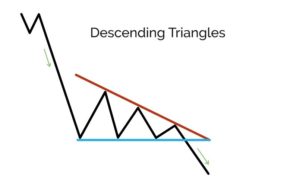

Descending Triangles

A descending triangle pattern is the inverse of the ascending triangle pattern. It typically forms in a bearish trend, horizontal support will develop and a descending resistance level will develop on lower highs. The price coils, building up pressure before finally, it confirms by breaking through the support line and continues the bearish trend. Additional confirmation can be obtained if the price returns to the old support line (now resistance) to test it.

Occasionally, descending triangle form in bullish trends, but these are rare.

Trading descending triangles

This pattern can be traded in a similar, but inverse, way to ascending triangles, once the pattern is valid and confirmed.

- Price target 1: the height of the triangle at its highest point, projected down from the breakout; or

- Price target 2: mirror a parallel of the resistance line down from the first support touch.

- Set the stop above the pattern’s resistance line. If breached this would invalidate the continuation potential of the pattern.

Let’s look at that on a chart of EUR/JPY. Its a downward trend going into the pattern, good duration and the price breakout below support. We can see both take profit techniques gave us a very similar level. There was a retest and slight breach of the horizontal support line but that added further to the confirmation of the pattern. If a trader had entered the trade at either the first breach or the second the stop would have never been in danger and the pattern still holds. This would have been a good trade.

- A descending triangle is predominantly a bearish continuation pattern.

- It forms when a horizontal support level forms with a descending resistance level, coiling the price.

- Take profits and risk management levels can be worked out in a similar way to those of an ascending triangle (but inverse).