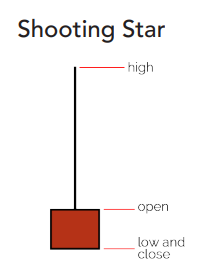

Shooting star pattern

This pattern is the inverse of the hammer pattern – it is a single candle pattern where the low and close are the same. Shooting stars are only valid if one develops in an uptrend, as follows:

What does it tell a trader?

This is a bearish reversal pattern. The body of a shooting star can be bullish or non-existent but carries less weight in our analysis if it is.

Let’s pause for a moment to think about what is happening to price for that candle to develop. The price has opened, been pushed higher by the bulls, only for the bears to come back and drive the price down below the open.

Example

- Shooting stars are single candle bearish reversal patterns.

- To be valid, shooting stars need to be identified in an uptrend.

- The head of a shooting star can be bullish or non-existent but this carries less weight.