Chapter 6

The History of Forex

The Forex markets are some of the largest financial global markets but it wasn’t always like that.

Due to its international nature, Forex traders should be aware of the major events that have shaped international monetary systems, the development of which ultimately allowed us to become currency traders today.

One of the most important events in the history of the Forex market is the creation and implementation of the Gold standard monetary system back in 1871.

- Learn more, take our premium course: Trading for Beginners

Before the Gold Standard

Before the inception of this international monetary system, countries around the world would use Gold (and, to a lesser extent, Silver) to trade and settle their payments.

This harks back to this era when the note could be exchanged at the Bank of England for ten pounds of Sterling Silver, hence the currency’s name – Pounds Sterling.

This means that the value of these commodities – the Sterling Silver and Gold – was strongly influenced by changes in global trade.

In international trade, economies with trade surpluses would collect Gold as payment for their exports, while nations with trade deficits would have lower Gold reserves, as it was used as payment for their imports.

However, linking the value of all trade back to a few lumps of metal, more of which could be dug up out of the ground, had its issues.

Creation of the Gold Standard

To better control the volatility of this method of payment and benefit from a low inflationary environment, the Gold standard was created to guarantee the value of currency conversion into a specific amount of Gold.

This meant that most major currencies would be backed by Gold – it was the Government’s job to keep enough Gold in its reserves to back up the amount of currency in circulation.

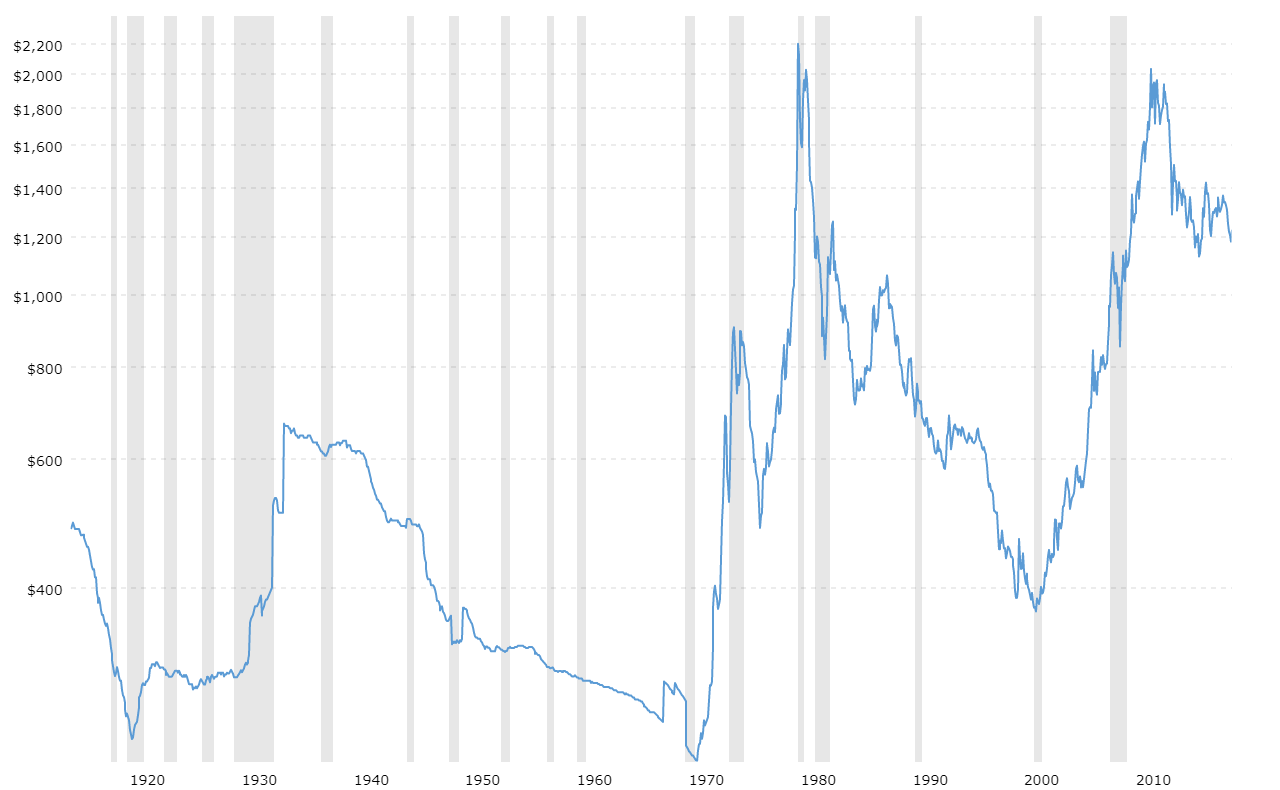

Check out this 100+ year gold price chart to see how volatile gold can be (Source: MacroTrends).

As most developed economies at the time pegged their currencies to an ounce of Gold, governments needed to possess a large Gold reserve to be able to meet the theoretical demand for currency exchanges.

Back then, an exchange rate would then be represented by the price difference of an ounce of Gold between one currency and another – this was the first official kind of currency exchange.

- Learn more, take our premium course: Trading for Beginners

The failing Gold Standard

The Gold standard started to break down during World War I, as many nations decided to print money to be able to finance their huge military expenses. As a consequence, the amount of Gold that these governments had wasn’t enough to keep up with the pace at which they were printing money.

Between the two World Wars

Gold parities were kept and the metal was always the ultimate form of monetary value, but major currencies – particularly those issued from the World War I victors, the United States, France, and Britain – would be used as an international method of payment (and a reserve instrument).

Gold was – and is still – considered as a safe haven asset that nations and investors buy when they seek stability.

