Revealed: How to Make Money Day Trading

Day trading is one of the most popular trading styles in the Forex market. However, becoming a successful day trader involves a lot of blood, sweat, and tears if you don’t follow some important rules and don’t manage your risk correctly.

In this article, we’ll discuss what it takes to become a profitable day trader. Some of the most popular day trading strategies and how to improve your trading skills by keeping a simple trading journal.

So, what are the different Forex trading styles?

The first thing you need to understand is that day trading isn’t just one type of trading style.

It’s not a trading strategy on its own, as it doesn’t show you how to open a trade, where set your exit points, when to trigger a trade or how much to risk.

It’s simply a style of trading. This means that there are hundreds of day trading strategies that you can switch between and still be a day trader.

To fully understand day trading, let’s briefly go through the other most popular trading styles in Forex trading – Scalping, swing trading and position trading.

- Scalping – This is the fastest and most exciting trading style of all. Scalpers open a large number of trades in a single day, leave them open for a short period of time and try to close them in a profit. Since scalping involves pulling the trigger many times during a trading day, trading costs can be quite high and eat up a hefty portion of your total daily profit.

- Swing trading – Slower than scalping and day trading, swing trading fits patient and disciplined traders who can wait for several days for a trading opportunity. Swing traders aim to catch the “swings” in the market, up-moves and down-moves that may last for several days.Being a longer-term trading style, swing traders often combine fundamentals in their analysis and use technical analysis to get into a trade and to set their exit levels.

- Position trading – Position trading is a very long-term trading style where trades are sometimes held open for months or even years. Position traders rely on fundamental analysis to find overvalued and undervalued currencies and to identify trends in macro-economic variables that could lead to long-lasting trends.

Position traders need to be well-educated on currency fundamentals, extremely patient and able to withstand large price fluctuations (i.e. have a large trading account.) One of the benefits of position trading is that trading costs are almost non-existent when compared to the potential profit.

- Learn more, take our premium course: Trading for Beginners

Day Trading: A Fast-Paced Trading Style

So far, we’ve covered the main points of scalping, swing trading and position trading. Day trading is just another trading style that fits perfectly in between scalping and swing trading.

Day traders open a few trades per week and try to close them by the end of the trading day, making either a profit or loss. Day traders avoid holding their trades overnight, as news that is published overnight may affect a position and reverse the price.

Many day traders analyse the market in the morning. They decide whether to go long or short on a currency pair. However, traders who follow a day trading style need to be aware that leaving a trade unmonitored throughout the day can be very dangerous, as intraday market volatility (e.g. after a GDP news release) may easily turn the price against you.

Read:

- Best 5 Economic Indicators of the Forex Market

- Essential Guide to Forex Signals (Revealed!)

- This is How You Make a Living Trading Forex

FINRA (The Financial Industry Regulatory Authority) defines a pattern day trader as “any customer who executes four or more ‘day trades’ within five business days, provided that the number of day trades represents more than six percent of the customer’s total trades in the margin account for that same five business day period.

Customers should note that this rule is a minimum requirement, and that some broker-dealers use a slightly broader definition in determining whether a customer qualifies as a “pattern day trader.”

Traders who trade stocks with a day trading strategy need to be aware of FINRA’s rule, since many stock brokers require a minimum deposit of at least $25.000 for a trader who is flagged as a “pattern day trader.” So far, there are no special requirements when day trading Forex.

There are many day trading strategies out there, and most of them can be grouped into one of the following categories:

- Trend-following: Trend-following strategies are perhaps the most wide-spread day trading strategy, and that’s for a good reason – they work. Trend-following refers to riding the trend as long as it lasts. You enter long when the trend is up, and short when the trend is down.

- Counter-trend trading: Counter-trend trading refers to trading against the trend. This approach is quite risky and should be left to the most experienced day traders out there. Basically, in a counter-trend strategy, a trader goes short during uptrends and long during downtrends in order to profit from price-corrections (counter-trend moves).

