Leading Indicators

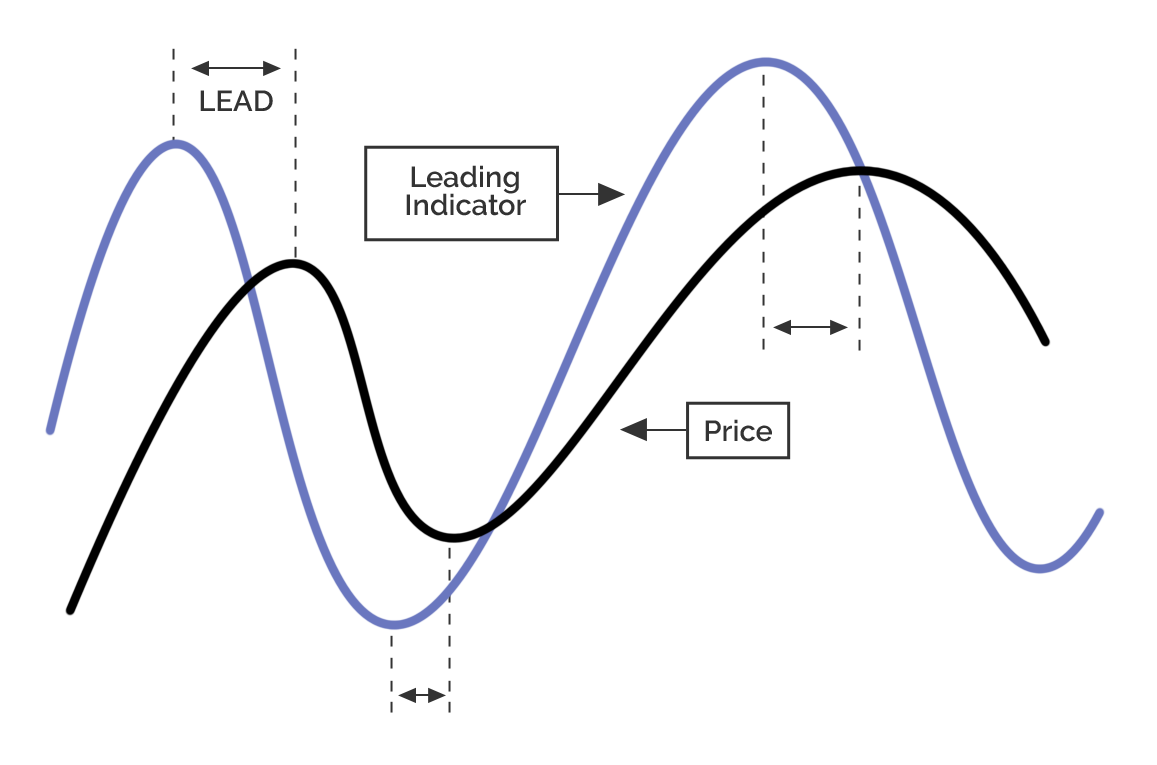

This type of indicator is designed to ‘lead’ price action. That means the information it shows traders comes before something happens.

Leading indicators are also known as oscillating indicators, it tries to identify overbought and oversold conditions and normally swing between two numbers – i.e. 0 and 100. Examples of popular indicators include the Relative Strength Index (RSI) and Stochastics.

Pros

Leading indicators are more likely to be used as an entry and exit signal in a trading system. A positive signal can get a trader into a move early.

Cons

Leading indicators can sometimes be too heavily relied upon in trading systems. Traders end up blindly trading them – they are just formulas.

- Leading indicators are designed to ‘lead’ price action.

- A leading indicator is also known as an oscillating indicator.

- An oscillating indicator usually swings between two fixed points and tries to identify overbought and oversold situations.

- Leading indicators can be very handy as part of an entry and exit strategy.

- Trading using only a leading indicator can be very risky.

- In other courses, we’ll look at the Relative Strength Index (RSI) and Stochastics.