How to Day Trade for a Living

Want to day trade for a living? Here’s a full guide on the most important points you need to consider before getting your feet wet in the markets.

Day trading is not easy, but with the right mindset, discipline, and plan, you’ll be able to become a consistently profitable day trader – just like thousands of others around the world.

Let this article be the first step towards your trading goals.

What is Day Trading?

Day trading is a popular trading style that involves opening and closing trades within one trading day. That’s why the style is called day trading or intraday trading as opposed to other trading styles, such as swing trading for example.

Most traders have started day trading the market early in their trading career, including me (and most likely you). It’s a great way to learn trading by having an instant response from the markets. When day trading, you’ll know whether you were right or wrong by the end of the trading day.

Nevertheless, it’s much more important to focus on the process of trading than to be “right”. Many successful traders I know simply follow a methodology, a process of trading the markets. They don’t aim to be right all the time. In fact, they don’t even measure their daily success by how money they’ve made, but whether they’ve followed their trading plan or not.

So, intraday trading involves making a few trades per day (often in the morning or around the market open), keeping them open for a few hours or until your profit target is reached, and closing any open trades by the end of the trading day.

Unlike scalping, day trading doesn’t require dozens of trades per day or lightning fast decision making. However, day trading is a quite active trading style, and in any case more active than swing trading or position trading.

This means you’ll have to actively monitor your trades most of the time. Day trading is not a “set and forget” trading style. News and other market events can quickly change your view and require prompt action from your side.

Does Day Trading Work?

You might wonder whether day trading actually works, given the high number of high-frequency trading (HFT) and algorithm traders that are active in the market nowadays. Around 60% of all day trading volume is generated by trading algorithms and HFT funds, so how can a human trader compete against this immense computing power?

The truth is, even programs and algorithms have risk levels they need to adhere to. While human traders aren’t able to compete with computers when it comes to speed, there are still niche trading opportunities in the market that algos aren’t designed for, which can become your edge in trading.

Another advantage for human day traders is the availability of dozens of trading strategies. That’s right, large funds can’t use some simple and effective trading strategies because of the significant position sizes that they’re trading. The profit opportunity would simply disappear as they’re trying to buy or sell billions of US dollars in the market. So, the fact that retail traders usually trade with a smaller trading account is actually a great advantage over large funds.

Nevertheless, momentum trading strategies are heavily influenced by algo traders, which makes it harder for retail traders to compete. News trading is also an area where algos feel at home.

That’s why I encourage you to take a different approach to day trading, which is called intraday swing trading. Instead of holding trades for a few minutes and looking for the big momentum, try to find your niche in trade setups that last a few hours by trading securities that have real order flow behind them.

- Learn more, take our premium course: Trading for Beginners

Costs of Day Trading

Another important consideration when day trading the markets are costs. Although day trading is significantly less cost intensive than scalping, trading costs can quickly pile up if you don’t have a well-defined trading plan.

Just like with other trading styles, the main costs of day trading are spreads and broker commissions. When choosing a broker, don’t fall into the trap of looking for brokers with the lowest costs, as it is the complete package that determines whether a broker is good or not. In addition, brokers often try to attract clients by offering zero spreads, but the commissions usually more than offset the savings on spreads.

I recommend getting to grips with brokers with our free Understanding Brokers course.

So, how much you’ll pay to day trade the markets boils down to two main questions:

- How many trades will you open per day

- How large is your position size going to be

Day trading usually involves opening a few trades per day, depending on the trading strategy you follow. Most day traders I know base their trading decisions on the 5-minute timeframe, and the 1-hour timeframe to get the bigger picture of the market.

I’ll usually open between three to five day trades each day, aiming for a reward-to-risk ratio of at least 2 (your reward-to-risk ratio is simply the ratio between your stop-loss size and take-profit size).

The other important variable in determining trading costs is your position size. Naturally, the bigger you trade, the higher your trading costs will be. The most successful traders I know use a position sizing method that links their position size with the size of their stop-loss.

