Contract for difference

A contract for difference (CFD) is a legally binding agreement between two parties, in our case, it is between us as traders and our brokers. The contract simply commits the two parties to exchange the difference in the price of a market between the point the agreement is entered and when the parties decide to conclude it. In practice for traders, this is when you click ‘submit’ on your deal ticket to when you decide to close the trade.

A CFD is a derivative, this means the two parties do not exchange the underlying asset – for example when trading a Gold CFD no gold actually changes hands, when trading a CFD of a company share price no share certificates change hands. Both parties agree to pay or receive the difference in prices.

A brief history of CFDs

Originally a CFD was a product used by asset managers to hedge long-only shares – it is a lot cheaper to trade a CFD than it is a share so it presented a more efficient method of offsetting risk if the manager thought the share price was going to fall. CFDs started becoming used for speculation in the 1980s and developed into a mass-market product for retail traders off the back of the internet going mainstream in the 1990s.

CFDs have developed into one of the most popular products for private (retail) traders to speculate with.

CFD company share example

Let’s show you what happens when a trader buys 100 BP CFDs. BP is a company share listed on the LSE and priced in £.

CFDs are priced in line with the underlying asset’s pricing currency. So for this example, if your primary trading account currency was euros or dollars by trading a CFD priced in pound sterling you exposure yourself to currency risk.

CFD FX example

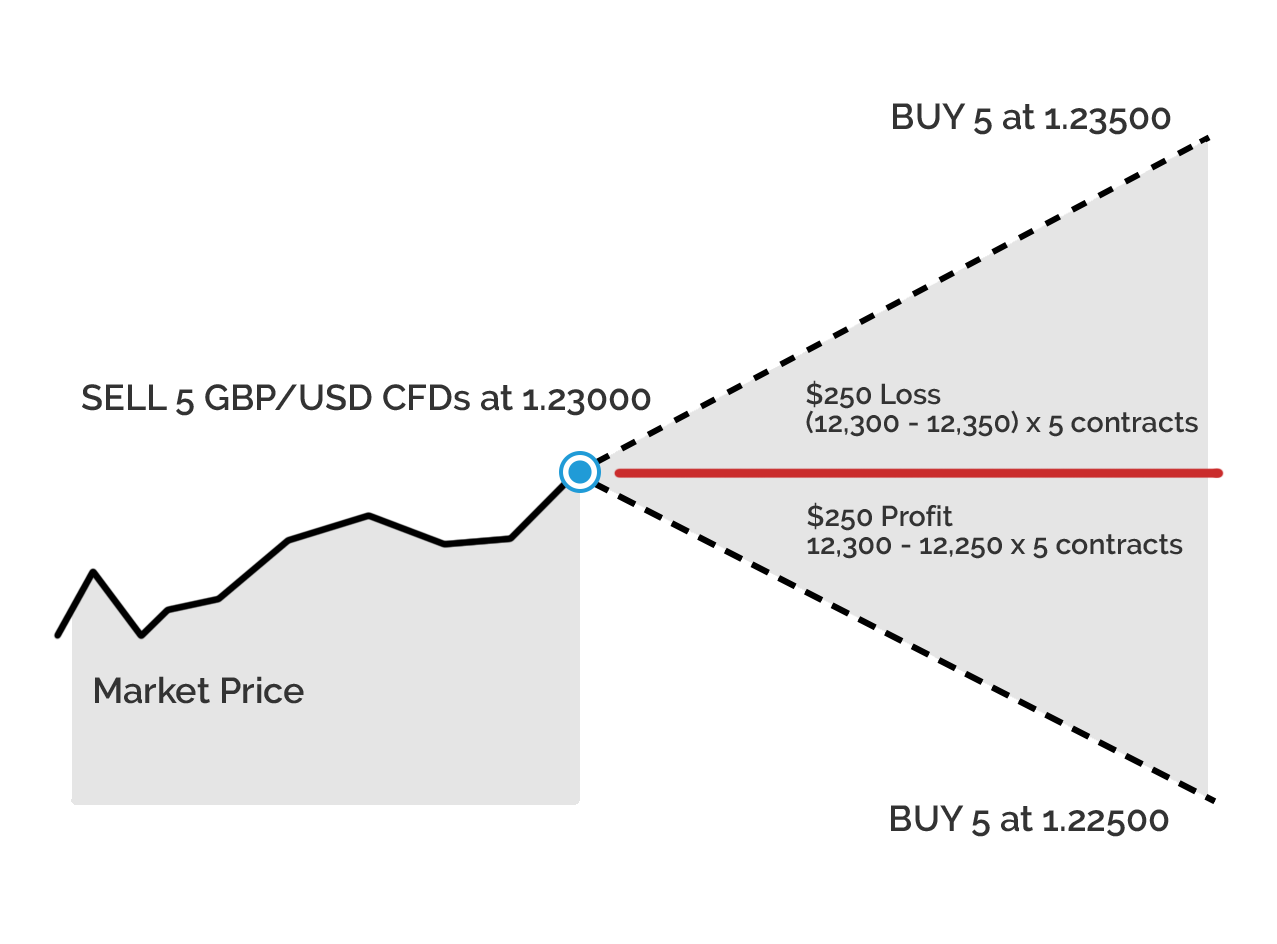

For an FX CFD the P&L and margin are always in the quote currency (2nd currency) of the pair, so for a GBP/USD CFD trade, this is USD.

1 FX CFD contract is per 0.0001, so in our example below 1 contract gets you $12,300 of exposure. By opening the trade and going short GBP/USD the trader is speculating USD will appreciate against GBP (or GBP depreciates against USD, its the same thing). To close the trade the trader must buy back the 5 CFD contracts.

CFD pros:

- No stamp duty on share CFDs.

- A huge range of markets can be traded using them, the popular CFDs are for equities, fx, commodities and debt markets.

- Low transaction costs – much cheaper than buying or short selling (borrowing, selling and buying back later) an underlying asset.

- Recognised and offered globally.

- Traders do not have to take delivery of the physical asset – like barrels of oil.

- A CFD is traded over the counter – this means it is not traded via a central exchange, it is an agreement between two parties. This allows brokers to be innovative and flexible in the markets they offer traders. Cryptocurrency CFDs are the most recent example of this flexibility.

- Losses are likely to be tax-deductible (your tax status is unique to you, we are not tax advisors so please get some advice if you need it).

CFD cons:

- CFDs can exposure the trader to currency risk.

- Leverage is hard-wired into the product. New traders sometimes don’t appreciate the underlying exposure they are taking on.

- Traders do not own the underlying asset and therefore don’t have any of the direct ownership rights you’d normally expect – like voting rights on company shares.

- Profits are likely to be taxable (your tax status is unique to you, we are not tax advisors so please get some advice if you need it).

- Banned or limited in some countries because of concerns over leverage, among other things.

- A contract for difference is an agreement between two parties to exchange a change in the price of an underlying asset.

- A CFD is a derivative traded over the counter.

- There are lots of benefits to CFDs, like lower transaction costs, no stamp duty and range of markets.

- There are also some downsides, like the inherent leverage CFDs create, lack of voting rights and exposure to currency risk.