Broker vs. Trader: What’s the Difference?

Brokers and traders – two completely different types of market participants, yet one cannot exist without the other.

Let’s take a closer look at the differences and similarities between brokers and traders. You may be surprised that their interests don’t always overlap.

- Learn more, take our premium course: Trading for Beginners

What is a Broker?

A broker is an entity, usually founded as a firm, that acts as a middleman between a trader and the market. Brokers collect market orders from their clients (traders) and execute them on the market. In other words, each time a trader wants to buy or sell a financial instrument, be it a stock, currency, or futures contract, he or she has to do so via a broker.

A broker is your window to the world of financial markets. You can’t trade the market directly, you have to do this through your brokerage account. Since each trade you open on the market needs to have a counterparty willing to take the opposite side, your broker does the hard work of finding a trader willing to sell to you (if you buy) or buy from you (if you sell). Once there are two participants willing to make a deal at the same price, we have a transaction on the market.

All this is done by your broker. Depending on the business model, a broker may look for traders willing to take the opposite side of your trade within the broker’s order book. If there are no internal clients with the opposite order, your broker may send your order to their external liquidity providers. Those liquidity providers are usually other large brokers, hedge funds, and investment banks.

Finally, if a broker is a market maker, they can also take the opposite side of your trade by selling to you if you want to buy, and buying from you if you want to sell. In this case, there can be a perceived conflict of interest between the trader and the broker, as your profits would be your broker’s losses, and vice-versa. In practice, this isn’t really an issue because the broker will normally have 1,000s of traders taking either side of its bid-offer price, however, some traders prefer STP and ECN brokers, which will be discussed later in this article.

What is Trader?

Now that you know what a broker is, let’s introduce the trader. A trader is a person who operates on financial markets, either as a professional or part-time trader, with the sole interest of making a profit from price fluctuations. A trader buys if his or her analysis shows that the underlying financial instrument has further upside potential, or sells if the analysis shows that there is further downside potential.

As a result, the trader may want to buy Apple shares to profit from the possible increase in the share price due to the expected growth in the company’s market value. The trader could buy 100 shares at $100 each, with an expected target of $120, returning him an attractive $2,000 profit (100 shares x $120 = $12,000 vs the $10,000 initial investment.)

To execute the trade, our trader would need a brokerage account first. He can’t buy $AAPL directly on the stock market but has to rely on the help of his broker to process the trade.

While there are many types of traders, we have covered news traders so far in those two examples. Besides news traders, there are scalpers, fundamental traders, day traders, swing traders, position traders, and a whole range of sub-classes like trend-following traders, breakout traders, and counter-trend traders. We will cover the main types of trading styles shortly.

So, What’s the Difference?

So, what’s the difference between a broker and a trader? Brokers act as a middleman between a trader and the market. They don’t make a profit with active trading (although some brokers also have their trading desks), but through matching interested buyers and sellers in the market.

For their service, brokers usually charge a fee or commission and the spread, which is the difference between the bid and ask prices on the market. With more trading volume, a broker makes more money.

On the other side, traders pay their bills by anticipating future price movements in the market. They buy when a stock, currency, commodity, or any other financial instrument shows a possibility to rise in value and sell if there is a possibility of falling prices.

Traders use various analytical tools to identify profitable trading opportunities in the markets. The most common tool among retail traders is technical analysis, which is based on the premise that historical price patterns tend to repeat themselves in the future.

Different Types of Brokers

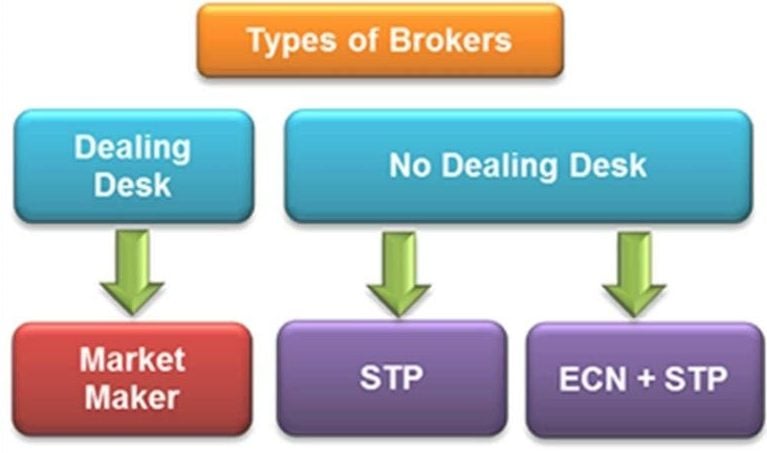

In general, all brokers can be grouped into two categories: dealing desk brokers, and no dealing desk brokers.

Dealing desk brokers provide liquidity to their clients and charge a small fee, usually in the form of spreads, to their clients. Dealing desk brokers literally create the market for their clients, which is the reason why they’re also called market makers, this makes this offering flexible and liquid.

To create a market for their clients, dealing desk brokers often take the opposite side of a trade. This means, when a trader buys, the broker sells to him, and vice-versa. Naturally, this can create a conflict of interest where a profitable trader isn’t in the best interest of the broker.

A popular type of brokers is no dealing desk brokers. Those brokers are either ECNs (Electronic Communication Networks) or STPs (Straight-Through Processing) brokers. An ECN broker provides an electronic platform where a large number of market participants communicate with each other and send their orders to match with other orders.