- Learn more, take our free course: Breaking Down Trading Costs

Day Trading Strategies

Let’s move on to the most exciting part of this article: Day trading strategies. There are dozens of trading strategies you can use to day trade the markets, but almost all of them can be grouped into the following three groups:

1) Breakout trading strategies

2) Trend-following strategies,

3) Mean-reverting strategies.

Breakout Strategies

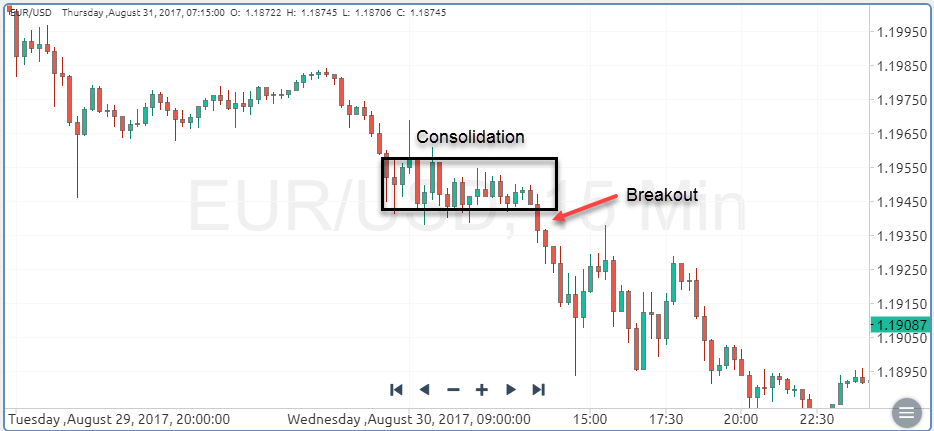

As their name suggests, breakout strategies are based on price breakouts above or below important technical levels. For example, imagine a consolidation phase in the markets where the price trades in a tight trading range of a few cents or pips.

A breakout trader would look to buy the asset when the price breaks above the trading range, or to sell the asset if the price breaks below the trading range. The assets in day trading can be any financial instrument, like stocks, commodities, forex, gold, and futures.

The chart above shows a breakout trade taken in the EUR/USD currency pair. Notice the tight range just before the breakout – This absence of volatility is the first sign that there is going to be a prolonged and powerful move once the trading range breaks. This trade offered an attractive reward-to-risk ratio by placing a stop-loss just above the breakout candle.

Remember, if the price returns inside the previous consolidation range, our selling setup would become invalidated and the downside breakout would likely prove to be a fake breakout.

To be a breakout trader, you need to be completely focused on the price-action and have the discipline to follow your trading plan. The volatility often occurs immediately after the breakout, which means that if you don’t pull the trigger fast enough, most of the profit opportunity will vanish.

That’s why most breakout traders I know use alerts at the edges of the trading range to be ready to open a trade just before the volatility comes along. If your trading platform doesn’t support price alerts, you can also use pending orders (like stop and limit orders) to catch a breakout trade.

Trend-Following Strategies

Another popular day trading strategy is trend-following. You’ve likely heard about the sayings “The trend is your friend” and “Buy low, sell high” – they are all about following the trend.

Once a trend forms, markets tend to continue trending until the price reaches a long-term support or resistance level, or the trend reverses because of some fundamental developments and news.

Trend-following is arguably the most popular day trading strategy among retail traders. Many traders who’re consistently profitable trade the market with a trend-following strategy.