- Breakout trading: Trading breakouts is a popular day trading strategy, especially among retail Forex traders. Breakout traders want to catch a breakout of the price above or below an important support/resistance level, chart pattern or any other price-structure. Volatility can be quite high immediately at the breakout point, which is the reason why day traders take advantage of pending orders to enter into a trade as soon as a breakout happens.

- Take our free course: Technical Analysis Explained

- Take our free course: Trends, Support & Resistance

- Take our premium course: Trading for Beginners

- Take our free course: Japanese Candlesticks Decoded

- Take our free course: Reversal Price Patterns

- Take our free course: Continuation Price Patterns

How do Traders Make Money Day Trading?

Applying a well-defined trading strategy is just one side of the coin in day trading. Without risk management, even the best trading strategy will eventually blow your account. You need to define your risk-per-trade and reward-to-risk ratios of setups that you want to take in order to make it in the long run.

- Risk Management – Risk management is a set of rules that are designed to help you grow your account and avoid large losses. Try to maintain a risk-per-trade (total risk on any single trade) equal to around 2% of your total tradi

ng account size, and a reward-to-risk ratio (ratio between the potential profit and the potential loss of a trade) of around 2:1. This way, you’ll stay in the game even during a losing streak.

ng account size, and a reward-to-risk ratio (ratio between the potential profit and the potential loss of a trade) of around 2:1. This way, you’ll stay in the game even during a losing streak. - Riding the Momentum – Since day trading is a relatively short-term trading style, there needs to be sufficient movement in the market in order to make a profit. Traders live on volatility, and trading slow markets without much movement will only increase your trading costs. Try to pick a volatile currency pair when day trading and catch breakouts as soon as they happen (with buy stop and sell stop pending orders, for example.)

- Trade Monitoring – Last but not least, it’s extremely important to monitor your trades when day trading. Even the slightest change in market sentiment may cause a trade to go against you, leaving you with a loss. Avoid trading during important news releases as markets can get quite unpredictable immediately after a release.

How to Enter into a Day Trade?

As mentioned previously, most day trading strategies can be grouped into three main categories: trend-following, counter-trend trading and breakout trading. Now let’s learn how to enter into a day trade, where to place your stop-loss and profit targets, and how to manage trades that are already open.

Trend-following strategies

Many day traders love to follow the trend. In a trend-following strategy, you would enter long when the trend is up and short when the trend is down. The best time to enter into a trend-following trade is immediately after the completion of a price-correction. You don’t want to short a downtrend when the price has already fallen to a large extent, or go long in an uptrend when the price is already overbought.

To master trend-following, you need to understand how trades form. An uptrend is formed when the price makes consecutive higher highs and higher lows, with each higher high pushing the price higher than the previous high. The best time to enter into a trade is exactly at the bottom of a higher low – that’s the level where traders who’ve missed the trend are ready to join the crowd and where traders who’re already long are adding to their positions.

Similar to uptrends, downtrends are formed when the price makes consecutive lower lows and lower highs. Here, the best time to short is right after a new lower high has formed – this is where new traders will jump into the downtrend with the short positions and where traders who’re already short will add to their positions.

