Welcome to our short course on markets, you’re in the first lesson so please play the video and follow the write-up below to get started.

What is a market

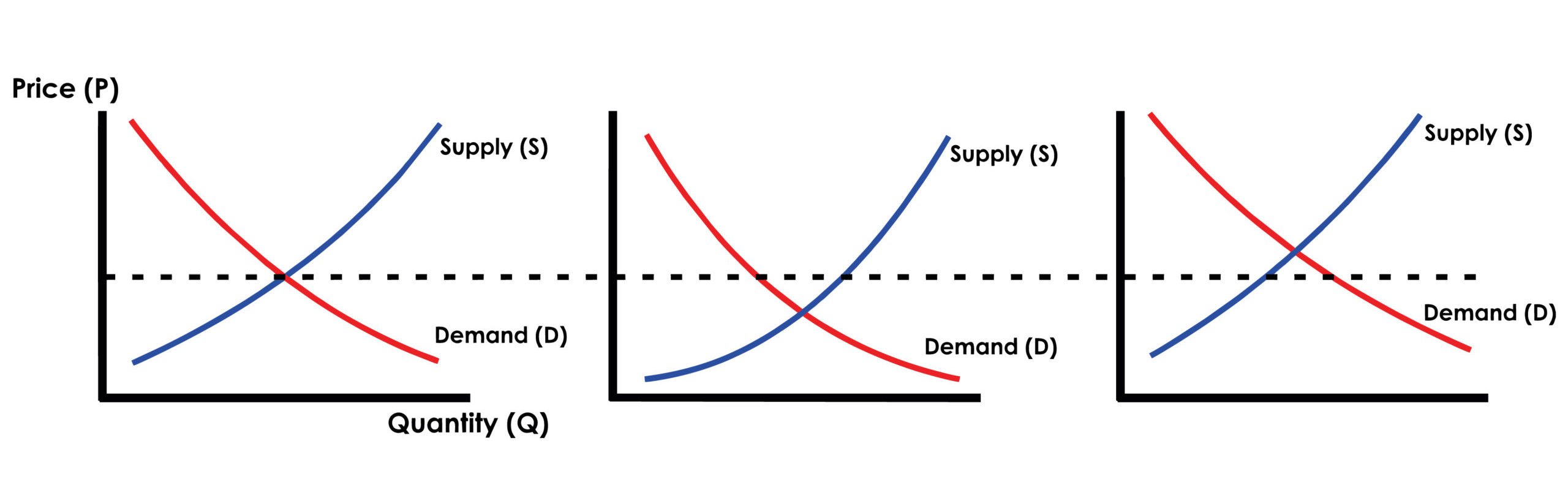

Financial markets are where everyone involved in the financial industry like banks, investors and traders come together and transact. The financial markets that we discuss, analyse and trade are known as free markets, a free market is where buyers and sellers trade using their own free will to determine a price. A trader is a student of the forces that influence the prices of freely traded markets. Traders analyse the markets using a variety of techniques to assess supply and demand. In a free market supply and demand will determine the price, too much supply and price will fall, too much demand and the price will increase, as illustrated by this graphic:

Private traders are only ever trading free markets.

Market types

There are two distinct types of market, OTC and exchange-traded.

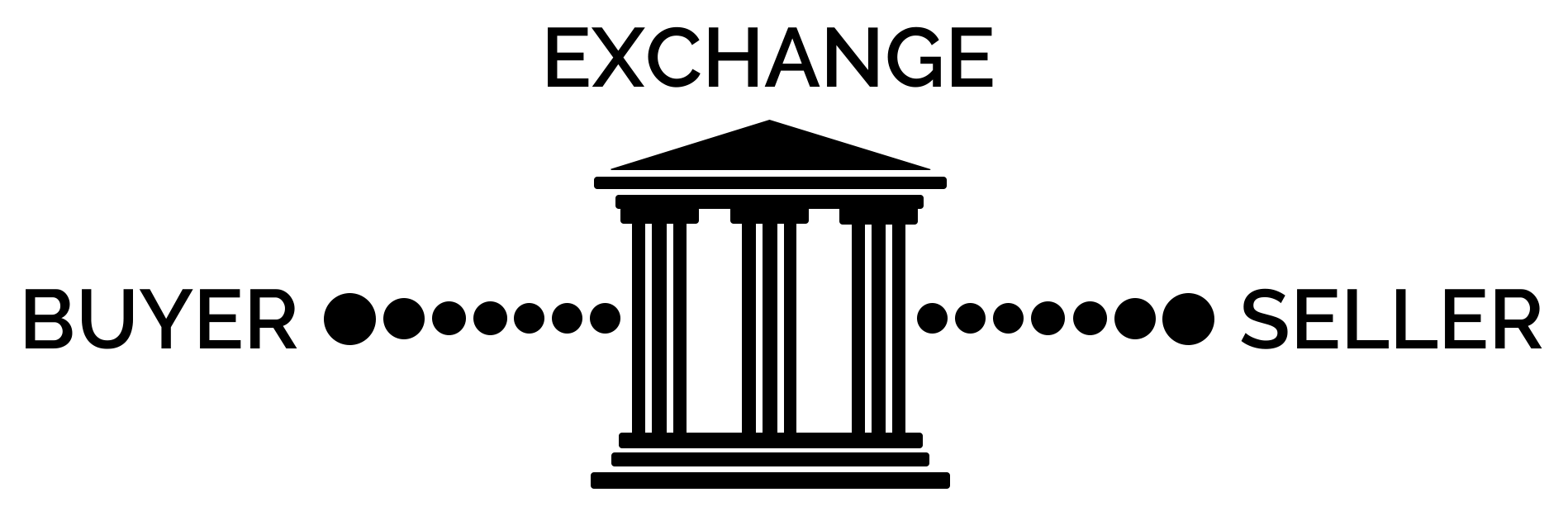

An exchange-traded market is centralised, so all trades are routed and approved through a central source, for example, the London Stock Exchange. Exchanges are relatively expensive and do not work with CFD’s or markets where the product needs to be tailored to the participant’s needs.

OTC trading or over the counter trading is just two parties trading directly with one another, this means it is decentralised. The upsides are financial instruments traded in this way can be tailored and it is relatively cheap. The downside is it needs lots of regulation to enforce standards.

When trading FX, CFD and spread bet markets the trader is participating in an OTC market.

- There are two types of market: open and closed. Traders can only trade the former.

- Traders are students of the forces that influence the prices of freely traded markets.

- Although the techniques might vary, every time Traders look at a market they are trying to assess the forces of supply and demand.

- Freely traded markets are either OTC or Exchange-traded.

- Exchanges are centralised, like most equities cash trading. It is standardised but expensive to run.

- OTC is decentralised, cheap to run, innovative but needs a lot of regulation to maintain standards.

- As a private trader, unless you trade cash shares, it is likely you will be participating in an OTC market.

If you’re happy with everything please click ‘complete’ to move on. You will be able to come back to the lesson.