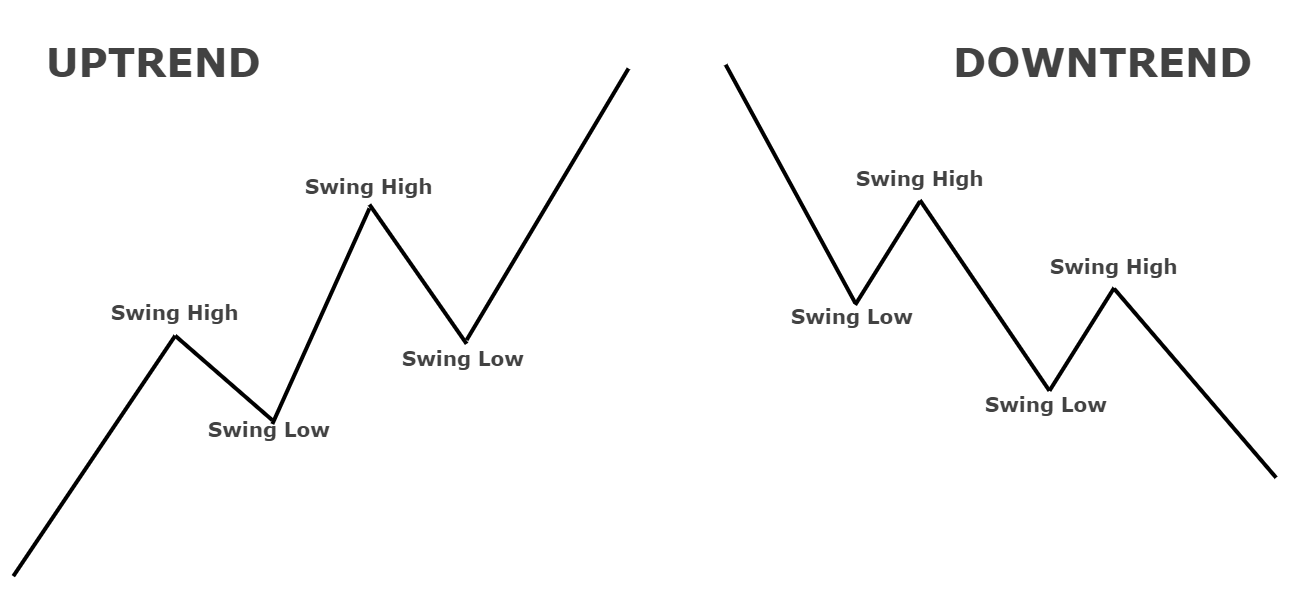

So, how to identify a trend? Markets can be in three states: in an uptrend, in a downtrend, or trading sideways. The following chart shows how uptrends and downtrends look like.

It’s crucial to understand this concept if you want to become a successful trend-following trader. Trends are much more than simply the market going in one direction.

In uptrends, there will be occasional short-term downtrends, also called price-corrections, before the price continues in the direction of the underlying uptrend. Conversely, there will be occasional short-term uptrends during downtrends.

Most new traders find it difficult to grasp the concepts of uptrends and downtrends, as they believe that trends are simply price-moves that go in a certain direction, either up or down. While this is partly true, notice the higher highs and higher lows in the uptrend example above, and the lower lows and lower highs in the downtrend example.

As long as the market forms HHs and HLs, we say that the uptrend is in-tact. Similarly, as long as the market forms LLs and LHs, we say that the downtrend is in play.

So, how are we going to trade market trends? Take a look again at the graphic above, and try to identify the best places to open a trade in the direction of the underlying trend.

If you found that Higher Lows (Swing Lows) provide a great buying opportunity during uptrends – congratulations! That’s the correct answer. The opposite is true for downtrends – we want to sell at the top of Lower Highs (Swing Highs). That’s what the saying of “Buy low, sell high” is all about.