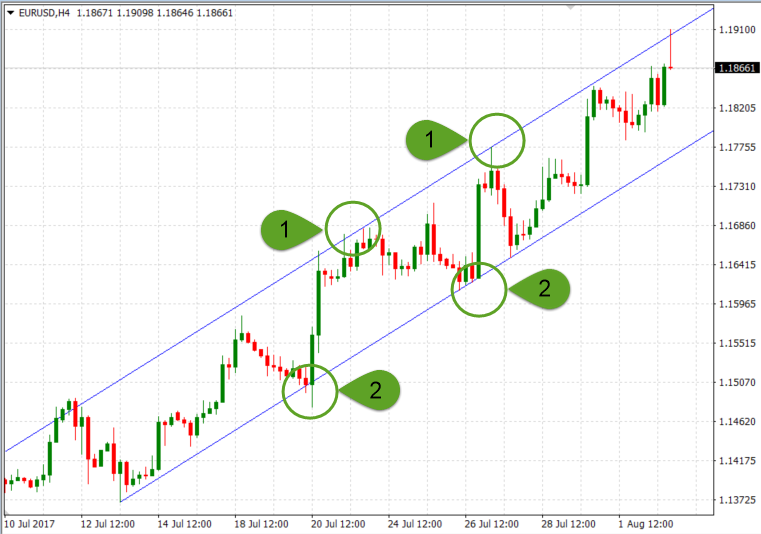

The chart below shows an uptrend in the EURUSD pair with a rising channel applied to the chart. Points (2) shows levels where you could enter long, while points (1) are potential profit targets. You should place your stop-loss right below the rising channel or below the higher low.

Counter-trend trading strategies

Counter-trend trading is a day trading strategy that adopts the opposite approach to trend-following.

In a counter-trend trade, a trader would go against the established trend in order to catch price-corrections. If you take a look again at the chart above, you’ll see that the uptrend didn’t go up in a straight line. Instead, the price forms so-called corrections at levels where many market participants are closing their long orders and take profits (points labeled (1)). So, a counter-trend trader would basically go short at points (1) and take profits at the lower channel line.

The problem with this approach is that it’s riskier than trend-following and has a lower profit potential. On the other side, combining a trend-following and a counter-trend trading strategy allows a trader to take more trades, both in the direction of the established trend and in the opposite direction. Still, counter-trend trading should only be done by experienced traders.

Take a look at the following chart.

A trader could enter into a short position at point (1) after the price made a fake breakout to the upside. His profit target could be set at an important Fibonacci level (such as the 38.2%), shown at point (2). After the price rejects the 38.2% Fib level, the trader could enter into a long position and ride the trend. This way, he would make a profit both on the up- and down-moves. A stop-loss should be placed just above point (1).

- Learn more, take our premium course: Trading for Beginners

Breakout trading strategies

Finally, breakout traders are day traders who aim to profit from breakouts out of important technical levels, support and resistance lines and chart patterns. Breakouts are often followed by a strong move and increased volatility, which makes breakout trading a popular way to day trade the Forex market.

Read:

- Ultimate Guide to Identifying Support and Resistance Levels on Any Chart

- Major Candlestick Chart Patterns You Need to Recognise

- How to Read Candlestick Chart Types

Pending orders are an effective tool when trading breakouts. By placing buy stops or sell stops at the breakout level, you don’t need to wait for the actual breakout to happen in order to open a trade. The pending order will automatically trigger a market order once the price reaches the level specified in the pending order. This also helps to catch the initial market volatility and increases the profit potential.

The chart above shows a typical breakout trade based on a symmetrical triangle. You could enter into the direction of the breakout right at the breakout point or after the price completes a pullback to the broken triangle line, shown by line (1). A stop loss should be placed just below the recent low (2), and the profit target, shown by line (3), should be equal to the height of the pattern projected from the breakout point.

Day Trading with Little Money: Is It Possible?

Many new traders are attracted to the Forex market because of the low minimum deposit requirements and the high leverage offered by Forex brokers. This means that traders with a trading account size of $100 can theoretically control a very large market position when trading on leverage. For example, a leverage ratio of 100:1 allows a trader to open a trade worth $10,000 with only $100 of trading capital.

This means that day trading is possible with little money. However, if you’re thinking to start trading with a small amount of money, always keep an eye on your free margin as it can drop quite fast given the number of trades when day trading. Your free margin equals your equity minus the total margin used on all your open trades. Your trading platform should be able to calculate this automatically.

Also, bear in mind that trading on very high leverage is risky. Leverage increases both your profits and losses. That’s why you should always respect your risk management and only risk a small amount of your capital on any single trade. Your position size should depend on the size of your stop-loss level.

