Forex Trading: Is it Hard for Beginners?

Forex trading is complex, but it doesn’t need to be complicated. Many traders have made it and become consistently profitable in the currency market by keeping an eye on their risk levels, having strict money management rules, and defining a set of trading rules in a written trading plan.

Let’s take a deeper look at why many beginners fail with trading and what you can do to join the elite club of CPTs (Consistently Profitable Traders.)

What is Forex Trading?

The Forex market, also called FX for short, is the marketplace for the world’s currencies. Trillions of dollars, pounds, euros, yen and everything in between exchange hands on a daily basis on the forex market, making it the largest financial market in the world. The forex market is so large, it dwarfs all other financial markets combined, even the stock and bond markets.

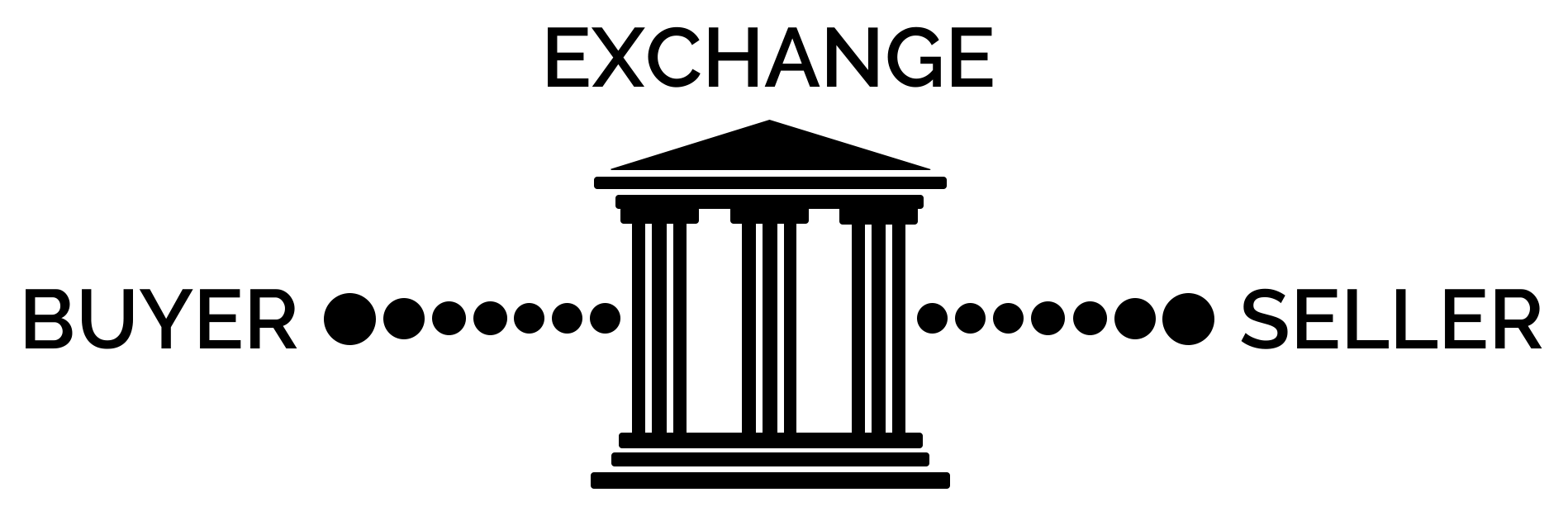

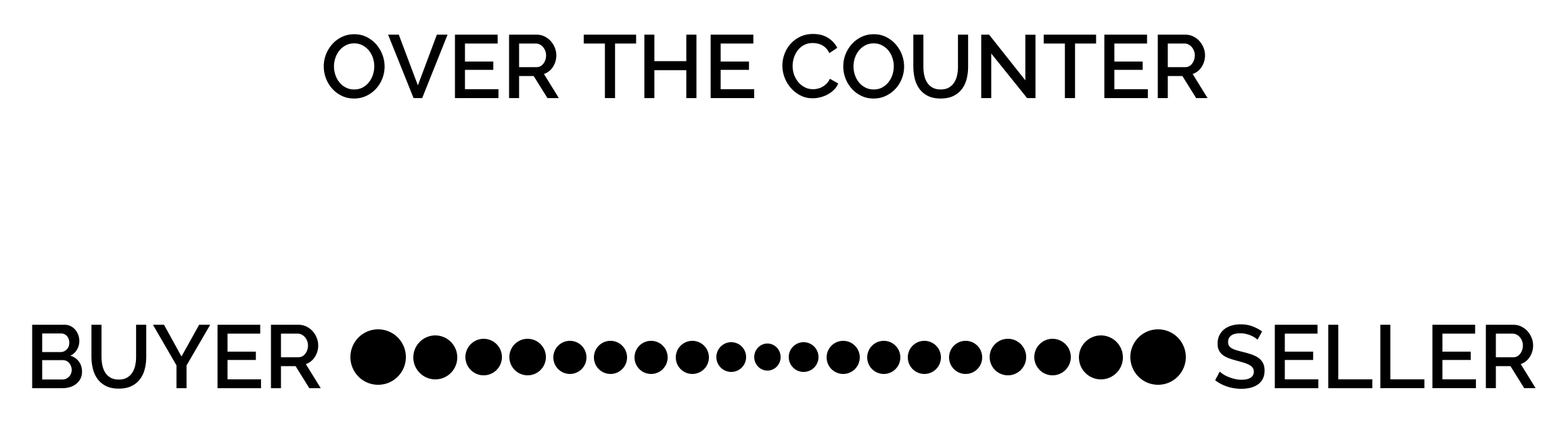

Unlike the stock market where stocks are traded on exchanges, like the New York Stock Exchange, there is no centralized exchange for currencies. Instead, currencies are traded over-the-counter, which is why this market is also called an OTC market.

Whenever a buyer and a seller agree on a certain exchange rate, a transaction takes place on the forex market. Those buyers and sellers are often big banks, hedge funds, pension funds, governments, and central banks. However, in the last two decades, retail forex traders are increasing their share in the overall daily trading volume, making them an important player as well.

