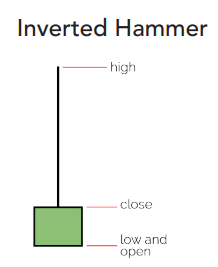

Inverted hammers

These are single candle patterns that suggest a bullish reversal if appearing in a downtrend.

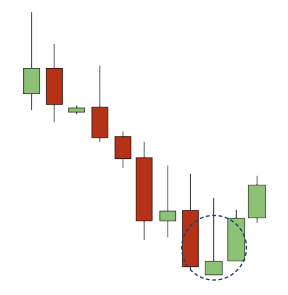

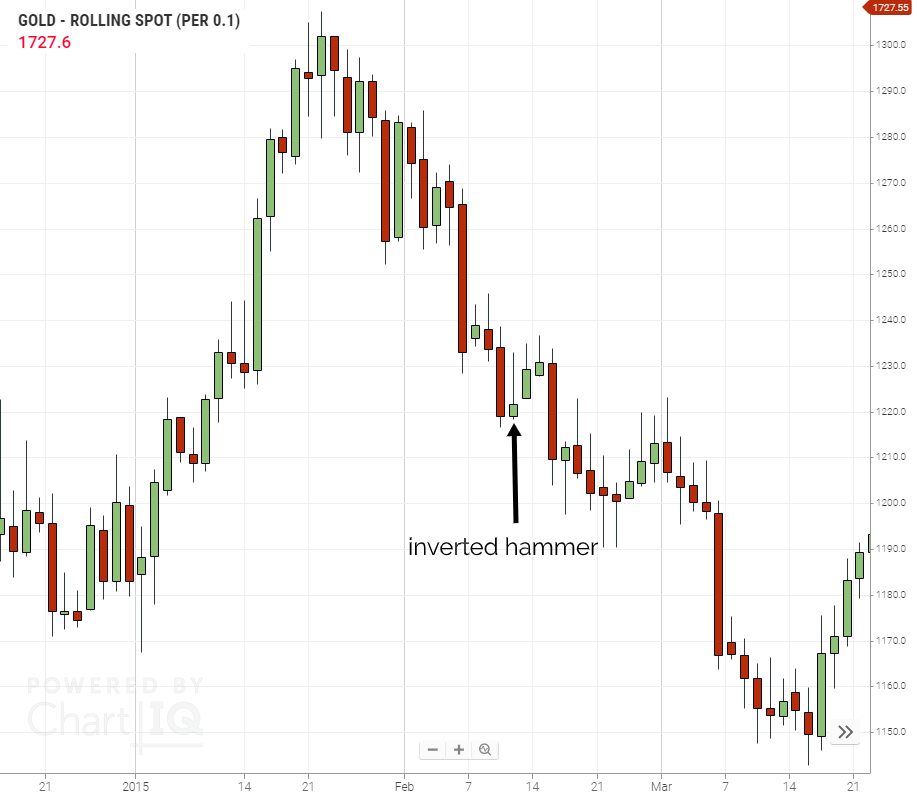

Unlike hammers, the inverted hammer has its body at the bottom with a long upper wick. For this candle to form the bulls have countered the prevailing trend, only to be pushed back by the bears. This suggests the force of the trend might be waning. With inverted hammers the following candle is really important – technical traders should be on the lookout for confirmation of the power of the bulls. Look out for gaps up, if the body closes above the body of the inverted hammer or if its a solid bullish candle. All add to the evidence that the trend might be reversing.

Example

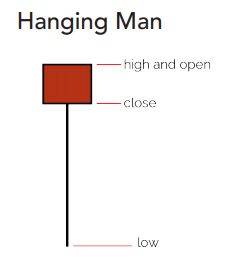

Hanging man patterns

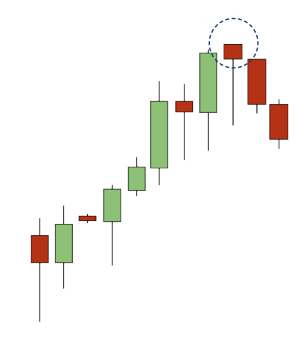

These are single candle patterns that suggest a bearish reversal if appearing in an uptrend.

The hanging man is the inverse of the inverted hammers, as is its development.

Examples

- Inverted hammers are a bullish reversal pattern if appearing in a downtrend.

- Hanging man is a bearish reversal pattern if appearing in an uptrend.

- With both patterns, the next period is important – if it is counter to the prevailing trend then there is more evidence of the reversal.