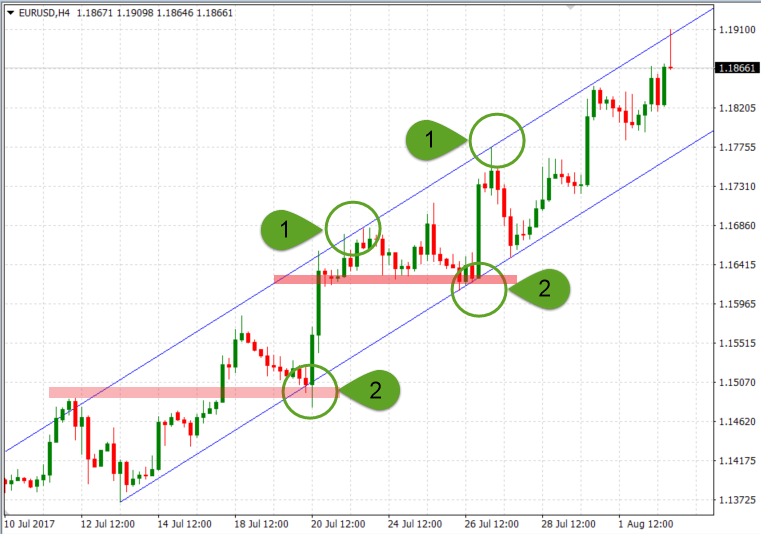

To identify when a swing low might bottom or a swing high might reach its top, traders use a variety of technical tools, including trendlines, Fibonacci retracements, channels, and horizontal support and resistance levels, to name a few.

Here’s a chart of a well-defined uptrend (notice the HHs and HLs) with attractive buying opportunities at points marked “2”. The market is facing continuous buying pressure after the price reaches the lower channel support, and the previous Higher High is acting as an important support level for the first buying setup.

In the second buy setup, the price reached again the lower channel support which aligned with an important horizontal support level. Those are setups that trend-following traders are looking at when entering a trade.

Mean-Reverting Strategies

Last but not least, mean-reverting strategies refer to strategies that aim to exploit the mean-reverting nature of markets. Markets are not a one-way street, and everything that goes up will eventually go down, and vice-versa.

There are several reasons why this happens over and over again, including profit-taking activities of large market players (funds which are buying in a market need to sell to close their positions), and overshooting fundamental price-ranges.

Whatever the case, traders need to know about the mean-reverting nature of markets and be prepared to trade it. These strategies are somewhat more complex than breakout and trend-following strategies, which means that you’ll need some screen-time and experience and profitably trade them.

A simple example of a mean-reverting trade would be a market that is extremely overbought or oversold. Technical indicators, such as the Relative Strength Index (RSI), can be used to identify those market conditions and to create plan for trading them.

Here’s a chart that shows a simple mean-reverting strategy using the RSI. Traders usually consider an RSI reading of above 70 to be overbought, and a reading of below 30 to be oversold. In this strategy, a trader would open a short position when the RSI crosses above 70 and returns to “normal” levels, or a long position when the RSI crosses below 30 and returns back to above 30.

Those trade setups can be seen on the chart marked by 1, 2, and 3.

This was a brief introduction into the various trading strategies that day traders use to trade the markets. While many traders I know use a combination of the mentioned strategies, it would be smart to stick to one single strategy until you’ve fully mastered it. Only then should you look for additional strategies to include in your trading arsenal. Trading with more than one strategy has an obvious advantage – You’ll be coming across more trading opportunities.

Main Risks of Day Trading

Despite the many advantages of day trading, this trading style doesn’t come without risks. Here’s a list of the main day trading risks you need to be aware of:

- Market news: Since day traders hold their trades for up to a few hours, unexpected market news can create large volatility in the markets and push the trades against you. This is not only true for the release of economic and company indicators, such as interest rate changes, employment statistics, and earnings, but also for unscheduled events like natural disasters, political turmoil, various comments, etc.

To avoid and control this source of risk, you should always stay up-to-date on scheduled releases, and try to anticipate unscheduled ones as good as you know. A good example was Brexit: Trading assets that have a tight connection with the British economy around the Brexit vote back in 2016 carried a huge risk for traders.

- Day trading can be stressful: When day trading, wins and losses come at you faster than with a longer-term trading approach, which in turn requires a mature mindset and psychology to handle that kind of stress.

Day trading also requires high discipline to follow your trading plan, patience to wait for trade setups, persistence in your trading strategy, and the ability to quickly adapt to changing market conditions.

- Day trading can be expensive: Around 10% of day traders make money. There’s no shortcut to become a consistently profitable day trader – it requires skills and experience.

In fact, according to the U.S. Securities and Exchange Commission, “day traders typically suffer severe financial losses in their first few months of trading.”

