Dow theory

Charles Dow is the ‘Dow’ in the Dow Jones Industrial Average – also known as the DJIA or Wall Street 30.

Charles Dow is the ‘Dow’ in the Dow Jones Industrial Average – also known as the DJIA or Wall Street 30.

Dow theory was conceived by Charles Dow in the late 19th century and later refined by William Hamilton. The theory seeks to explain how trends behave and is the basis of technical analysis.

Dow theory assumptions

Confirming the primary trend

In Dow theory the price of a market has three movements:

- The primary trend

- The secondary trend, and

- Daily fluctuations

Dow is the grandfather of trend following trading – the objective of Dow theory is to confirm the direction of the primary trend. This is the trend that lasts from a few months up to five years. Once identified for the index, Dow’s rule was to only place trades in individual stocks in that direction.

If the index primary trend is up, only buy shares. If the index primary trend is down, only go short.

Dow said identifying the primary trend of the index was needed before placing trades in the individual shares.

Working out the primary trend

The primary trend can be analysed using simple trend confirmation techniques in a daily timeframe:

- Trendline analysis – higher highs and higher lows for a bullish primary trend, or lower highs and lowers lows for a bearish trend.

- 20/50/200 day Moving averages – is the price above each? is each average sloping up?

Aligning indices

Hamilton argued the transportation index needed to align with the main index to confirm the primary trend in the main index. Back then, the transportation index contained the shares of railroad companies. The theory was raw materials needed to be moved for the US economy to perform well – the more being moved, the better the transportation companies performed.

Secondary movements

Secondary movements last a few weeks to a few months and run counter to the primary trend. When they happen they are typically quite sharp.

Daily fluctuations

Dow and Hamilton put daily fluctuations of the price down to randomness and of no real meaning.

This point stands the test of time – traders should not be looking at a few periods of data to inform their actions.

Primary market stages

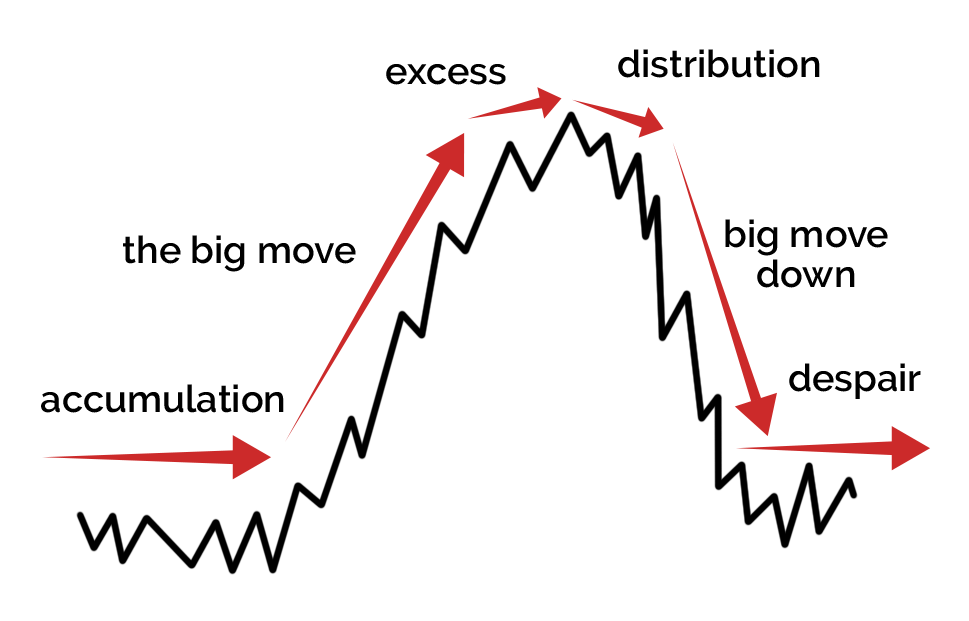

Dow theory states primary bull and bear markets each move in 3 stages. These stages relate to the psychological state of market participants.

The four market stages theory is based on this work and we’re covering that in a later lesson, so we’ll explain stages there in more detail.

Volume

Dow theory concerns itself with the analysis of shares, where volume can be accurately tracked (because everything is traded through a central exchange). Dow theory states volume should increase in the direction of the primary trend.

For example, in a bull market volume should be heavier on advances and lower on corrections. When this happens bulls and bears are undecided.

In a primary bear market, volume should increase on the declines and decrease on the rallies.

When volume behaves like this, it is confirmation of the direction of the primary trend.

Weaknesses of Dow theory

Over the years, several key weaknesses of Dow theory have been identified:

- It is late in confirming a change of primary trend. It is basically a lagging indicator.

- With its use of the transportation index, it is out of date. With a huge services sector and global trade, modern economies don’t work like that.

- It was developed with share investing in mind, nowadays OTC markets – like fx – play a bigger role in trading and the volumes for these are not readily available.

- Its focus on the primary trend is too long term for today’s modern intraday traders – technology has shifted the time horizons of traders.

What to take from Dow theory

- To always have an appreciation of the primary trend.

- The wider trends in related markets are important. If you’re trading a soft commodity, knowing the primary trend of the soft commodity index adds insight.

- Markets go through stages, driven by participant psychology. This tenet has stood the test of time.

- Dow theory uses analysis of an index to work out the primary trend.

- When the primary trend is known the theory states only trade individual shares in that direction.

- There are three market movements: primary, secondary and daily fluctuations.

- Hamilton argues the transportation index needs to align with the main market index for the primary trend to be valid.

- Dow states markets move through stages of the participant psychology.

- The primary trend is supported when volume increases in the direction of the primary trend.

- Developed over a hundred years ago Dow theory has a few weaknesses but it still has its place in trading theories.