Chapter 8

Risk Management Tools

A large part of the inherent risk comes from the fact that spread betting is a highly leveraged investment product (meaning that it amplifies profits greatly but can also expose bettors to potentially large losses).

Therefore, in order to be a successful spread bettor, it is critical that you practice good risk management in your trading. This chapter covers the basic risk management principles, as well as risk management tools – trading tools – that spread betting companies make available to you.

- Learn more, take our free course: Mastering Trading Risk

The risks of spread betting

The first step in managing your spread betting risk is understanding clearly what the risks of spread betting are. There is a more extensive list in chapter 16 – The Risks of Spread Betting – but here’s a rundown of the main inherent risks associated with financial spread betting:

Please note: this is not the case in EU any longer where there is negative balance protection.

For forex traders trading standard lot sizes with a pip value of $10, that can mean sudden profits or losses of $1,000 or more.

You can protect yourself against market gapping price action with the use of risk management tools such as guaranteed stop loss orders (discussed later in this chapter).

Basic principles of spread betting risk management

There are certain basic principles to follow for effective risk management, in addition to specific spread betting tools for managing risk that are provided through your betting firm’s trading platform.

Know the Markets you Bet – Every financial market is different. Stock shares don’t trade the same way that commodities do, and commodities don’t trade the same way as the forex currency exchange market. Becoming familiar with the market you want to spread bet before ever deciding to trade is the first step to good risk management.

Learn the times of day when your market tends to be most active – when significant price changes are likely to occur. Know the average daily trading range of any financial instrument you trade.

And of course, make sure you know the minimum price movements and what kind of profit/loss each point represents.

Understand Pertinent Economic Data – Learn which economic reports are most likely to significantly impact the instruments or markets you trade. Generally speaking, the most important (high risk) economic reports to watch are the following:

- Gross Domestic Product (GDP)

- Central bank interest rate announcements

- Employment/unemployment figures

- Retail sales

- Producer Price Index (PPI)

- Consumer Price Index (CPI)

If you’re spread betting individual stocks, keep track of when the company releases quarterly and annual earnings reports.

Earnings reports – especially when they come out significantly higher or lower than expected – are major movers of stock prices and may determine the overall price trend for some time (at least until the next earnings report).

For the convenience of their clients, spread betting firms publish a daily economic calendar showing all the data releases scheduled for that day.

Have a definitive trading strategy

Financial spread betting is not meant to be blind gambling.

It’s a form of investing. Your spread bets should always be based on careful market analysis – fundamental analysis, technical analysis, or some combination of the two.

- Learn more, take our free course: Building the Evidence

Part of your market analysis should include calculating the risk/reward ratio for any spread bet you’re considering:

What’s your reasonable potential loss vs. your reasonable potential profit?

It is reasonable to estimate the potential loss is 18 points and your potential gain is 42 points. That’s a favourable risk/reward ratio because the potential profit is more than twice the potential loss. Remember, it could be more either way – it is just an estimate.

On the other hand, if the highest price you could reasonably expect the stock to reach was 105, then the bet would not be attractive from a risk/reward analysis, as you’d be risking 18 points against a potential gain of only 7 points.

Whatever your trading strategy is, it’s critical that you exercise the necessary self-discipline to follow it, to abide by its rules, even during times when it’s not performing well.

Many studies have found that “not following your trading strategy” is a much more common cause of losing trades than “using a flawed trading strategy”. A good trading strategy has clear rules for entry and exit, employs stop-loss orders to minimise risk, and is well-suited to the market you’re trading.

Understand leverage and margin requirements

Because spread bets and CFD (contracts for difference) trading offer extremely high leverage, it’s essential to understand how leverage and margin requirements work.

The margin requirement for a spread bet is the amount of money you have to put up to initiate and hold your spread bet position. Use bet sizes that are commensurate with the amount of trading capital you have – we show you how to do this in our Trading for Beginners course.

Make sure you always have enough money in your account to cover the required margin for your spread bet(s) – and don’t forget to allow for the market to temporarily move against you, which will increase the margin required to hold the position.

If you lack the necessary margin money, your spread betting firm will automatically close out your bet. This may result in you losing money when – had you been able to maintain the position – you would have ended up with a winning bet.

Specific risk management tools for spread betting

Spread betting companies offer their clients several tools to help them limit and manage risk.

1. Stop-loss orders

We introduced stop-loss orders in Chapter 4 – How does spread betting work? – the order type is one of the most basic risk management tools. A stop-loss order is designed to help keep any trading losses at an acceptably low level. Keeping your losses small and manageable is key to being overall profitability of your spread betting enterprise.

Now assume that technical analysis indicates that if you are correct in your price forecast, then the price should not drop back below 60. If the price does decline to below 60, then that would indicate that your market analysis is probably incorrect, so you wouldn’t want to hold your bet and risk further loss. You handle this situation by placing a stop-loss order at 58.

