Let’s move on and look at several key concepts all market participants should understand.

Buying

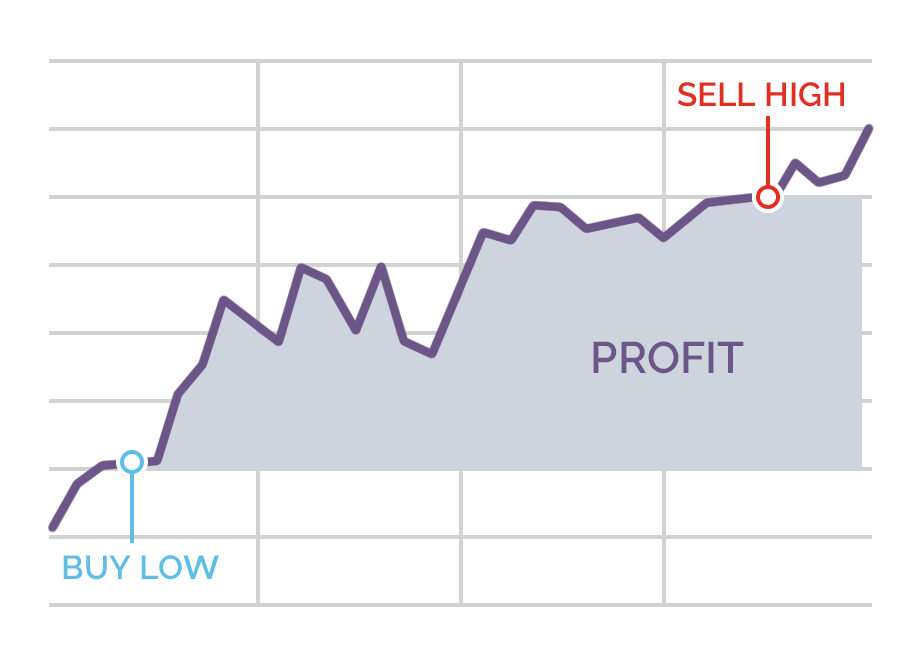

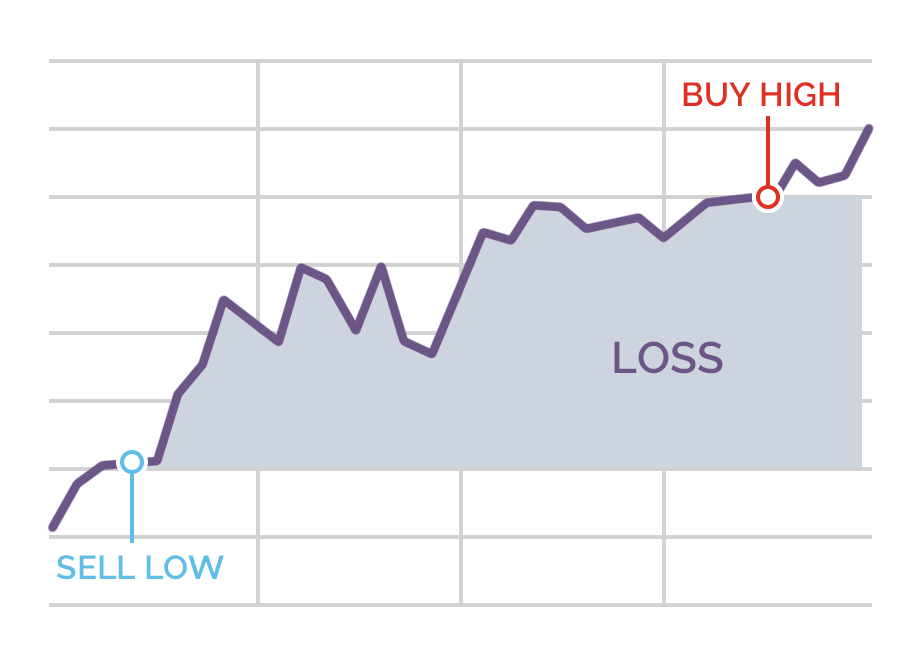

When a trader buys a financial instrument it means they are going long, in general terms they are bullish about that market. A trader would buy a financial instrument if they think the price will rise in the future and they wanted to profit from the price increase.

There are two outcomes for traders going long a market – first, the price goes up, they exit the position (sell it) and make a profit.

Second, the price can go down, they exit the position (sell it) and make a loss.