Take a Read: 15 Mind Opening Day Trading Statistics

Why is Day Trading So Difficult?

Just like trading in general, day trading is not simple to master. In fact, shorter-term trading styles, such as scalping and day trading, are often more difficult to learn than longer-term trading styles.

Most of the rules that apply to longer-term trading also apply to day trading, technical levels work the same and chart patterns are analysed in the same way across all timeframes. However, day traders need to make trading decisions much faster since they’re trading on short-term timeframes. There’s no room to double-guess an entry, analyse the market in-depth and let emotions interfere with your trading decisions.

If you want to become a successful day trader, you must have a detailed trading plan and stick to it all the time. Also, try first to master a longer-term trading style before getting your feet wet in day trading. A common mistake among beginners is to start trading on very short timeframes and then move on to longer-term trading later on.

How to Avoid Common Mistakes When Day Trading

Day trading is not easy. Follow these points and avoid making common mistakes of traders new to day trading. Only start day trading after you’ve built a trading plan, have a profitable trading strategy and strict risk management rules in place.

- Have a Trading Plan – A trading plan works like a road map in trading. It includes your strategy, entry and exit points, entry triggers, how to manage losses and when to close a profitable trade, to name a few points. A trading plan should be written on paper, so you can quickly get back to it if your trading performance starts to deteriorate.

- Build a Robust Trading Strategy – Your trading strategy should be part of a well-written trading plan. Good trading strategies need to be robust and describe how to analyse the market to find trading opportunities. It should also include rules when to enter a trade and where to place your stop-loss and take-profit levels.

- Respect Risk Management – Managing your trading risk is the ultimate road to success. Even the best trading plan and strategy won’t be of much help if you don’t control your losses and manage your money. Define the maximum amount you want to risk on any single trade and the reward-to-risk ratio of potential trades you want to take.

- Keep a Trading Journal – If you want to improve your trading performance, keeping a trading journal is a good way to achieve that. A trading journal consists of journal entries that include the traded instrument, entry and exit prices, the date and time you took the trade, the reason you pulled the trigger and its results. You should do regular retrospectives of your journal entries and try to learn from your past mistakes, i.e. losing trades.

- Monitor Your Trades – Day trading is a short-term trading style and monitoring your trades needs to be part of your daily routine. Since day traders have relatively tight exit points, even the slightest change in market sentiment can lead to a losing trade. If a trade doesn’t perform, just close it. There will be many other trading opportunities along the way.

- Follow a Forex Calendar – News reports, headlines, labour market statistics, inflation rates and other important releases can have a significant impact on the market. If your trades aren’t based on fundamentals, try to avoid leaving a trade open during important news releases. Following a Forex calendar needs to be part of your market analysis.

EAs, Robots and Indicators in Day Trading: Do They Work?

All day trading strategies described above are based on pure price-action. However, you can successfully apply indicators to them to increase the success rate of trades, confirm a setup or filter through them.

The RSI is a popular indicator among day traders. This momentum indicator measures the magnitude of recent price-moves and identifies overbought and oversold market conditions. When the value of the RSI indicator moves above 70, this signals an overbought market (consider selling). Similarly, when the value of the RSI moves below 30, it indicates an oversold market (consider buying).

However, the RSI can stay overbought or oversold for long periods of time during strong uptrends and downtrends, respectively. That’s something you have to bear in mind.

- Learn more, take our free course: Relative Strength Index: Fast Track

Some traders use EAs (Expert Advisors) and trading robots, but their performance can easily change during major shifts in the market environment. Trend-following EAs work great in trending markets but give a lot of fake signals when markets are ranging. If you’re using an EA or robot in your trading, you need to be very cautious and monitor your trades more actively than when trading on your own.

Day Trading Other Markets: Stocks and Cryptocurrencies

Besides the currency market, traders can also day trade other financial markets, such as stocks or cryptocurrencies. However, be aware that different financial markets may behave differently and consider adjusting and fine-tuning your trading strategy to suit the dynamics of other markets.

