Let’s get to the juicy part, the strategy:

The Breakout Strategy

Strategies are trading systems used to apply an overall approach. We’re going to take you through the system used for a simple breakout strategy.

First of all, let’s show you a strategy for a breakout to the upside, where we’d be looking to go long.

Step 1: Confirm the trend

So, following our approach explained earlier in the course we seek to identify the trend. Check the following:

- A series of higher high and higher lows (at least 3).

- A rising support trendline.

- Price is above a 50 period SMA.

- The 50 period SMA is rising (sloping up).

- Confirm the trend in two higher timeframes.

To expand a little on that last point, we seek to further confirm the trend using two higher timeframes. So, if we were trading using a 15-minute timeframe, this means conducting the same checks in hourly and 4 hourly. Only when we can confirm an upward trend using this method are we comfortable going long – we are checking the tide is in our favour.

Step 2: Continuation pattern forms

What we are looking for next is a continuation pattern, normally this is a pennant or flag pattern developing at a historic resistance level.

- Price hits historic resistance level.

- Pennant for flag price patterns forms.

Step 3: Confirmation

Next, we need to confirm the price pattern or it isn’t a valid pattern. This happens when the price breaks out to the upside of the resistance area.

- Confirm price pattern.

- Go long.

It is at this point we have enough evidence in our favour and can enter the trade, going long.

We can obtain additional confirmation of the price pattern if the price comes back down to retest the old resistance area – now support. This is also a good opportunity to enter the trade.

Trade management

We know to never have an open position without a stop order in place, protecting our downside. We set stops at places that are close enough to give protection but wide enough not to be taken out by random noise in the market. We’d set the stop at a level where this trade would no longer make sense. Setting it at the level of support in the pennant or flag means if the price does fall to that level the price pattern isn’t valid, the trend has left the market, and the reasons for placing the trade no longer hold.

In terms of risk, we think 1% is prudent. This means a trader should never risk more than 1% of their capital if the trade triggers the stop. This means if you had £10,000 capital, a 1% risk is £100. So, for example, the gap between trade entry and the stop level is 25 points, that’s a £4 a point trade.

- Place stop order at the pattern support level.

Risk reward

We are looking for an outsized reward for the risk we’re taking, we think if we’re taking 1% risk, that we should be aiming for at least a 2% reward. We can set up the trade by placing a limit order at this level.

- Place limit order at 1:2 risk to reward.

When not to trade it

Perhaps, it is just as important when not to trade this type of set up. If the set up occurs in the following scenarios then in our opinion it becomes too risky as a trade.

- If the resistance is significant in higher timeframes than ones used for the trend confirmation.

- If the consolidation is happening just ahead of a key economic announcement.

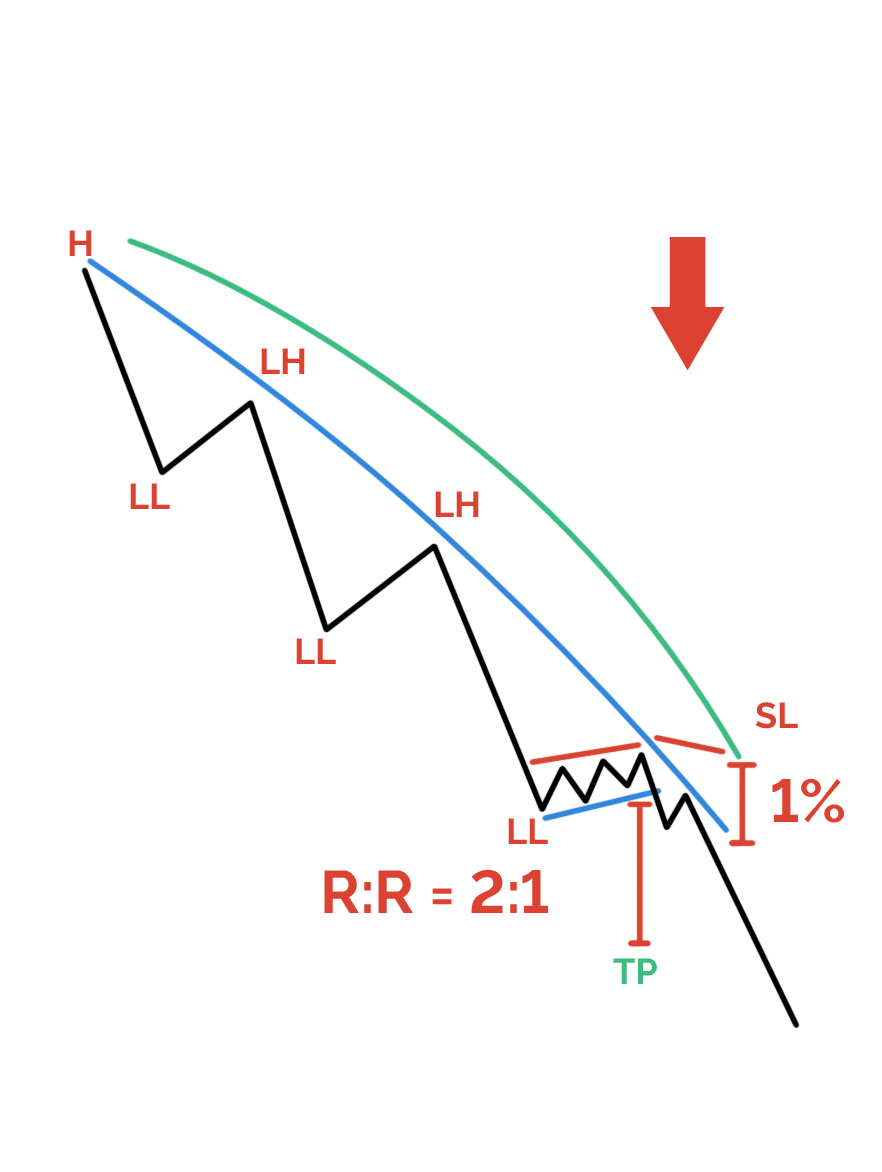

Breakouts to the downside

So, a breakout strategy can also be applied to a downtrends market in a similar, but inverse to the up-trending market set up. We won’t go through the details again, but here are the steps for sell set up.

- A series of higher lows and lower lows (at least 3).

- A falling resistance trendline.

- Price is below a 50 period SMA.

- The 50 period SMA is falling (sloping down).

- Confirm the trend in two higher timeframes.

- Price hits historic support level.

- Pennant for flag price patterns forms.

- Confirm price pattern with a breakout to the downside.

- Go short.

- Place stop order at pattern resistance level.

- Place limit order at 1:2 risk to reward.

- We took you through the strategy’s steps.

- We’ve shown you some risk management considerations.

- We showed you when not to trade it.

- If these steps don’t align, don’t force it, step away and wait for another setup.

- The breakout strategy can also work as a short set up.