Let’s introduce a three-candle pattern:

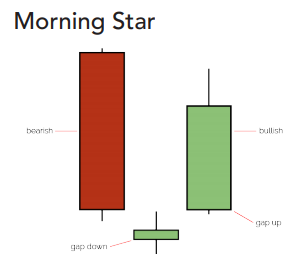

Morning stars

These three-candle patterns are a bit rarer than the others mainly because there are more variables. Morning stars occur in downtrends and are bullish reversal patterns. They consist of the first candle, which is in line with the bearish prevailing trend. There is a gap down for candle two, which is a spinning top or doji – so lots of uncertainty. The bulls then take over and there is a gap up to the open of the third candle where they continue and produce a big bullish candle.

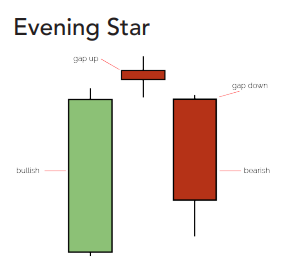

Evening stars

These are the inverse of morning stars, its a bearish reversal pattern. The bulls are in control, gapping up to period two. Then uncertainty with a spinning top or dogi – the colour is not important here. Finally, the bears get control, gapping down the price at the open of period three and pushing on down.

For both patterns, an important point to note when analysing markets that don’t close for long, like fx markets, is that you can be forgiving of the gaps. If analysing markets with long closes, like individual equity markets, you can be a lot stricter.

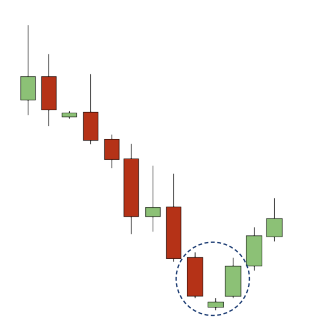

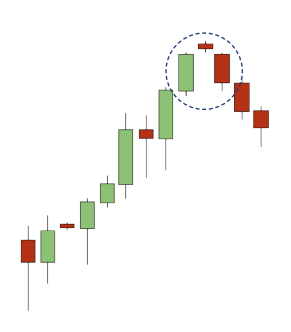

Example

- Morning stars are three-candle bullish reversal patterns.

- Evening stars are three-candle bearish reversal patterns.

- When looking for these patterns be aware of how long a market closes for.