Elliott waves

Created by RN Elliott in the 1930s, Elliott wave theory is based on the ascension the market forms the same repeatable wave patterns over and over, this movement is based on repeatable mass participant psychology. Knowing where the market sits in this cycle might give traders an insight into what might happen next.

The Elliott wave sequence

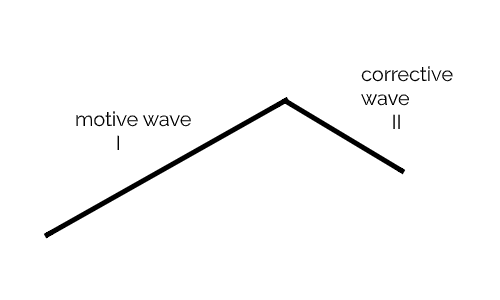

The market moves in waves, a large motive wave followed by a corrective wave, these two waves are labelled I and II.

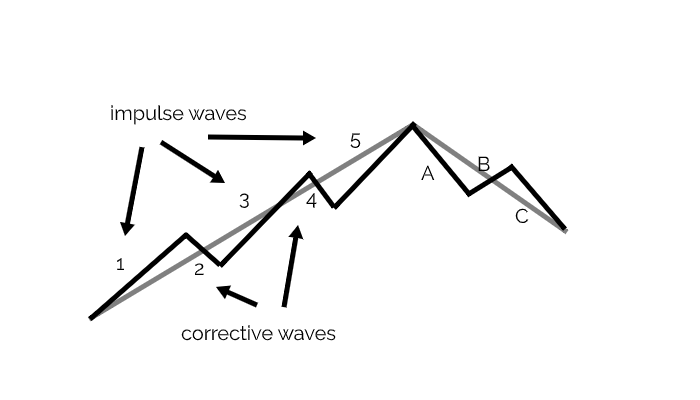

The motive wave has 5 sub-waves, waves 1, 3 and 5 are called impulse waves, waves 2 and 4 are corrective waves. Corrective wave II has three sub-waves, two down, one up – labelled A, B and C.

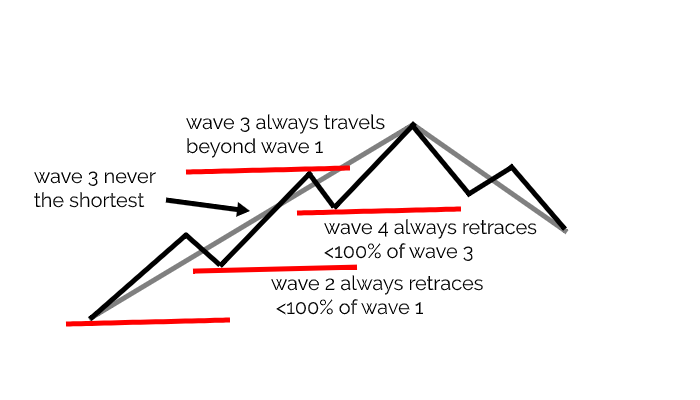

There are three rules for the motive wave to be valid:

- wave 2 always retraces less than 100% of wave 1

- wave 4 always retraces less than 100% of wave 3

- wave 3 always travels beyond wave 1

Typically, wave 3 is never the shortest wave.

This is inverted in a downtrend – waves 1, 3, 5 and B are downward. 2, 4, A and C are up.

Once the cycle ends it starts again.

Waves are fractal

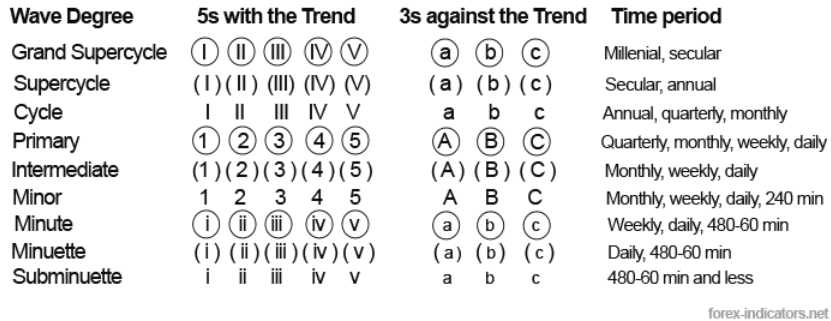

Elliott wave theory argued that waves are fractal in nature, meaning waves 1 and 2 are also split into 8 wave sub-cycles. These wave degrees range form very long term – the Grand Supercycle, through to the Subminuette. These all have 8 waves in and are all labelled differently:

Elliott wave patterns

Setting rules and structures around waves means patterns can develop. These are similar to the concept of Price Patterns, something we teach in another course.

