Forex Trading Costs: What Does it Cost to Trade?

Let’s face it: We all love trading but often forget about the various costs and fees when placing trades on the Forex market. Forex traders need to be aware of those costs and know their meaning in order to stand a chance of becoming a good trader.

Here’s an overview of the main trading costs you’ll face on the Forex market on a daily basis.

Forex Spreads

When it comes to Forex trading fees, the spread is arguably the best-known cost when placing a trade. However, there is a range of other costs and fees (some of which are hidden) that you need to know about as a Forex trader.

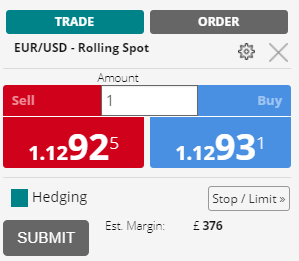

Most of you already know that the spread represents the difference between the bid and ask prices for a currency pair. For example, the EUR/USD (euro vs US dollar) pair can be trading at 1.12925/1.12931, which means that the buy price is 1.12931 (the price at which your broker will sell to you at) and the sell price is 1.12925 (the price at which your broker will buy from you at).

Most brokers offer very competitive spreads nowadays. For major currency pairs such as the EUR/USD or GBP/USD, the spread can be as low as half a pip.

However, minor pairs (pairs that don’t involve the US dollar as either the base currency or counter-currency) and exotic currencies (like the Turkish lira and Mexican peso) can have much higher spreads. Minor pairs usually go around 2-3 pips, while exotic pairs can have spreads as high as a few hundred pips!

Bear in mind that the actual spread cost depends on the size of your position. If you’re trading one standard lot of EUR/USD with a 0.6 pip spread, your spread cost will be $6. But, if you’re trading only 1,000 units of EUR/USD, your total cost will be around 6 cents.

- Learn more, take our free course: Breaking Down Trading Costs

Broker Commissions and Fees

Besides spreads, your broker may also charge you other trading costs in form of various commissions and fees. Note that most brokers have abandoned charging trading commissions due to the high competition among brokerages, but you may still find some that do charge those costs.

Usually, trading commissions come in the form of cost per traded side, or per traded lot. “Per traded side” refers to whether you’re buying or selling a currency pair (with a “round-trip” referring to opening and closing a position).

“Per traded lot”, as its name suggests, is a commission based on your trading volume and charged for each traded lot (100,000 units of the base currency.) Trading commissions per traded lot are popular among brokers that advertise trading accounts with zero spreads. As you can see, although you won’t pay any spreads, the charged trading commissions more than offset the savings on the spread side.

When talking about trading fees, a common fee that many brokers are still charging their clients is the “inactivity fee.” If your trading volume doesn’t reach a certain threshold, such as 10 lots in a 3-month period, for example, your broker may charge you an inactivity fee. Inactivity fees are especially common among stockbrokers but less so among CFD and Forex brokers.

The safest way to know whether your broker is charging any trading commissions or fees is to check on your broker’s website under the “Trading Costs” section (if there is one), or by contacting the broker directly through e-mail or live chat. Some of those commissions and fees may be hidden so you won’t know about them until you start actually trading with the broker.

Slippage in Forex

Slippage is not the same type of cost as spreads, commissions, or fees. Slippage is subtler, and your broker – if it’s an honest and/or well-regulated one – doesn’t profit from slippage.

So what is slippage? In simple words, slippage is the difference between the price you saw on the screen before opening a trade and the price at which your trade got executed. This is because when you click the ‘trade’ button all you are doing is placing an at-market order with your broker. Your broker will try to get you the best possible price in the market, but that doesn’t always mean the price you thought you traded at.

For example, you may want to buy the EUR/USD pair at 1.12931, but your trade got filled at 1.12956, which is a difference of 2.5 pips. This is not the spread (difference between bid and ask prices) but the difference between the bid OR ask price you expected, and the bid OR ask price you got filled at.

Why does slippage occur? The most common reason why slippage occurs is because of an imbalance between buyers and sellers. Simply said, the current exchange rate for any currency pair reflects the latest exchange rate at which a transaction occurred, i.e. a buyer and a seller agreed to exchange certain currencies at a specific exchange rate.

Since the Forex market is the most liquid financial market in the world with the largest number of buyers and sellers, there are numerous buyers and sellers at any given price level. However, sometimes this balance gets distorted by unexpected market conditions, such as during the release of unexpected market reports, political and social turmoil, unexpected natural events.

The period of the day at which you want to trade can also impact the occurrence of slippage. The most liquid time of the market is the London-New York overlap (the period during which both the London market and the New York market are open, typically between noon and 4 p.m. GMT).

During this part of the day, slippage will usually be minimal, except if unexpected market news hits the market. If you want to minimize the risk of slippage when placing a trade, make sure you place your trade during liquid hours of the market.

