Markets are split into different asset classes, each with its own characteristics.

Stocks

Stocks, shares and equities are terms used interchangeably in Finance, and broadly mean the same thing – a unit of ownership in a company. These assets entitle the owner to a share of the company’s profits – distributed as dividends, and to various rights, like voting at the company’s AGM.

There are thousands of publicly traded companies, you probably use products and services from these popular ones every day:

Each of these publicly listed companies has issued millions of shares, owned by pension funds, hedge funds, banks, private investors, other companies, traders, and so on. These shares are traded on stock exchanges all around the world, including the London Stock Exchange, the New York Stock Exchange, Nasdaq, Deutsche Börse and the Shanghai Stock Exchange.

Share prices continuously change to reflect what the market participants current view of the future value of that particular portion of the company is. Here is the live Apple Inc price for one share:

Commodities

These are goods that have what economists call fungibility – this is when one unit is the same as another unit – an ounce of gold is the same as the next ounce of gold. Commodities are typically raw materials and they come in two types:

Indices

An index measures the performance of a collection of assets, normally stocks, through a single price.

Popular stock indices include:

- Dow Jones Industrial Average (also called the Dow, DJIA and Wall Street 30). This is a collection of 30 blue-chip American stocks, including Nike, Apple, Microsoft and Walt Disney.

- Nasdaq 100 (US Tech 100). This is an index of 100 US technology companies, including Amazon, Netflix, eBay and Tesla.

- S&P 500 (US500). An index of the largest 500 stocks by market capitalization in the US, including Coca-Cola and Walmart.

- FTSE 100 (Financial Times Stock Exchange 100 Index, UK100). The 100 largest shares listed on the London Stock Exchange, including Shell, BP and AstraZeneca.

- Dax 30 (Deutscher Aktien Index 30, Germany 30). 30 major German blue-chip stocks, including Adidas, Volkswagen and Deutsche Bank.

- Euro Stoxx 50 (Euro Stocks 50). The 50 largest EU stocks, listed in Europe, including SAP and Allianz.

- CAC 40 (Cotation Assistée en Continu, France 40). The largest 40 French stocks, including L’Oréal, Total and LVMH.

- Nikkei 225 (Japan 225). The largest 225 stocks listed on the Tokyo Stock Exchange including Fujitsu and Daikin Industries.

- Hang Seng 50 (Hong Kong 50). Hong Kong’s top 50 listed shares, including Tencent.

- ASX 200 (Australia 200). The top 200 companies from the Australian Securities Exchange, including Westpac and ANZ Bank.

It should be noted that an individual stock can be in more than one index.

As well as by exchange, there are also indices for sectors, industries, for smaller sized stocks and also for other asset classes like commodities.

Currencies (forex, fx)

Governments, banks, companies and individuals need foreign currency every day. This might be businesses buying goods from an overseas supplier, a bank hedging its exchange rate risk or an individual going on holiday and needing some spending money.

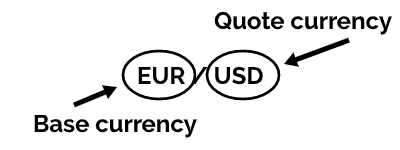

Because one currency is being bought and one sold, exchange rates are always quoted in pairs. When trading Forex markets, we’re always concerned with currency pairs, not just a single currency. Let’s look at a live price for the EUR/USD pair – the Euro and the US Dollar.

What this is telling us is in the market right now you can sell 1 euro and buy about this number of dollars. You can also sell about this number of dollars to buy 1 euro.

The price of a currency pair is always quoted using the same convention: the first currency in the pair is called the base currency and it is worth 1, while the second currency is called the quote currency and shows how much of the quote currency you’ll exchange for 1 unit of the base currency.

Cryptocurrencies

In 2008 Bitcoin was launched, bringing with it the Age of cryptocurrencies – the next step in the evolution of currencies. Bitcoin is a digital currency, meaning it is decentralised – without a Central Bank backing or administering it.

In 2008 Bitcoin was launched, bringing with it the Age of cryptocurrencies – the next step in the evolution of currencies. Bitcoin is a digital currency, meaning it is decentralised – without a Central Bank backing or administering it.

All cryptocurrencies have a distributed ledger of transactions called a blockchain verified on nodes using a sophisticated encryption process. The theory is this level of protection means the digital currency is free from supply manipulation by Central Banks.

There are now hundreds of cryptocurrency markets:

Like traditional currencies, the price you see for a cryptocurrency is quoted for a pair. The price you normally see is the number of US dollars to one unit of that cryptocurrency, but check this, you can get prices for the particular crypto to most traditional currency pairs.

FAQs

- In Finance there are 1000’s of financial markets, the prices of all of them change as buyers and sellers come together and agree on a price for the asset.

- A stock is a unit of ownership in a company, traders can trade the price of a stock in companies like Apple. Amazon or Facebook.

- A commodity is a fungible raw material. There are hard commodities like oil and gold, as well as soft commodities like corn and sugar.

- An index is a collection of assets, normally these are collections of shares, like the FTSE 100 or Dow Jones Industrial Average but you can get an index of any group of assets – like a commodity index.

- Currencies are traded in pairs and the price is what one unit of the base currency can buy or sell for in the quote currency. The most popular currency pair is EUR/USD.

- Cryptocurrencies are the newest type of market, these are digital currencies. Similar to currencies but secured by cryptography instead of the State.

Once you’re finished with this lesson please click ‘Mark Complete’ to move on.