Lets move on and explore what a lagging indicator is.

Lagging indicators

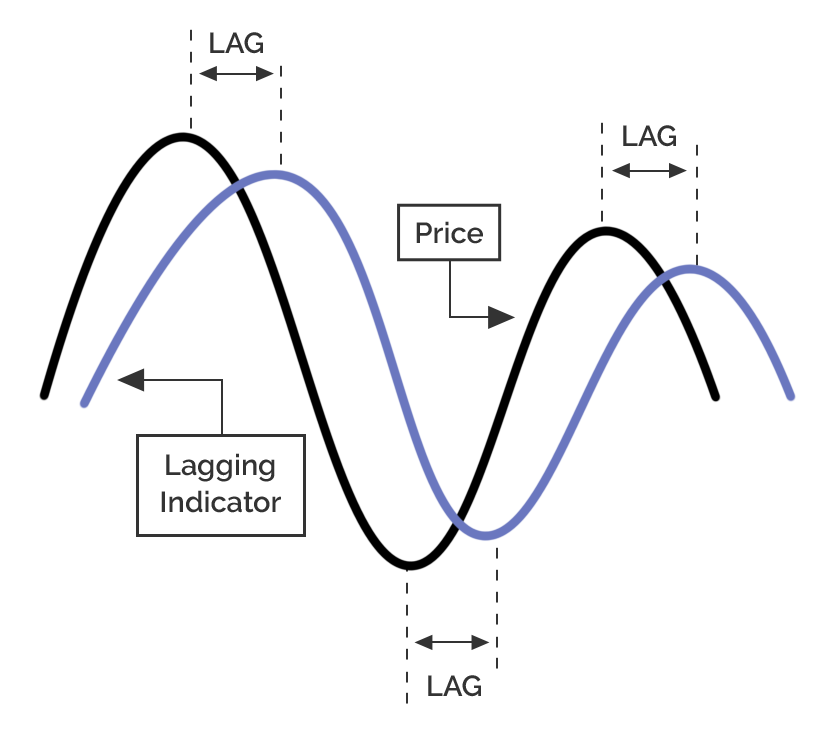

The key feature of a lagging indicator is the information it gives you ‘lags’, or follows the price action, or trend. In practice, most of these indicators are used to confirm the trend, after it has started.

Popular lagging indicators include Moving Averages, Moving Average Convergence Divergence (MACD), Parabolic SAR and Bollinger Bands.

The main pro:

Lagging indicators provide confirmation of trends, essentially the holy grail of technical analysis.

The main con:

Because they lag, traders have to wait to get a confirmation or the information they need. Sometimes a price move is over by the time its confirmed by an indicator and the opportunity to profit is missed.

Traders face a balancing act: confirmation vs catching a trend.

- Lagging indicators follow the price action during a prevailing trend, they ‘lag’ price action.

- They are used to spot and confirm trends after they have been established.

- Lagging indicators are also known as trend-following indicators.

- The main pro of lagging indicators is they help confirm trends.

- The main con is sometimes traders can wait too long to confirm the trend, and miss it.

- The trader must strike a balance: confirmation vs catching a trend.

- Popular lagging indicators include Moving Averages, Moving Average Convergence Divergence (MACD), Parabolic SAR and Bollinger Bands.