Financial spread betting

In broad terms, a financial spread bet is a CFD wrapped up as a bet for tax reasons. With financial spread betting in the UK and Ireland, any profits are normally tax free.

There are some differences. Instead of trading contracts, traders specify an amount per point they want to bet on the price of an underlying asset. This is done in the account’s base currency, so the currency risk CFDs bring is now gone.

Like with CFDs, a spread bet is an OTC derivative and the trader does not own the underlying asset. In order to trade, the broker needs the trader to place margin on the account, not requiring the trader to fully fund the value of the underlying asset being bet on creates leverage.

Spread betting on a company share example

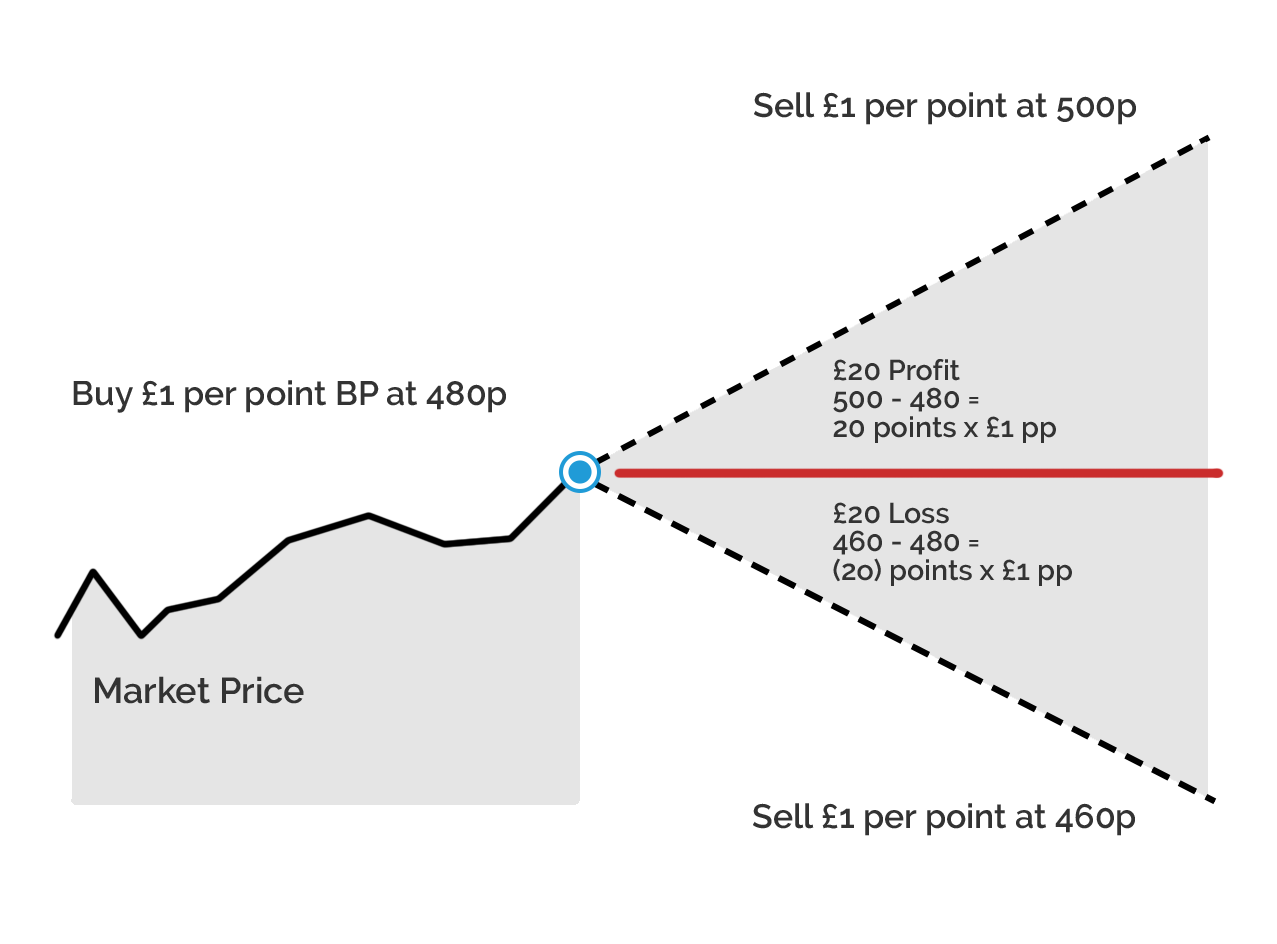

Let’s show you the BP trade again but this time using a financial spread bet. Shares are normally priced in pence when spread betting and a point is a one pence move, so from 480 to 481 is one point.

We’ve assumed in this example that our trader has their account’s base currency set to GBP. If the base currency was set to euros they would bet in euros per point. This is a big positive for spread betting, the trader can speculate on markets not priced in their chosen currency and not be exposed to the currency risk you can get with CFDs.

Spread betting FX example

For the GBP/USD trade a point is set at 0.0001, so from 1.23000 to 1.123010 is a 1 point move.

Again note the base currency is £, so the betting per point is in £ and therefore so is the P&L. The exposure to USD at the start of this example was £12,300, please note the difference to the CFD, where it was $12.300.

Spread betting pros:

- No stamp duty on company share spread bets.

- No capital gains tax in the UK and Ireland on profits.

- Unlike CFDs, there is no base currency risk.

- A huge range of markets can be traded using them.

- Low transaction costs, like CFDs.

- OTC – so flexible and innovative.

Spread betting cons:

- Losses are likely to not be tax-deductible so FSBs are not that useful when hedging.

- Leverage is hard-wired into the product. New traders sometimes don’t appreciate the underlying exposure they are taking on.

- Traders do not own the underlying asset and therefore don’t have any of the direct ownership rights you’d normally expect – like voting rights on company shares.

- Banned or limited in some countries because it’s legally a CFD. Its also banned or limited in other countries because it’s a bet.

- Financial spread bets are very similar to CFDs, and there are only a few differences.

- Traders stake an amount in their chosen base currency per point of change in the price.

- If you win, doing it as a spread bet means it does not normally attract CGT, however, losses are not tax-deductible.

- Financial spread betting is the most popular product in the UK for retail trading.