If the bid price – the first, lower number quoted in the spread – drops to 58 or lower, then your stop-loss order is triggered, and your bet automatically closed out at the best available market price.

Note: When triggered, a stop-loss order effectively becomes a market order. Therefore, it is not guaranteed to be filled at a specific price – only at the best available market price at that time.

You can further manage risk by adjusting your stop-loss price when the market moves in your favour. You can move your stop-loss price to a level that further reduces your risk – or if the market has moved substantially in your favour, you can move your stop loss to lock in some profit.

For example…If you bought a spread of 30-32, and the price advanced all the way to 56, then you might adjust your stop-loss price up to 45, thereby locking in 13 points (45-32=13).

2. Guaranteed stop-loss orders

By paying a slight premium, you can get a guarantee that your stop-loss order will be filled at exactly your specified stop price. This is true even if the market gaps past your stop price level from the market close on one day to the market open the next.

Even if the FTSE closes on Friday at 7550 and then some significant economic event over the weekend causes the index to gap lower on the Monday open – opening at 7450 – your bet would still be closed out at 7500 – thus saving you from a 50-point additional loss.

Using guaranteed stop-loss orders is worth considering if you (A) regularly hold bets overnight, or (B) are trading extremely volatile markets.

3. Limit orders

Limit orders are only filled if they can be filled at the price that you specify, or better. Limit orders can be used to manage your risk by making sure you take profits when possible.

After watching the market trade uneventfully, mostly between 55 and 60, for a couple of hours, the bettor has to go out to run some errands. Upon returning a couple of hours later, they discover, much to their dismay, that the market price had briefly spiked up as high as 80, but is now trading back down around 57.

Basically, they missed their chance to get out at their desired profit level!

The way to avoid this scenario is to place a limit order to close out your spread bet at 75. When the market, even just momentarily, traded as high as 80, the limit order closing out your bet for a hefty 25-point profit would have been filled.

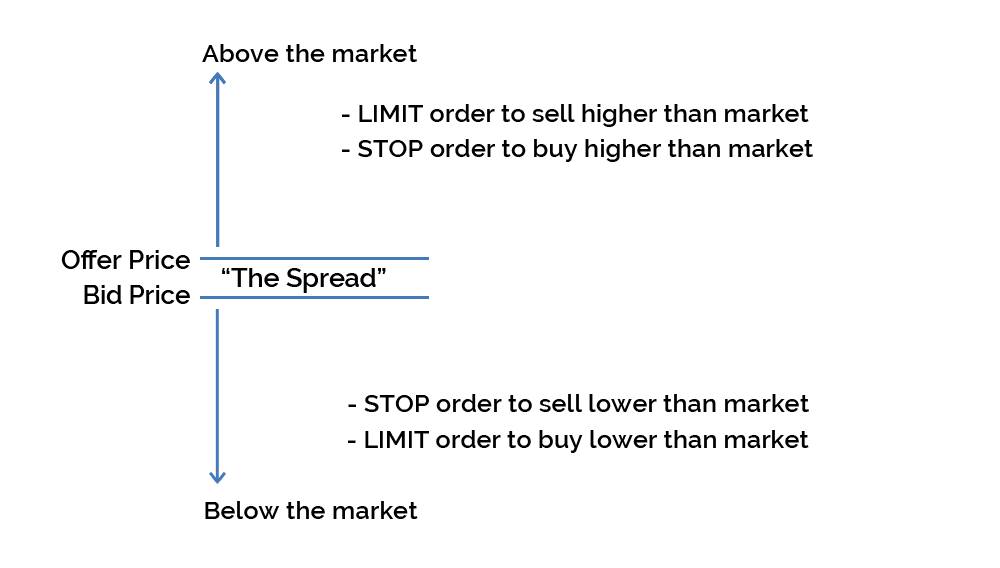

Here’s the stop and limit order terminology diagram we showed you earlier in the guide as a reminder:

4. Portfolio diversification

By betting on a variety of financial instruments, you may not succeed in absolutely maximising your potential profit, but you will obtain significant additional protection against losses from unsystematic risk factors.

This is because having a diversified portfolio of investments usually means that when some of your spread bets are losing money, others are showing profits.

Read: Find Out How hedge Fund Managers Place Successful Trades Day in Day Out

Conclusion

There is an inherent level of risk in spread betting, so it may not be suitable for everyone. Whether it’s right for you will depend on your risk tolerance and investment objectives.

Fortunately, spread betting companies offer a range of risk management tools to help you trade. You can use trading tools such as limit orders, stop-loss orders and guaranteed stop-loss orders to either lock in profits or protect yourself against unacceptably large losses.

You should only spread bet with money that you can afford to lose. Before deciding to trade, make sure that you understand the risks, the market you plan to trade, and how to use the various risk management tools offered by your spread betting provider.

- Learn more, take our free course: Mastering Trading Risk

Start learning now

Learn the skills needed to trade the markets on our Trading for Beginners course.