Fortunately, this also means that with the right learning approach you can reach the top and join the exclusive group of consistently profitable day traders. At My Trading Skills, you’ll find a comprehensive and in-depth trading course that is tailored for beginner day traders, get started here. Make sure you go through all of the lessons and completely understand each trading concept before placing your first trade.

How Much Money Do You Need to Start Day Trading?

In order to start day trading, you need surprisingly small funds. Most brokers don’t even have a minimum deposit threshold, which means that you can open an account with as much as $1. Of course, to make any meaningful profit day trading, you’ll need a larger trading account.

Nevertheless, if you’re just getting your feet wet with trading, I encourage you to open a very small trading account as it allows you to get a feel for the market. Demo trading is fine to get a grasp of your trading platform and the most essential trading concepts, but it doesn’t offer much more than that.

Some traders may use demo accounts to test a new trading strategy, but even in this case the outcome might be different than you might expect. When there’s no real money in the game, traders tend to subconsciously become more reckless with their trading rules.

So, how much do you need to start day trading?

If you want to get a real feeling for the market but don’t have the necessary experience to expect a meaningful profit, you can start with a few hundred dollars.

That’s enough to cover your margin (if trading on leverage), and to be able to open large enough position sizes that return a profit or loss of a few dozen dollars. If you can pay for your lunch (plus an extra beer?) with one winning trade, you’ll take trading more seriously and start to develop a strict and well-defined trading plan.

Now, how much money do you need to play the game full-time?

The answer obviously depends on how much you’re able to invest, and how much you can afford to lose. Always trade with the money that you can afford to lose! Don’t invest your life savings in one single trading account.

Many serious day traders who I know have a trading account of $50,000+. Some of them started big as they already had trading experience, while others built their account gradually over time. If you’re trading with a US broker, the minimum account size you have to maintain for day trading is $25,000.

This so-called PDT rule (“Pattern Day Trader”) states that if you open more than four day trades (opening and closing a trade within a day) during a five-day window, you’ll need to have at least $25,000 in your account.

The best way to determine how much money you need to start trading is to analyse your previous trading performance with a smaller trading account.

Now that you know your actual (and precise) trading performance, you can start to gradually grow your account to reach your income target. This being said, never approach trading as a regular income generator. Trading should be used to gradually increase your account size, month by month and year by year.

In fact, most successful traders keep adding to their trading account from other income sources to increase their buying power in the markets.

- Get started, take our premium course: Trading for Beginners

Should You Quit Your Job to Day Trade?

Answering this question is obviously not as easy as it seems. Many successful day traders do this professionally and are able to generate significant profits in the markets. They’re full-time in the markets.

Trading is not a hobby. There are other hobbies that are cheaper and less stressful, like playing tennis, riding a bike, or going to a gym. If you approach trading as a hobby, you’ll most certainly not succeed.

I’ve quit my day job to completely focus on the markets. But people don’t see the countless hours and days it took to develop a robust trading plan, practice discipline and trading psychology, and reading every trading book I came across.

It took me five years of daily trading until I got the courage and confidence to quit my day job.

How did I know it was time? I was consistently profitable, month by month, build up my trading account, and felt I could do more if I could focus on trading full-time.

Final Words

Financial markets and day trading are truly fascinating. I still remember looking at my first ever chart back in 2008. The financial crisis was at its peak, gold was soaring, and I remember opening a gold chart to check what the hype was all about. I felt in love with charts and trading and never looked back.

Day trading is a relatively fast-paced trading style that involves opening and closing trades within a single trading day. As a result, traders know whether they were right or wrong by the end of each day, which helps in building your trading plan and preparing for the next trading day. Unlike with longer-term trading, the feedback with day trading is almost instant.

If you’re serious about day trading, you need to stay up-to-date on major financial news, economic indicators, market risk sentiment, and more. Fortunately, most of those skills are acquired naturally through months and years of screen-experience.

Still, becoming a consistently profitable trader and joining the top 10% doesn’t come on its own. To get the right trading foundations, get started today with My Trading Skills Trading for Beginners Course and get 18 on-demand lessons, live workshops, expert support and much more to fast track your trading career.