. Whether its a profit or a loss, obviously depends on whether you are long or short.

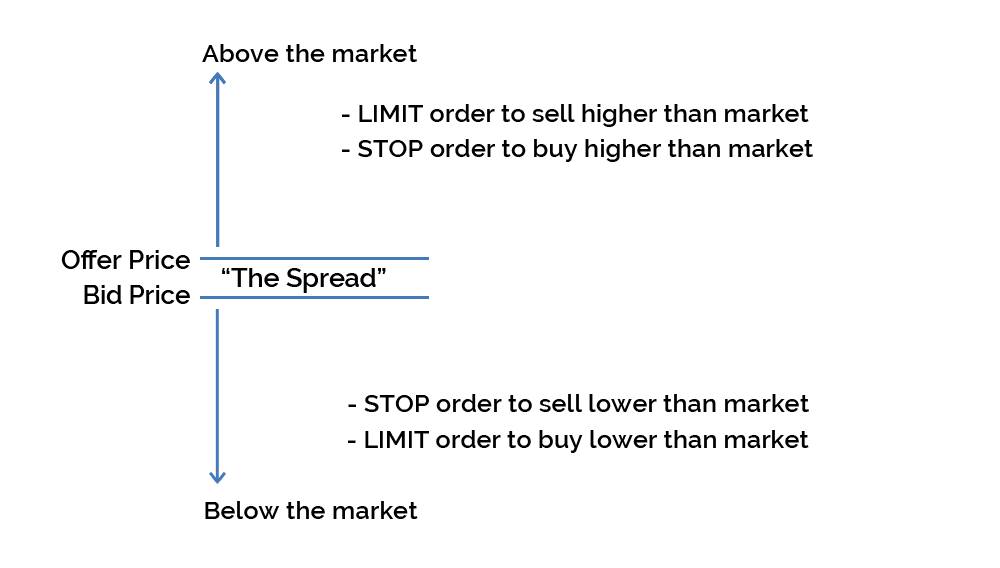

Stop orders

Stop orders are where you instruct your broker to place a buy trade at a price higher than the current price, or a sell trade lower than the current price.

Stop-loss orders are closing orders at a price level that represents a certain amount of loss, in case the market moves against you. This will limit your potential loss on the trade to an amount you are comfortable with. With a standard stop order, if the market hits your stop price, then your trade will automatically be closed out at the best available market price.

This does not guarantee that your order will be filled at the exact price level of your stop, only that it will be filled at the best price available when triggered. If the market is moving rapidly or is closed but reopens at a price that then triggers your order, your trade might be filled at a substantially different price. This fluctuation in order fill price is known as “slippage”.

If you want to be assured of avoiding market slippage, then you can pay a small premium to place a “guaranteed stop-loss order”. With a guaranteed stop, you are guaranteed to have your trade closed at the exact stop-loss price level you specified in your order.

Limit orders

Limit orders are where you ask your broker to place a buy trade at a price lower than the current price, or a sell trade higher than the current price.

You can set a closing limit order to automatically close out your trade if the asset you’re trading reaches a certain level of profitability.

If you ever get confused with the terminology, here’s how to remember how limit and stop orders work:

Margin

Now, even with brokers coming up with smaller lot sizes having to have that sort of capital is limiting. We’ve got a whole chapter dedicated to margin trading later in the guide so we won’t give a detailed explanation here. For now, you just need to know that when trading Forex your broker will not require you to fully fund the position you take on. Your broker will “lend” you a certain percentage of a given position’s value, with your own funds being used as a deposit – this deposit is called margin.

- Learn more, take our free course: Margin Trading Demystified

What moves the FX market?

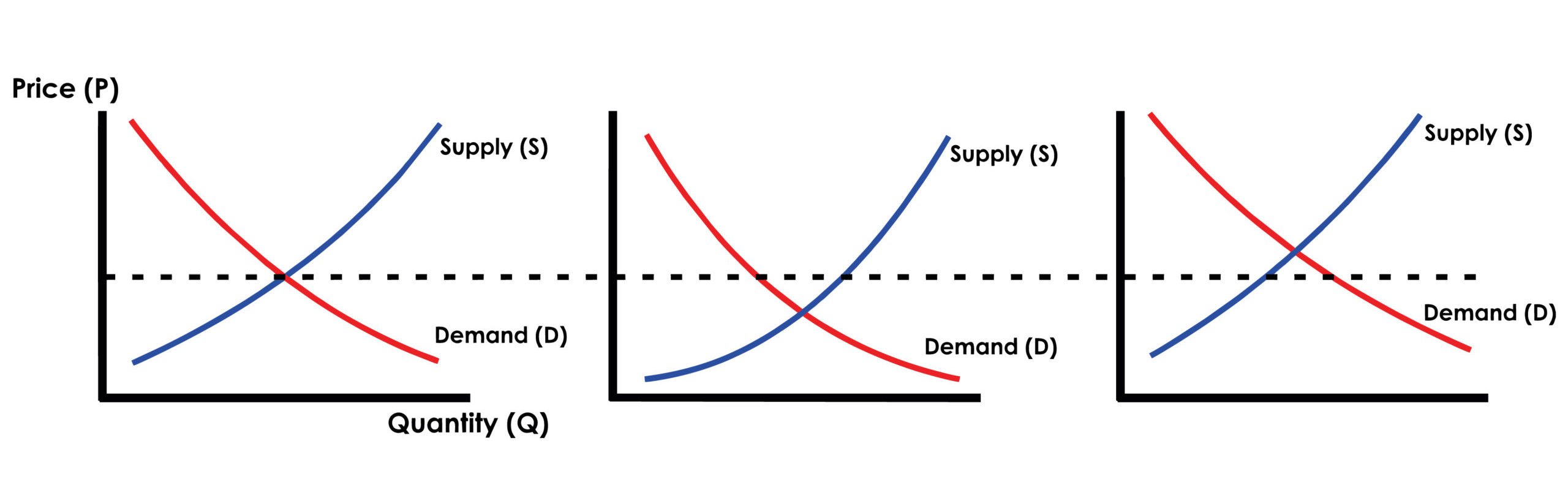

Now we’ve got a good understanding of some of the basics of currency trading, what actually makes a currency pair’s price move? What we are doing as Forex traders is analysing the relationship between supply and demand. If the demand for a given currency increases, or if the supply of the currency in the economy decreases for whatever reason, then the price of this currency will tend to strengthen – and vice-versa. Anyone that has studied economics will recall these diagrams: There are considerations that can affect the demand levels of a given currency:

There are considerations that can affect the demand levels of a given currency:

- short-term (interest rates, volatility, market sentiment)

- medium-term (geopolitical risks, economic growth, employment situation, fiscal policy)

- long-term (terms of trade, purchasing power parity)

Keep an eye on the economic calendar

The economic calendar helps you keep an eye on the most important publications, reports, statistics, and speeches that can impact currency exchange rates and create profitable trading opportunities.- Learn more, take our free course: How Traders Find Opportunities

To sum up

We’ve covered lots in this chapter, so when you next open up a Forex trading platform you’ll have a really good appreciation of what it is you are seeing – please go back over anything you don’t fully understand – Forex traders need to know these basics like the back of their hands.

You should now have a good understanding of the main aspects of Forex trading, from the basics around how a currency pair of priced to how its price movements are measured in Pips, through to how to work out the value per Pip of a lot.

Start learning now

Learn the skills needed to trade the markets on our Trading for Beginners course.