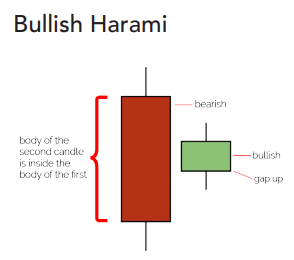

Bullish haramis

These patterns get their name because they look like the outline of someone that’s pregnant – harami is the Japanese word for pregnant. They are a two candle bullish reversal pattern that occur in downtrends. The first candle continues the trend and ends up large and bearish. The second starts forming after a gap up and ends up being a small bullish candle, within the body of the first.

The second candle is normally a spinning top or neutral dojo which suggests uncertainty. The bears have shifted from being dominant in candle one to being uncertain in candle two. If this swing in sentiment continues there will likely be confirmation in candle three.

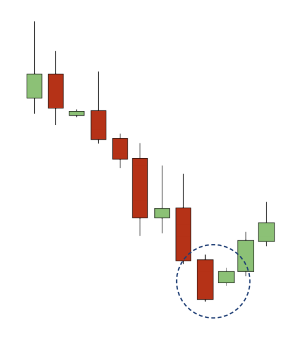

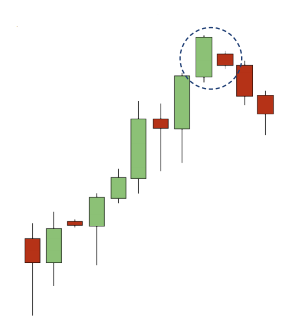

Example

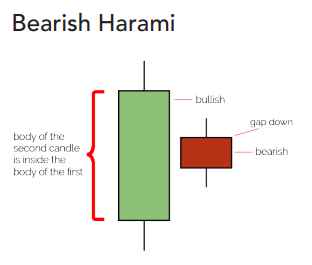

Bearish Haramis

These are the inverse of bullish haramis. The bulls have been in control, only for it to switch to uncertainty.

- Haramis are two candle reversal patterns.

- Harami means ‘pregnant’, which the outline of the pattern might illustrate.

- They suggest a swing of sentiment away from the trend towards uncertainty.