Day trading stocks may also require a larger trading account (pattern day traders need to have at least $25,000 in their accounts), many illiquid stocks form gaps in the price at the start of a new trading session and trading times are also different. Also, many brokers have different leverage ratios for stock trading.

Read:

- How do Forex Brokers Make Their Money?

- Secret Practices to Watch out for With Your Broker

- A Guide to Getting to Grips With Your Broker’s Platform

Just like stocks, cryptocurrencies can be successfully traded with a day trading strategy by adjusting your current trading strategy and risk management rules. Bear in mind that cryptocurrencies can be quite volatile at times, which makes having strict risk management guidelines even more important. Avoid trading in times of an upcoming fork or other important events that may affect the price of cryptocurrencies.

Best Time to Day Trade

The best time to place a day trade is when the market is the most liquid. This will reduce trading costs by keeping spreads tight, reduce slippage that could move the price against you and increase the overall success rate of your trades.

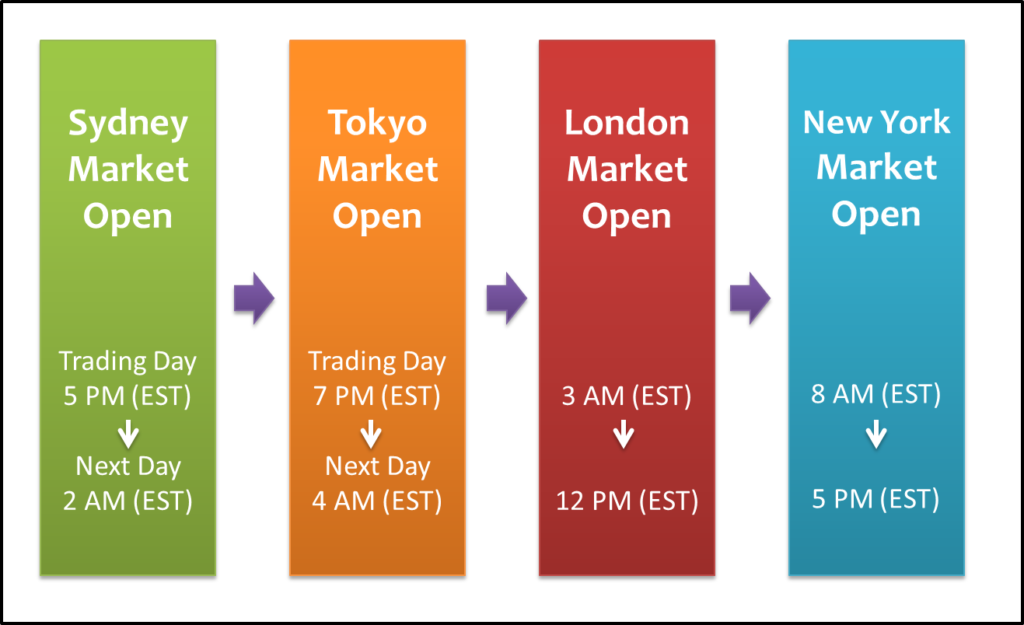

In Forex, the most liquid market hours are usually the New York and the London session, especially when those two trading sessions overlap. The following graphic shows the open market hours of each Forex trading session and their overlaps.

Trading on Fridays can also impact your trading performance, as many traders are closing their open trades to avoid keeping them open over the weekend. This can cause fake breakouts and lead to reversals of short-term trends established during the week.

Day trading needs to be understood before getting your feet wet

New traders should first sharpen their trading skills with longer-term trading styles, such as swing trading, which gives them enough time to analyse the market and make sound trading decisions.

Only when you fully understand how the markets operate and gain the required experience should you start focusing on shorter-term trading styles. Day trading is fast-paced and doesn’t forgive any trading mistakes.

- Learn more, take our Trading for Beginners course