- Learn more, take our free course: Breaking Down Trading Costs

Overnight Rollover Costs

Another type of cost that is common in the Forex market is rollover cost, especially if you hold your trades for longer than a day. The reason you’re charged this is that the prices quoted for an FX pair are nearly always for its spot market – this is normally for settlement on a T+2 days basis (so in two days from the point of the quote). If you want to push this on a day by holding the trade open overnight then you’ve pushed this settlement date on a day as well. You’ve changed the basis of the trade so you’re charged a fee to reflect this. Rollover costs depend on the currency pair you’re trading. As you probably already know, central banks around the world charge interest rates for holding their domestic currencies.

Financing Costs

Financing costs are often bundled in with the rollover charge and are another important cost to bear in mind when trading on the Forex market.

Before we get to explain what financing costs are, here is a brief introduction. In the Forex market, currency pairs tend to move in narrow ranges due to the high liquidity of the market. As a result, Forex brokers offer very high leverages to allow traders to profit even from small price movements.

Whereas most stockbrokers offer leverage of 5:1, it’s not unusual to find Forex brokers that offer leverage of up to 500:1. With such high leverage, a Forex trader is able to control a position that is 500 times larger than his trading account!

However, it comes with a cost. Brokers charge financing costs that are expressed in annual interest rates, and that is derived from the current market interest rate plus a small markup. Financing costs are charged on a daily basis on the notional position. While those costs are generally small, they can easily increase with your total position size.

Withdrawal Costs

Last but not least, withdrawal costs are also an important cost to consider when trading on the Forex market. To withdraw your profits from your brokerage account to your personal bank account, most brokers will charge a withdrawal fee. Some brokers offer a free withdrawal per trading month though.

What’s Your Cost per Forex Trade?

Now that you know the main costs of Forex trading, it’s easy to calculate your total cost per trade. Here is an example. Let’s say you bought the AUD/USD pair with a position size of 1 lot (AUD 100,000). These are the costs of your trade:

- Spread – The spread is the difference between the bid and ask price of a currency pair. If the AUD/USD pair is trading at 0.7050/52, the spread is 2 pips. This is your first cost of the trade, and since you bought 1 lot of the pair, your spread equals $20.

- Broker commissions and fees – There are not many brokers out there that charge both spreads and trading commissions, but brokers that do usually charge a commission per traded lot, e.g. $7 for a round-trip (opening and closing of a trade.) If you bought 1 lot, your commission for the trade could be around $7, but this again depends on your fee structure of your broker.

- Slippage – If you’re a news trader and buy the AUD/USD pair during a major news release, slippage needs to be a concern. During high-volatility market reports, slippage (and spreads) can rise by dozens of pips. Prepare for those costs if news trading is your preferred trading strategy.

- Overnight rollover costs – Rollover costs depend on the interest rates of the respective currencies you’re trading. In the AUD/USD pair, the Australian dollar has traditionally a higher interest rate than the US dollar, so your broker would add the difference of the two interest rates (calculated on the basis of your position size) to your trading account each day you hold the trade open.

- Financing costs – If you opened your trade on leverage, your broker will charge you financing costs. Let’s say you have a trading account of $10,000 but your total position size equals $100,000. This would require a leverage ratio of at least 10:1, but since most brokers offer a leverage of 33:1 or higher nowadays, your required margin would be $3,000. This also means that you would need to borrow the remaining $97,000 from your broker and pay financing costs on it.

- Withdrawal costs – Finally, if you close your AUD/USD trade in profit and decide to withdraw the profits to your bank account, you’ll have to pay a withdrawal fee (except if your broker offers a free monthly withdrawal.) There is no hard rule for how high withdrawal costs can be, but most brokers will charge around $25.

For reference, if you closed your AUD/USD trade with a 100 pips profit, which is a reasonable profit target for a swing trader, your total profits would equal $1,000. Deduct the aforementioned fees, and you’ll get your net profit.

Zero-Spread Accounts: Are They Worth It?

Nowadays, some brokers offer so-called zero-spread accounts. Those accounts don’t charge spreads but a commission per traded lot. For example, the bid and ask price for the EUR/USD pair would be almost the same, so you could buy and sell the pair (open and close your position) basically for the same price but pay a commission to your broker per traded lot.

In my experience, those savings are almost negligible, but traders whose trading strategy relies on scalping could benefit from the narrow spreads. Also, bear in mind that slippage can and will occur even with zero-spread accounts.

- Learn more, take our premium course: Trading for Beginners

Final Words

The Forex market comes with a very competitive cost structure due to its highly liquid nature. Still, Forex traders need to be aware of the main costs when looking for trading opportunities.

Spreads represent the difference between the bid and ask prices and your broker may charge you commissions and inactivity fees. Slippage may occur during times of high market volatility and prepare for rollover costs if you plan to hold your trades for longer than a day. In addition, you’ll have to pay financing costs when trading on leverage, as well as withdrawal costs when withdrawing your profits with certain brokers.