An ECN can aggregate retail traders, institutional traders, commercial banks, hedge funds, and other large brokers into a large pool where it’s easy to match orders and to get the best possible price in the market. ECN brokers usually charge a commission for their services.

STP brokers are quite similar to ECN brokers, with the main difference that STPs act as a middleman between the trader and the broader marketplace. When you send a market order to an STP broker, the broker’s job is simply to push your order to internal or external liquidity providers to find the best possible match for your order.

How do Brokers Make Money?

Brokers make money in a number of different ways.

Spreads – First, many brokers charge spreads, which is the difference between the buying and selling price for a financial instrument. If you’ve ever traded stocks or Forex, you may have noticed that there are two prices displayed on your trading platform.

The same is true for the EUR/USD pair. If you’re buying the pair, your price is 1.1052. And if you’re selling the pair, your price is 1.1050. The difference of 2 pips is the spread and your broker’s profit.

Commissions and fees – Besides spreads, some brokers also charge various commissions and fees to their clients. For example, you may face an inactivity fee if you’re not actively trading for a period of time.

Or you may pay a commission for each traded lot in the Forex market (100,000 units of the base currency). Check your broker’s website to understand the costs you have to pay for using the broker’s services.

Additional trading tools – Depending on your needs, some brokers offer additional trading tools that you have to pay for.

For example, a broker may offer an advanced trading platform for a certain monthly fee, or real-time quotes and news updates that you have to pay for. Fortunately, competition made most of those extra tools free for traders.

Withdrawal fees – I know many brokers that charge a fee for withdrawing profits. Some of them may have one free withdrawal per month and charge any additional withdrawal request. There isn’t anything wrong with this fee, especially if you aim to withdraw to your local bank account. International wire transfers can come at a hefty price, and brokers will usually pass part of those costs to their clients.

- Learn more, take our free course: Breaking Down Trading Costs

How Do Traders Make Money?

In theory, making money trading is easy – buy low and sell at a higher price. But wait, before you put your hard-earned savings into a brokerage account and start trading every move you see on the chart, let’s make one thing clear: Trading isn’t complicated, but it’s complex. It’s a game of discipline, patience, trust in your trading strategy, and strict risk management rules.

Hitting the buy or sell button is easy once you know what you’re doing, but most traders fail at a crucial part – analyzing the market for profitable trading opportunities. You need to have a well-defined trading plan before you even place the first trade of your life. Honestly, I didn’t have a plan for my first trade and blew my very first account in just a few weeks.

To become a consistently profitable trader, you have to put some work into it. Successful traders understand the fundamentals that move various asset classes, they follow important market news that can create trading opportunities, and they know exactly at what price levels they want to enter into a trade, take profits, and cut their losses.

In addition, before entering a trade, profitable traders know exactly how much they want to risk. This is usually expressed in percentage terms and represents a very small fraction of the overall trading account (usually 1-2% per trade).

Risking a small percentage of your trading account also allows you to stay in the game after a series of losses. There will be a losing streak, but the key is to stick to your trading plan. Even the best trading strategies are able to generate positive results only over a large basket of trades.

The table above shows how much you need to make to recover from a losing streak. If you lose only 10% of your trading account, a return of 11.11% will bring you back to breakeven.

However, if you lose 50% of your account, you’ll have to make a whopping 100% return only to recover your losses! That’s why risking a small percentage of your account per any single trade is mandatory for success in trading.

Different Types of Trading Styles

Depending on how they approach the markets in trading, most traders can be grouped into four main trading styles – scalpers, day traders, swing traders, and position traders.

Scalpers – Scalpers are very short-term traders who hold their trades for a few minutes, and sometimes even for a few seconds. They aim to catch small price movements caused by important technical breakouts or sudden market news and are considered the most active traders on the market. It’s not unusual for a scalper to open dozens of trades per day. However, a large trading volume comes hand in hand with higher trading costs.

Day traders – Day traders open and close their trades within the same trading day. They usually hold their trades open for a few hours and take a handful of trades per day. Just like scalpers, day traders aim to catch market volatility caused by unexpected news, market reports, and technical breakouts. However, unlike scalpers, day traders face lower trading costs and a less stressful trading environment.

Swing traders – Swing traders stick to their trades for days and weeks and base their decisions mostly on fundamental analysis. Earnings reports, interest rate decisions, PMI reports, and political turmoil can all be used to find a profitable swing trading opportunity in the market.

Position traders – Finally, position traders are very long-term traders who can hold to their trades for months or even years. They try to take advantage of large fundamental shifts in the market and are not bothered by short-term price changes. However, in order to withstand price fluctuations without getting a margin call, position traders need to have sizeable trading accounts.

Final Words

Brokers and traders and two completely different types of market participants. They have different goals, different income sources, and in some cases even different interests. However, one cannot exist without the other.

Traders can’t access the global financial markets without a brokerage account, as brokers act as a middleman between traders and the market. For every buy order, you have to find a seller willing to sell to you at the specified price. And for every sell order, you have to find a buyer to purchase from you.

Brokers deliver this service by matching buy and sell orders within a large pool of liquidity providers, either within their own client base (i.e. other traders who have opposite orders) or with the help of external market participants.

- Learn more, take our free course: Understanding Brokers