Gauging uncertainty

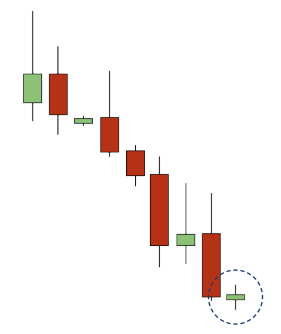

As traders we want to know when the market participants are uncertain – its acts as an alert to sit up and pay attention. Its not a reversal signal or anything more than an alert though.

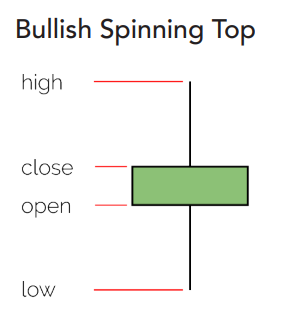

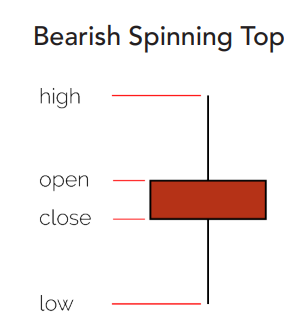

Spinning tops

We introduced dojis in the previous lesson, spinning tops are similar and are also a pattern to watch out for.

Because the open and close prices are so close, the difference between a bearish or bullish spinning top is negligible. For either to be valid, and suggest uncertainty, it needs to be in a trend.

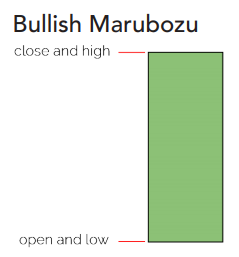

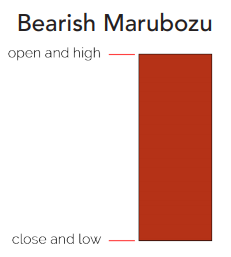

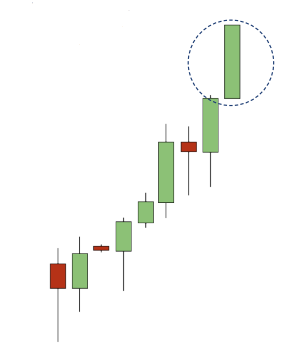

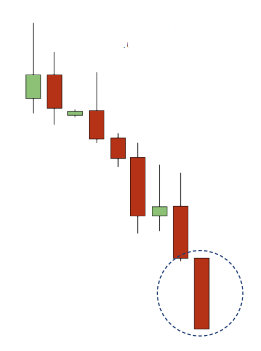

Marubozus

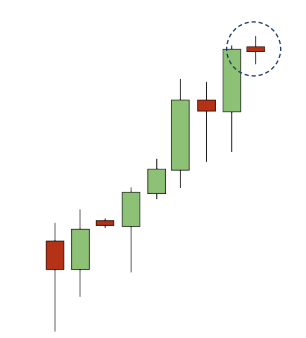

So, we’ve shown you how spinning tops and dojis suggest uncertainty in a trend, well marubozus do the opposite, these suggest certainty.

When a bullish marubozu is found in a bullish trend, it underlines the certainty of the trend. Its the same with a bearish marubozu in a bearish trend.

Bearish marubozus in an uptrend or a bullish marubozus in a downtrend do not tell us anything about certainty. They might be the start of a multi candle pattern, but that is for later in this course.

Examples

- We want to know when the market participants become uncertain in the trend, it acts as an alert.

- In addition to the dojis introduced earlier, spinning tops also suggest uncertainty in a trend.

- Marubozus suggest certainty in a trend.