Among others, these include:

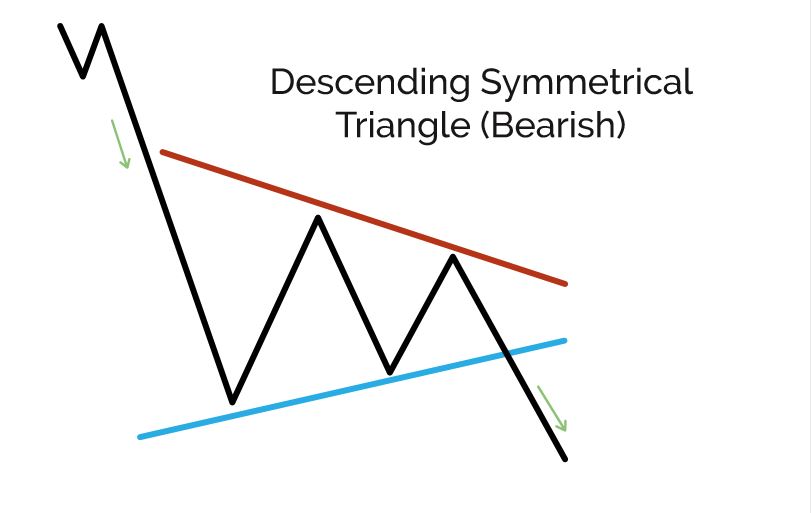

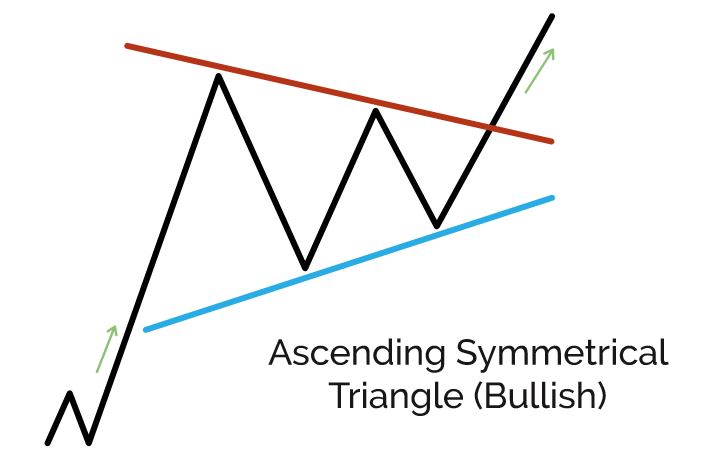

Symmetrical triangles:

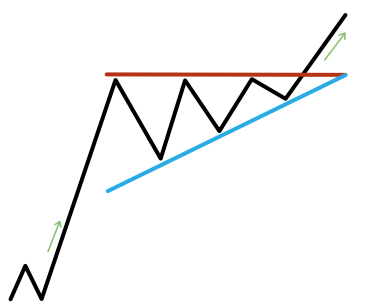

Rising triangle:

Elliott wave traders use these patterns to predict future price movements, set take profits and stop losses.

Elliott wave weaknesses

- It is really difficult to count and accurately label the waves.

- Elliott wave analysts can always blame their wave count and not the theory.

- Today’s markets don’t fit these patterns. Elliott wave theory was backed tested in the 1990s and it was found to be too unreliable to be used to trade with.

- Because waves follow set rules they create patterns, these are used by Elliott wave traders to forecast future price moves and to manage risk.

What to take from Elliott wave theory

- Elliott wave was found to work better on larger, liquid markets. This suggests the psychology of participants moves price.

- The theory helps confirm the assertion that prices move in trends.

These two findings should help us get comfortable that technical analysis, correctly applied, will help us develop an edge.

We appreciate this lesson was an overview of the theory, if you want to learn move about Elliott waves, please have a look at this website.

- Elliott wave theory says markets follow repeatable wave cycles.

- There are 8 waves in a cycle. The first 5 make up the motive wave, the next 3 the corrective wave.

- Waves are fractal and can themselves be made up of sub-waves. There are nine wave degrees.

- Elliott wave theory provides some useful confirmations of technical analysis but on balance its too hard to correctly label waves and too easy to blame this and not the theory.