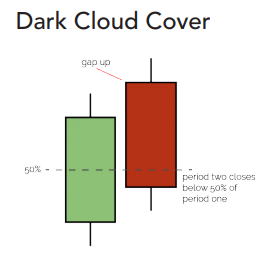

Dark cloud cover patterns

These are bearish reversal patterns – so they appear in uptrends. The first candle is bullish and continues the trend. The second gaps up on open but closes the period below the halfway point of candle one. More weight would be given to the pattern the more extreme the candles – so if the first candle was a bullish marubozu and the second gapped up and ended up being a bearish marubozu we’d be looking hard at that market for more evidence of a reversal.

The rejection of the gap up is a bearish sign and this is added to by the reversal below the middle of period one. The sentiment looks like it is shifting.

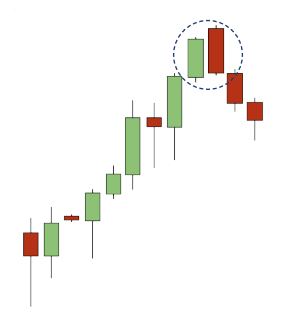

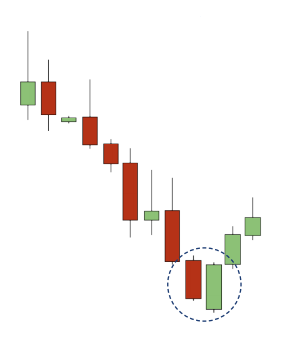

Example

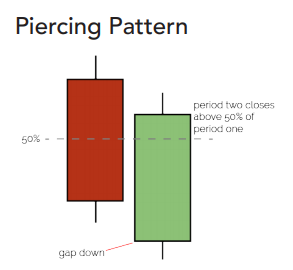

Piercing patterns

These are the inverse of dark cloud cover patterns – these form in downtrends and are bullish reversal patterns.

- Dark cloud cover patterns are bearish reversal patterns.

- Piercing patterns are bullish reversal patterns.

- The feature of them is the gap up or down in the second candle and its retreat to more than 50% by the close. Market sentiment appears to be changing.