Selling

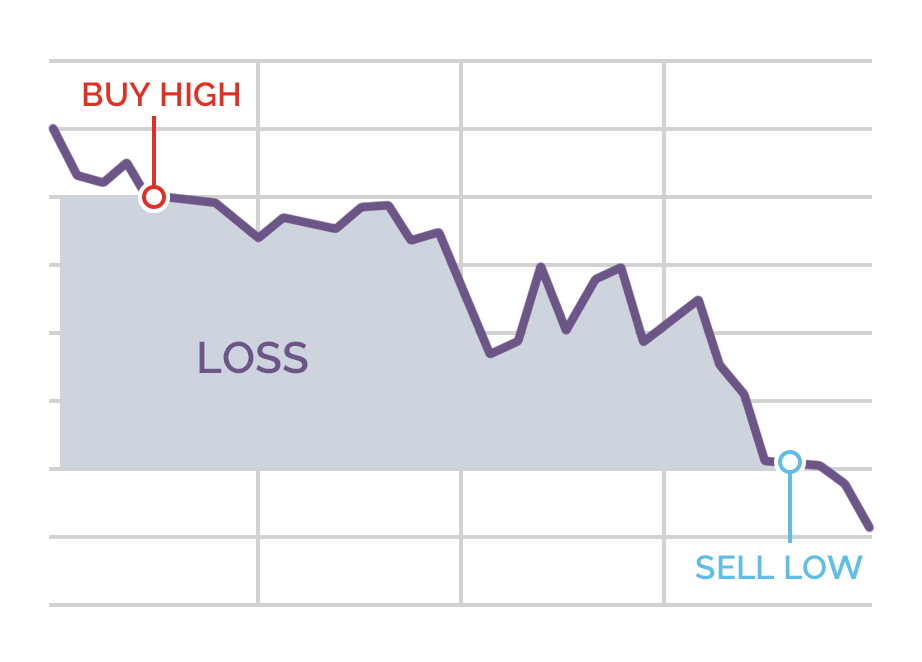

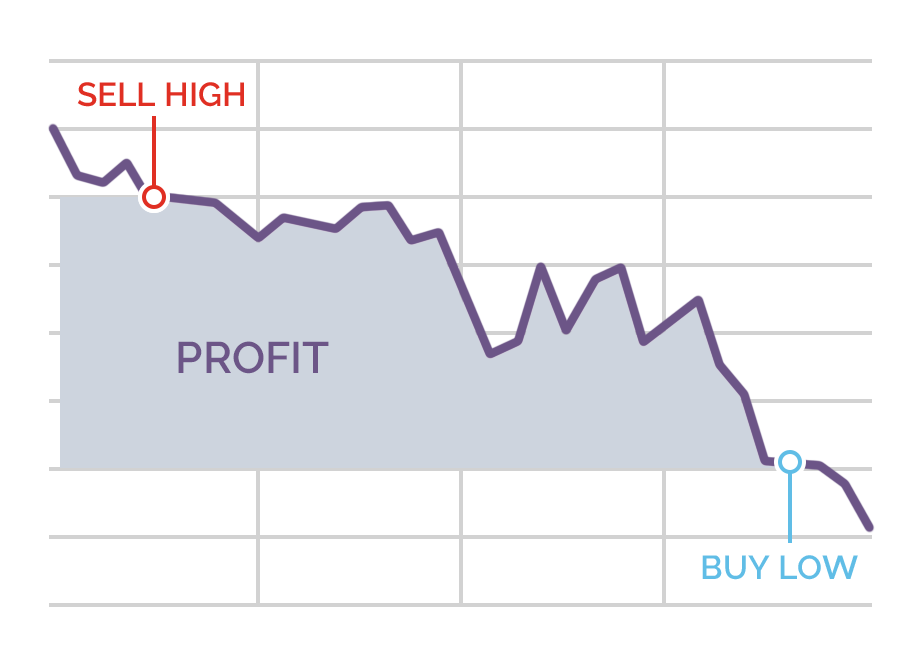

A trader who wishes to sell or go short on a financial instrument is looking to make a profit from a falling price.

There are two outcomes for traders selling an asset – first, the price can go up, they exit the position (buy it) and make a loss.

Second, the price can go down, they exit the position (buy it) and make a profit.

Traders who think the price will fall are known as bears.

Shorting has been around the markets since markets began, but it has become a lot easier recently. If trading cash shares a trader borrows the share from someone that owns them already and immediately sells them, the price falls, and the trader buys them back from the market at a later date for a lower price. They then return the borrowed shares using the shares just purchased to do so. For the trader, this locks in a profit from the falling price and a loss if the price goes up.

However, the process is a lot easier when trading derivatives. Traders don’t actually borrow or sell the underlying asset to go short. The CFD or spread bet mirrors the financial outcome of such a transaction. It is a zero-sum agreement between the broker and the trader. For the trader, it is as simple as pressing a button on a screen.

