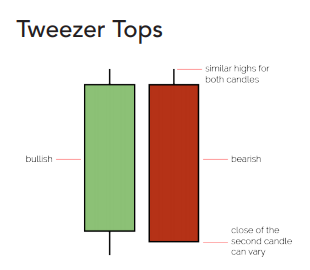

Tweezer tops

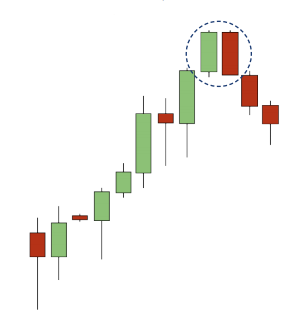

These occur in uptrends and are a reversal pattern. The first candle needs to be bullish, but unlike other patterns, the exact shape of it isn’t that important. The crucial element is the high of the first candle needs to be very close to the high of the second. The second candle then needs to be bearish. This combination of requirements can leave you with quite a few different variations.

The bulls have continued the trend in the first candle and make a new high. As the second candle develops the same high is reached but the bulls have had enough and bears come in and take the price lower. We’ve seen the control switch in the second candle, this change has happened just after the start of period two.

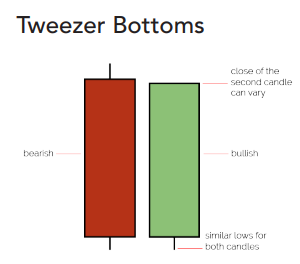

Tweezer bottoms

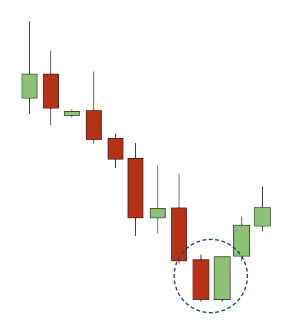

In tweezer bottoms the inverse is true – these are bullish reversal patterns that occur in downtrends. Again, similar rules apply – the first candle needs to be bearish, both candles need to have similar lows and the second candle needs to be bullish.

Example

- Tweezer patterns are multi candle reversal patterns.

- Tweezer tops occur in uptrends and tweezer bottoms in downtrends.

- Tweezer tops need the first candle to be bullish, the highs close together and the second candle bearish. The inverse is true for tweezer bottoms.