Let’s turn our attention to reversal patterns.

Hammers

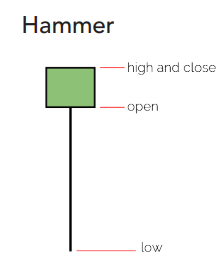

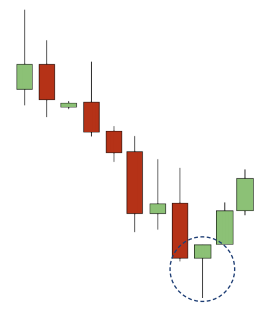

Hammers are a single candle pattern with a long lower wick and a bullish, small body at the top – the price has closed at the high for the period. A hammer is only valid if it forms in a downtrend, as follows:

What does it tell a trader?

Hammers are bullish reversal patterns, which means they suggest a reversal to an uptrend might occur. For the pattern to form the bears who have driven the trend to date have been countered by the bulls that have pushed back enough to move the price higher. There appears to have been a shift in sentiment – as technical traders we seek confirmation that the trend has changed in the form of a bullish candle.

You can get hammers with a bearish head (red), where the open is slightly above the close and when the open and closing price are the same (you’ll see this in a moment), but they carry less weight in our analysis.

Example

- Hammers are single candle bullish reversal patterns.

- To be valid, hammers need to be identified in a downtrend.

- The head of a hammer can be bearish or non-existent but carries less weight.