There are eight major currencies in the Forex market: the US dollar (USD), Canadian dollar (CAD), British pound (GBP), Euro (EUR), Swiss franc (CHF), Japanese yen (JPY), Australian dollar (AUD), and the New Zealand dollar (NZD). These currencies are called the major currencies because they account for the majority of all forex transactions.

Still, there are also some other important and highly-traded currencies, such as the Norwegian and Swedish krona, the Turkish lira, Mexican peso, or South African rand. Those currencies are sometimes called minor currencies and exotics.

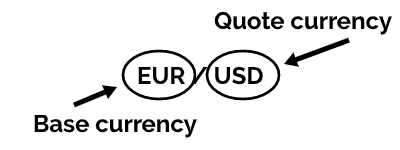

In the Forex market, all currencies are quoted in pairs. A pair consists of a base currency and a quote currency, and the exchange rate refers to the price of the base currency in terms of the quote currency.

For example, if EUR/USD (euro vs US dollar) currently trades at 1.25, this means that it takes 1.25 dollars to buy one euro, the base currency is always the ‘1’ in the equation. When the EUR/USD exchange rate rises, this means that euros become more expensive relative to US dollars (i.e. the USD falls), and if the exchange rate falls, this means that euros become less expensive relative to US dollars (i.e. the USD rises).

Just like in the stock market, a Forex trader makes money by buying undervalued currencies and short-selling overvalued currencies. For example, if a trader thinks that the British pound is going to rise against the US dollar because the British economy outperforms the US economy, he or she could buy the GBP/USD pair. Remember, a rising GBP/USD rate means a stronger pound (base currency) against the US dollar (the quote currency).