Spread

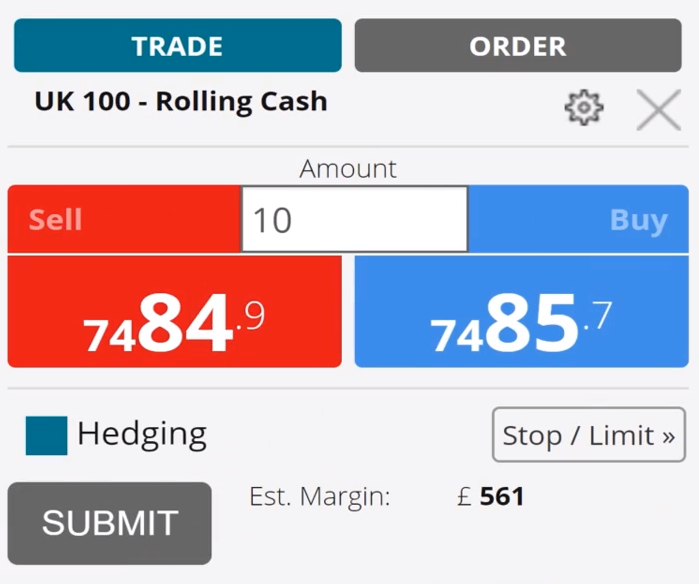

When trading online (using a broker) you will always see two prices for the market you wish to trade on, the ‘sell’ and ‘buy’ price, as demonstrated in the below deal ticket:

A trader would go long at the ‘buy‘ price as it’s always the higher of the two, also known as the ‘offer‘ or ‘ask‘ price. The trader can sell the asset at the ‘sell‘ price, also known as the ‘bid‘ price.

The difference between the buy and sell price is called the spread – on the ticket for the UK 100 – Rolling Cash market example, given above, this is 0.8 (7485.7 minus 7484.9). Spread is important and we have dedicated a whole lesson of another course teaching you about this – see the next steps section at the end of this course for the details.

Orders

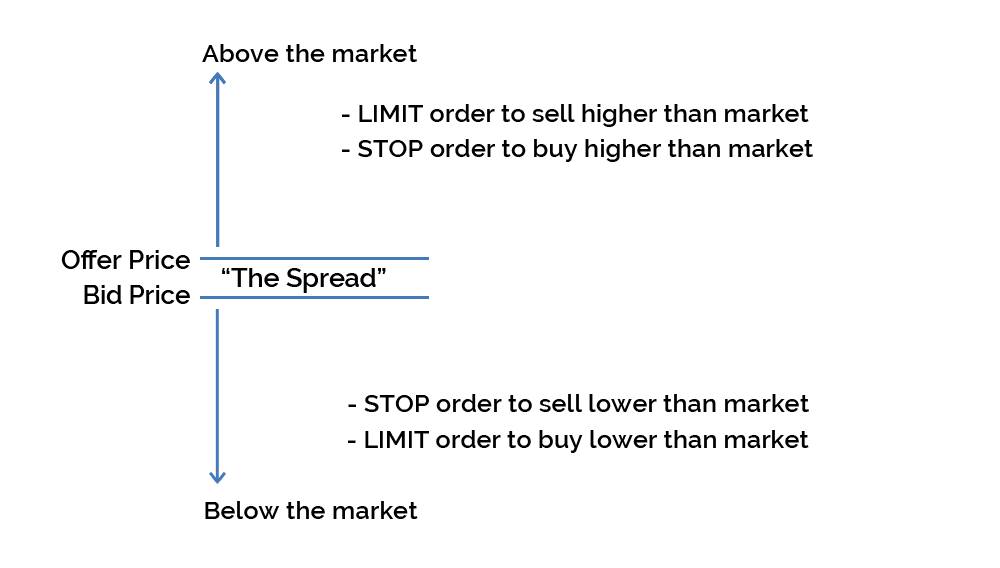

Orders are an instruction to your broker to place a trade at a predefined price and quantity, as decided by you, the trader. There are two main types of order: Stop and Limit orders.

Orders can be used to open and close positions/trades. So, for example, the orders to do the following would be:

Another feature most brokers offer that traders should be aware of are contingent orders. These are orders that are contingent on something else happening. For example, a trader can set a buy order to enter a transaction and a contingent sell order to exit it, which is set only when the first buy order gets filled. There isn’t much use of having the sell order if the initial buy order hasn’t been executed.

Orders and the terminology around them can be confusing for new traders. The best way to understand how limit and stop orders work is to obtain access to a broker’s demo platform, here you can trade using virtual money, make mistakes and get to learn the lingo. However, at this point the single most important thing to take away from this lesson is:

This will ensure you have some protection in place, should the trade move against your position.

- When traders think the price is going to go up they buy the asset, it is described as going long and they are bullish.

- When traders think the price is going to go down they sell the asset, it is described as going short and they are bearish.

- When trading derivatives traders don’t actually borrow and sell the underlying asset to go short, the CFD or spread bet just mirrors the financial outcome of such a transaction.

- Traders go long at the offer/ask/buy price, it’s always the higher of the two prices quoted on a deal ticket.

- Traders go short at the bid/sell price, it’s always the lower of the two prices quoted on a deal ticket.

- An order is an instruction to your broker to place a trade at a predefined price and quantity.

- Orders can be placed for a buy or sell trade, they can be contingent on something happening and be placed to open and also close a trade.

- Stop orders are to buy above the current market price or sell below it.

- Limit orders are to sell above the current market price or buy below it.