Horizontals

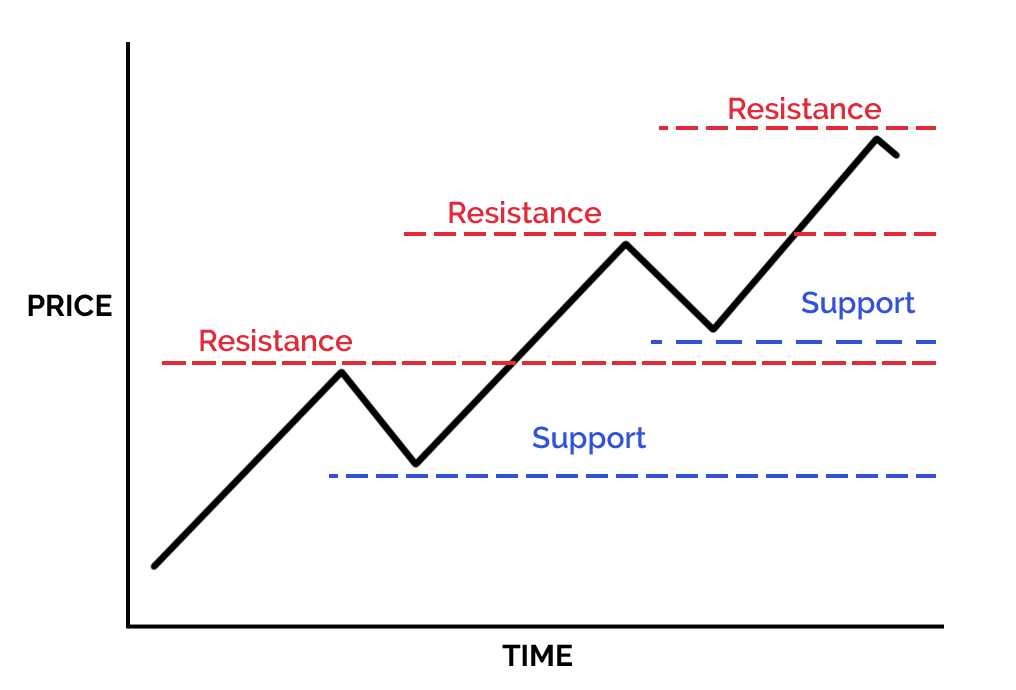

Marking up horizontal lines at previous highs and lows in price is a simple method for predicting potential areas of future support and resistance.

Whether these are potential support or resistance depends on the current price – if the current price is below the area it is a potential resistance level. If the price is above it is potential support. If an area has been a resistance area previously, and highs in the price have developed there, it does not mean it can only be a potential resistance area going forward. It can also be potential support if the price is now above it and vice versa. These are areas where the balance between bulls and bears has switched previously and we should sit up and watch closely when the price next approaches them – from either direction.

Round numbers

Another method of finding a potential support and resistance area is by simply looking at round numbers in the price. Traders tend to place their stop or limit orders at round numbers, this increases the likelihood of the balance of power between the bulls and bears shifting at these levels.

For example, look a 10-minute chart of EUR/GBP, where there is resistance at 0.90000.

How S&R strengthens

Once we’ve identified potential support or resistance we can analyse it further. There are several important factors which add to its significance in our analysis:

- Horizontals projected forward from previous highs and lows is a good place to start with S&R analysis.

- Rounds numbers are a common method of identifying S&R areas.

- We assign more significance to an S&R area if it has been previously been tested by the price more often and held, if the testing was recent and if there was a lot of volume.