How to Get into Forex Trading

While the basics of Forex trading sound easy, many new traders face obstacles on their journey to becoming a consistently profitable trader. Let’s cover the easy bit – how to get into Forex trading – first, and then we’ll provide some actionable tips that will help you become a better Forex trader.

In order to get into Forex trading, follow these steps:

Your broker will usually charge a small fee for their services in the form of spreads, which is the difference between the buying and selling prices for a currency pair (e.g. EUR/USD can trade at 1.2505/1.2506, depending on whether you’re buying or selling the pair.), and/or a commission.

Most brokers don’t have minimum deposit requirements anymore, which means that you can start trading with as little as $100. However, bear in mind that it will be quite hard to grow your account with such a small capital base, which can easily lead to beginner mistakes like overtrading and overleveraging.

I would recommend staying on a demo account as long as necessary to learn the basics of the market, buy and sell orders, pending order types, and market analysis. But once you’re ready to trade live, don’t hesitate to switch to a real trading account. This doesn’t mean that you have to be a profitable trader just yet, but you’ll get a feeling for trading and risking real money which demo accounts aren’t able to provide.

Of course, consider trading with small position sizes at first, and don’t focus on your profits (or losses) until you find a profitable trading strategy that fits your trading style.

Learn the fundamentals of the forex market, including the characteristics of major currencies and currency pairs, the most important market reports (central bank meetings, interest rate decisions, inflation rates, unemployment rate, GDP growth, etc.), the largest market participants and their objectives (governments and central banks, banks and hedge funds, investors and retail traders), as well as the basics of technical analysis. Wrap this all together and add some risk management rules, and you’re ready to place your first trade.

- Learn more, take our premium course: Trading for Beginners

After one week of trading, chances are that the professional trader has lost his entire trading account and that the inexperienced trader is in a much better position. That’s the power of risk management.

As traders, we have constantly to deal with uncertainty. We never know what the outcome of our next trade will be, but over a sample of 100 trades, we can say that we’ll make a profit if our strategy works. With a win rate of, say, 70%, you can’t risk 50% of your trading account on any single trade. There will be times when you’ll have two, three, or even five losers in a row. Risking 20%, 30%, or 50% on a single trade will certainly wipe out your account. As a rule of thumb, don’t risk more than 1% of your trading account size per trade.

Why Do Most Traders Lose Money?

What’s hard about trading is controlling your emotions and sticking to your trading plan.

Most market participants are still humans with their distinctive set of emotions. Fear of losing, greed for the big money, fear of missing out, boredom, addiction, and gambling – all those activities and emotions are normal in a human being. But, the problem is that the markets can be an expensive way to learn how to control your emotions.

When new traders start, the most common mistake they make is overtrading and overleveraging. Overtrading refers to taking too many trades without a solid plan, hoping that the next trade will be the big winner. Overleveraging, on the other side, tries to take advantage of high leverage to magnify profits. The problem is, leverage also works the other way around – it magnifies your losses as well.

Another big mistake that new traders make is to cut their winners short and to let their losers run. They close their profitable positions too early, fearing the market could reverse and take all their profits off the table. Similarly, they let their losing trades run, hoping the market will reverse in their favour again.

Both mistakes, when done over hundreds of trades, can wipe out a trading account. The key is to let your winners run, or even add to your profitable positions, and to close your losing trades as soon as possible. If you followed this rule, you would have a hard time trying to blow your account.

Key Rules to Reduce the Chance of Losing Money in Trading

Here are some effective rules that will help you reduce the chances of losing money in trading:

Final Words

The practicalities of trading – opening a trading account and participating in fx markets – are, nowadays at least, pretty easy. However, trading can be a difficult endeavour, especially for inexperienced traders who haven’t created a trading plan with strict risk management rules yet. Fortunately, you can increase your chances of becoming a profitable trader if you take the time needed to learn about the markets and the various analytical tools, the importance of keeping a trading journal and having a trading plan, and by keeping your risk-per-trade relatively low compared to your trading account size.