Welcome, to get started please play the video:

Why worry about costs?

New traders often aren’t worried about the costs of trading, they fixate on their P&L and as long as it is positive aren’t too worried about anything else. We are trying to get you to think about trading as a business. Yes, the revenue needs to be positive for it to stand a chance of being a profitable business but the costs also need to be understood and managed. Sometimes, cost management can be the difference between being a profitable trader or not.

What is ‘Spread’?

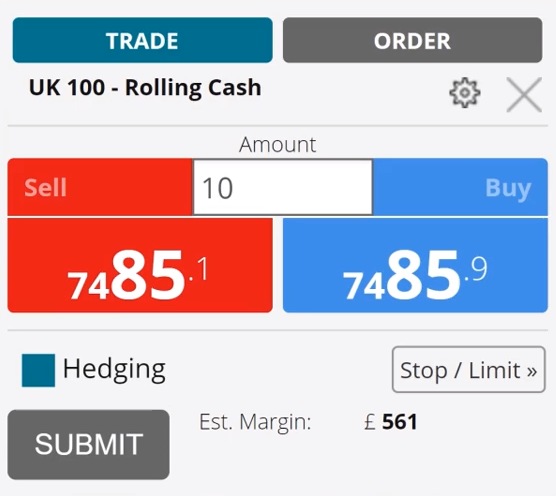

In the lesson on Buying, Selling and Orders in our How Traders Interacting with the Markets short course we introduced the concept of Spread. By way of reminder, all markets have a bid-offer price (also known as the sell-buy or bid-ask price), you can see that on this deal ticket for the UK 100 Rolling Cash market:

The price you, the trader, can go short at is 7485.1, the price you can go long at is 7485.9, the difference between the two prices is the Spread, so in this case, it is 0.8.

Why Spread is a cost

Let’s run a through why the spread is a cost. If the trader simultaneously bought and sold the trade set up given in the earlier deal ticket they would get:

Opening trade – Buy £10 a point at 7485.9, this gives the trader a notional long position of £74,859.

Closing trade – Sell back £10 a point at 7485.1, immediately the trader sells back the exposure for £74,851, a difference and loss of £8.

Because the trade was done simultaneously the underlying market has not moved…so where has the trader’s £8 gone? This is the cost of Spread, another way to calculate it is: amount traded x spread, £10 x 0.8 = £8.

This is the market effectively levying a fee on the trader for trading, all brokers will quote prices with a bid-offer spread. Because there won’t be an actual fee taken from the trader’s account most new traders don’t know it is there and figure it out after some time trading that this is how their broker makes its revenue. In order to offer you their services brokers need to make money so there is no getting around this charge.

This is where, from one broker to another, the commercial offering can differ a lot. It can cost new traders many multiples more in spread to trade at one broker than another. The key is to make sure you trade with a broker that has ‘tight’ spreads, all other things being equal. As traders, we are looking for value and it is about weighing up what you get with what you pay.

Fixed vs variable spreads

Most brokers publish its spreads somewhere on its website – however, when trying to work out if a broker’s spreads are tight, and therefore good value, it is important you are comparing like with like.