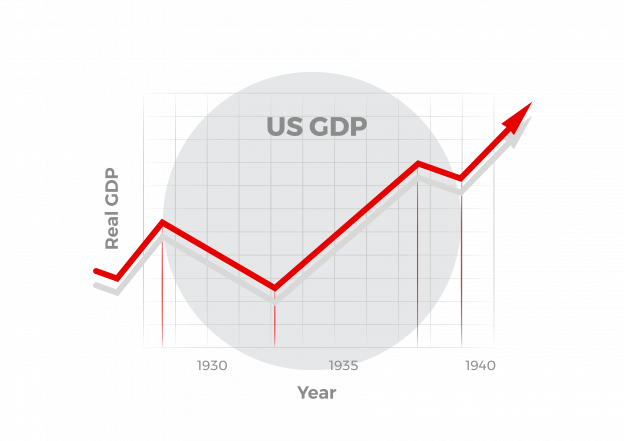

From 1920, the American economy boomed during the period known as the “Roaring Twenties”, leading to very high inflation and a rapid growth in equity prices that led the American Central Bank (the Fed) to raise interest rates in 1928, and again in 1929.

From 1920, the American economy boomed during the period known as the “Roaring Twenties”, leading to very high inflation and a rapid growth in equity prices that led the American Central Bank (the Fed) to raise interest rates in 1928, and again in 1929.

The economic downturn that followed was called the “Great Depression” lasting from 1929 – after the stock market crash of October 1929, to 1939. It was a period of lower consumer spending and investment, which led to high unemployment and slow economic growth.

Read: We Explain What The US Unemployment Rate Is

As interest rates and monetary policies were linked by the international Gold standard, and as countries weren’t able to increase their money supplies to stimulate their economies, recessions occurred in many countries around the world and it was very hard for governments to get out of them. Some historians are of the opinion the economic malaise was a big contributing factor towards World War II.

Bretton Woods, a new framework for the currency markets

In July 1944, while World War II was still raging, more than 700 representatives from the 44 Allied nations met in Bretton Woods, New Hampshire, USA, for the United Nations Monetary and Financial Conference.

The major change with the Bretton Woods system was the role of the U.S. Dollar, as it became the World’s reserve currency. Indeed, all foreign currencies were pegged to the American Dollar, whose value was itself linked to the price of Gold. These leading Western nations developed the Bretton Woods Agreement.

This new framework had key features such as the use of a system of fixed exchange rates between countries, as well as the creation of 3 international agencies to oversee economic activity.

- The International Monetary Fund (IMF)

- The International Bank for Reconstruction and Development – now part of the World Bank

- The General Agreement on Tariffs and Trade (GATT) – which led to the World Trade Organization (WTO)

The end of Bretton Woods…

While the U.S. Dollar became the only currency to be backed by Gold, the Bretton Woods system eventually failed. Gold reserves were too low for the American government to provide convertibility for all the US Dollars that central banks held around the world.

Indeed, by 1971, the USA was holding enough Gold to cover only about 20% of foreign American Dollar reserves – not to mention its huge reserve deficit, and the country’s growing public debt.

As the Bretton Woods system became untenable, very high inflation led many countries to devalue their currencies, such as France, the UK, and Germany. On August 15, U.S. President Richard Nixon decided to withdraw the U.S. Dollar/Gold convertibility.

…and the beginning of the free-floating system

This action, known as the “Nixon shock” triggered the age of the free-floating currency market, where countries could choose their exchange rate regimes (Jamaica Accords of 1976).

Broad adoption of fiat money replaced the Gold Standard. Fiat money is not ultimately backed by anything physical, like Gold or Sterling Silver, instead, it is backed by the Government issuing it.

However, even though the Gold standard was permanently abandoned and fiat money was adopted, it didn’t mean countries would adopt a merely free-floating exchange rate method.

There are 3 exchange rate systems today

- Floating rates – where a currency exchange rate freely fluctuates depending on supply and demand. Central banks can also intervene to control extreme fluctuation by raising short-term interest rates, increasing bank reserve requirements, and buying/selling their own currency to control pricing.

- Pegged rates – where one country directly links its currency exchange rate to another currency, such as China’s Yuan, and the Hong Kong Dollar that are linked to the U.S. Dollar, or Bulgarian Lev, and Denmark’s Krone are pegged to the Euro.

- Dollarisation – where a country uses a foreign currency as its national currency, such as Panama, and El Salvador, which use the American Dollar.

The internet age

In the past, the main participants in the Forex market were only central banks, commercial banks, highly wealthy investment funds, and large international financial institutions.

However, the development of technologies have led to the creation of internet-based trading platforms for individual traders, also called retail traders, allowing them to trade in smaller sizes than what’s offered on the interbank market and using margin.

Forex trading platforms are now provided by Forex brokers – these could either be market makers, creating their own bid and ask prices, or Electronic Communications Networks (ECN), using available prices from the interbank market.

Read:

Cryptocurrencies

In 2008 Bitcoin was launched, bringing with it the Age of cryptocurrencies – the next step in the evolution of currencies. Bitcoin is a digital currency, meaning it is decentralised – without a Central Bank backing or administering it. The ‘I promise to pay the bearer’ commitment is now not from the Chief Cashier backed by a Government’s wealth but instead is a concept digitally enforced through cryptology.

The number of Bitcoin is fixed at 21 million meaning, eventually, only demand will influence its price.

There are now hundreds of cryptocurrencies and the concept is in its infancy – while digital currencies have clear advantages over fiat currencies, there are clear disadvantages as well – the jury is definitely out as to its place in the currency landscape but it is certainly here to stay in some form.

Start learning now

Learn the skills needed to trade the markets on our Trading for Beginners course.