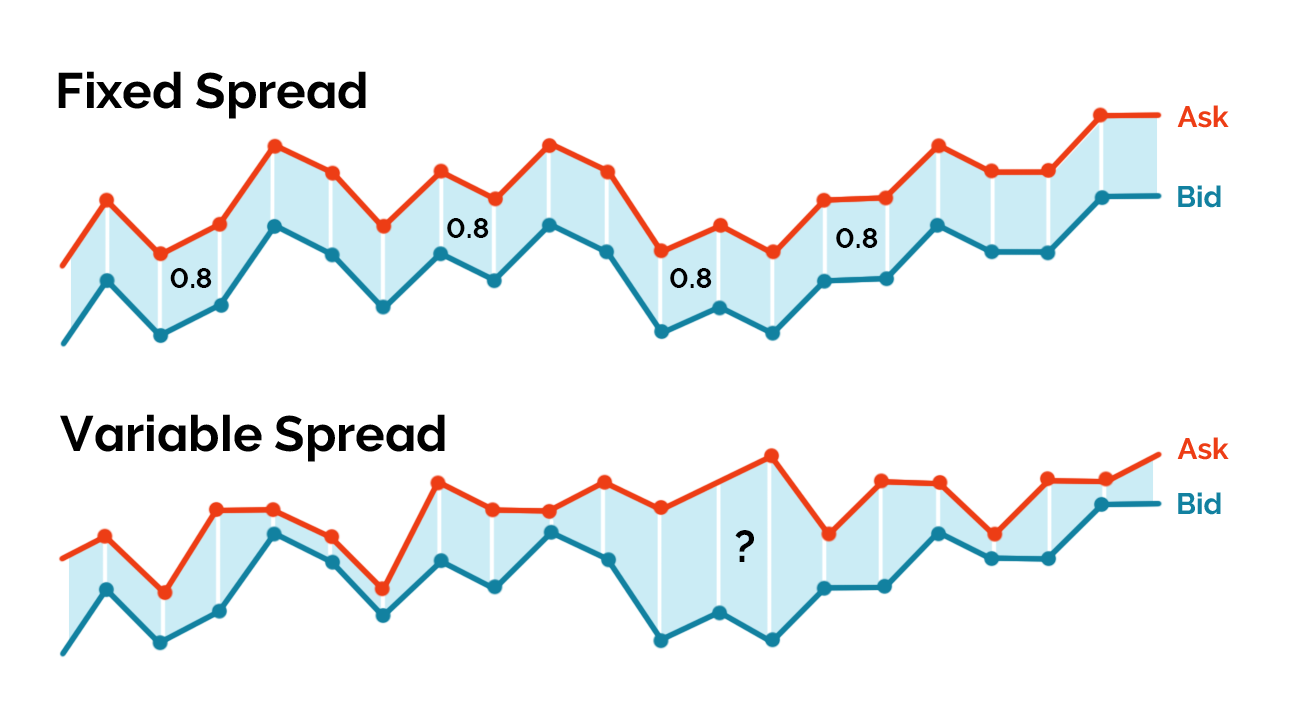

A fixed spread is when the broker fixes the difference between the buy and sell price, in our example the 0.8 spread on UK 100 – Rolling Cash stays like that no matter what happens in the underlying market (during predefined trading periods, i.e. the trading day). A broker offering variable spreads can change the spread at any time as they see fit. Over time, the bid-offer spread profiles of the two on the same underlying market might look like this:

So, why is this an issue? Because there is always an opening and closing leg to any trade, when trading with a variable spread it means a trader does not know the cost to trade before placing a trade. A trader can enter a trade when the market has one spread, something happens to widen the spread, and the trader is facing a higher cost to exit the trade.

In our fixed spread example above we know the spread to get into and out of the position was £8 before the trade was placed, with variable spreads we can not say what it will cost to trade.

However, variable spreads are not all bad. The reason traders use variable spreads is that they normally mirror the underlying market conditions, this means they might be tighter at some points and the trader can get a cheaper cost to trade.

Fixed spreads are typically offered by retail derivatives brokers in commodity, index, bond and FX markets. Individual equity market spreads cannot be fixed, instead what tends to happen is the commission charge is fixed. Some brokers offer fixed spread markets because they want to offer a more consumer-friendly product to new traders.

There are pros and cons to trading using fixed and variable spreads, it is a balancing act and you need to decide what is right for you. Just make sure, when you research how tight a spread a broker is offering that you are comparing fixed with fixed and variable with variable.

When you are new to trading using fixed spreads gives a trader clarity around the costs to trade and it is one less variable to manage. If you are a new trader we would suggest using a fixed spread broker until you are confident you really know the markets you are trading and why spreads might widen.

- Traders should treat trading as a business and actively manage costs.

- Spread is the difference between the bid and offer price, multiplied by the volume traded will give the trader their spread cost.

- Spread cost is typically the largest cost for a frequent trader.

- Spread should be thought of as a charge the market takes from the trader to trade.

- Some brokers offer wide spreads, some tight spreads. If you want to manage your cost of trading – go for tight spreads (all other things being equal).

- Brokers will either offer fixed or variable spreads. Make sure you are comparing like with like.

- With fixed spreads you know the total spread cost before placing a trade.

- We think its sensible for new traders to use fixed spreads. Ideally, tight and fixed spreads.

Once you’re finished with this lesson please click ‘Mark Complete’ to move on.